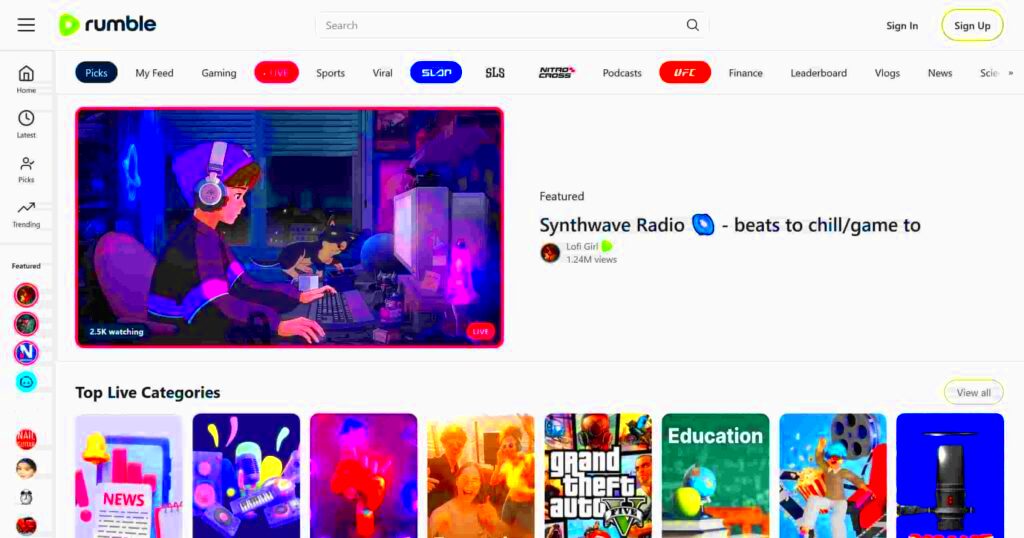

So, you're thinking about diving into the exciting world of Rumble stock? You're in the right place! Rumble has been making waves as a popular video-sharing platform, especially for creators seeking alternatives to mainstream platforms. In this guide, we’ll walk you through everything you need to know about investing in Rumble, whether you’re a seasoned investor or just starting out. Let's get started!

Understanding Rumble as a Company

Rumble, founded in 2013, has established itself as a rising platform for video content, offering creators a space to share their work without fear of censorship. But what sets Rumble apart from its competitors? Let’s break it down:

- Mission and Vision: Rumble aims to provide an open platform where content creators can freely express their ideas and monetize their content without restrictive algorithms or policies.

- User Base: With millions of monthly active users, Rumble has become a popular choice for those seeking alternative media landscapes, appealing to a diverse audience.

- Monetization Opportunities: Unlike many traditional platforms, Rumble offers unique monetization options for creators, allowing them to earn money from ads, licensing, and subscriptions.

Rumble's business model is built around generating revenue through ads, subscriptions, and partnerships. As it continues to grow, investors are increasingly interested in its stock. Here's a quick summary of Rumble’s strengths:

| Strengths | Details |

|---|---|

| Creative Freedom | Encourages a diverse range of content without heavy restrictions. |

| Growing Audience | Rapidly expanding user base attracted to alternative media. |

| Innovative Revenue Models | Multiple monetization options providing financial benefits to creators. |

In summary, Rumble is more than just a video-sharing platform; it's a vibrant ecosystem for creators and viewers alike. Understanding its core principles and growth potential can help you decide if investing in Rumble stock is the right move for you.

Read This: How to Create a Rumble Account and Join the Platform’s Growing Community

Why Invest in Rumble Stock?

Investing in Rumble stock presents an exciting opportunity for those looking to immerse themselves in the evolving landscape of digital content and social media. Here’s why you might consider adding Rumble to your investment portfolio:

- Growing Platform: Rumble has rapidly gained traction as an alternative video-sharing platform, especially among users seeking free speech and a space for diverse content. The increase in user engagement translates to potential revenue growth.

- Diverse Revenue Streams: The company has multiple monetization avenues, including advertising, subscriptions, and content partnerships. This diversification can help insulate it against market fluctuations.

- Market Demand for Alternatives: As more content creators look for alternatives to mainstream platforms, Rumble's unique positioning is appealing. Its model promotes creators who may feel sidelined, increasing user loyalty.

- Innovative Features: Rumble continually rolls out new features to enhance user experience, making it more attractive for both content creators and viewers. This innovation can drive more traffic and engagement over time.

- Positive Growth Potential: Analysts have noted Rumble's potential for future growth, particularly as it expands its reach into new markets and demographics. Investing early could yield substantial returns.

Ultimately, whether you should invest in Rumble stock depends on your investment goals and risk tolerance. Always consider conducting your research to ensure it aligns with your long-term strategy.

Read This: What Royal Rumble Did Edge Return? A Historic Moment in WWE

Preparing to Buy Rumble Stock

Before diving into the world of investing in Rumble stock, it’s essential to prepare adequately. Here’s a step-by-step guide to help you get ready:

- Research the Company: Familiarize yourself with Rumble’s business model, financial performance, and market potential. Analyze recent news, press releases, and stock performance to understand where Rumble stands.

- Set Your Investment Goals: Establish what you wish to achieve through your investment. Are you looking for quick returns or a long-term hold? Your strategy will influence your buying decision.

- Choose a Brokerage: Select an online brokerage that caters to your needs. Look for advantages like low fees, user-friendly interfaces, and strong customer support. Some popular options include:

| Brokerage | Features |

|---|---|

| Robinhood | Commission-free trades, easy to navigate. |

| E*TRADE | Comprehensive research tools, robust educational resources. |

| Fidelity | No account minimums, excellent customer support. |

- Create a Trading Account: Open an account with your chosen brokerage. Be prepared to provide personal information and complete identity verification.

- Fund Your Account: Transfer money into your brokerage account. Depending on your chosen platform, this process may vary.

- Stay Informed: Keep up with Rumble's developments and overall market trends. Tools and resources available through your broker can aid in decision-making.

Getting prepared can make your investing journey smoother, so take your time and set yourself up for success!

Read This: How to Monetize Rumble Videos and Make Money from Your Content

Step 1: Research and Analyze Rumble's Financial Performance

Before diving into any investment, it’s crucial to understand what you’re getting yourself into. Rumble, a rising platform in the digital video space, has been making waves lately, and doing thorough research will help you make informed decisions. Here are some key factors to consider:

- Revenue Generation: Take a close look at how Rumble generates income. Does it rely on ad revenue, subscriptions, or another model? Understanding its revenue stream can give you insight into its potential growth.

- Market Position: Where does Rumble stand against competitors like YouTube and Vimeo? Analyzing its market share and unique selling points is vital.

- Financial Statements: Review Rumble’s latest financial statements, including balance sheets and income statements. Look for trends in revenue, expenses, and profitability.

- Growth Potential: Consider Rumble’s plans for expansion. Are they venturing into new markets or adding features that could attract more users?

Additionally, keep an eye on news articles and press releases about the company. Changes in leadership, partnerships, or business strategies can significantly impact stock performance. Don't forget to check financial analysts’ reports, which can provide expert insights into Rumble’s future.

Read This: How to Unlock Toga in My Hero Ultra Rumble

Step 2: Choose a Brokerage Platform

Once you’re confident in Rumble’s financial health and growth potential, the next step is to choose a brokerage platform. But with so many options out there, how do you decide which one is right for you? Here are some aspects to consider:

- Brokerage Fees: Look at the commission fees and other charges associated with trading on the platform. Some platforms offer commission-free trades, while others might have variable fees.

- User Experience: Choose a brokerage with an intuitive interface. A user-friendly platform can make your investing journey much smoother.

- Research Tools: Consider how well-equipped the brokerage is in terms of research and analysis tools. Access to advanced charts, financial data, and news alerts can make a significant difference.

- Security Features: Ensure that the brokerage has strong security measures to safeguard your personal and financial information.

- Investment Options: Apart from Rumble stock, check if the brokerage offers other investment options such as ETFs, mutual funds, or options trading.

Here’s a handy comparison table of some popular brokerage platforms:

| Brokerage | Fees | User Experience | Research Tools |

|---|---|---|---|

| Brokerage A | 0% commission | Beginner-friendly | Advanced analytics |

| Brokerage B | $5 per trade | Standard | Basic tools |

| Brokerage C | No commissions | Intuitive design | Comprehensive resources |

Take your time to compare different platforms before making your choice. A suitable brokerage can dramatically enhance your investing experience—so choose wisely!

Read This: How to Delete a Video on Rumble and Remove Your Content

Step 3: Set Up and Fund Your Brokerage Account

Alright, folks! Now that you've done your homework and chosen a brokerage, it's time to roll up your sleeves and set up your account. This step is critical because having the right account can make or break your investing experience.

First off, head over to your selected brokerage's website. You’ll typically find a “Sign Up” or “Open an Account” button waiting for you. Click on it, and fill out your personal information. Here’s what you usually need:

- Name: Your legal name, just like it appears on your ID.

- Address: Where you reside, important for tax purposes.

- Social Security Number: For identity verification in the U.S.

- Employment Information: Some firms ask about your job status and employer.

- Financial Information: This includes your net worth, income, and investment experience.

After you submit this info, you might need to verify your identity by uploading documents like your driver’s license or a utility bill. Don’t worry; this is standard procedure.

Once your account is set up, the next step is to fund it. Most brokerages let you do this via:

- A direct bank transfer (ACH transfer)

- Wire transfer

- Check deposit

Choose the method that works best for you. Just remember, it may take a few days for the funds to clear, so plan accordingly. Happy investing!

Read This: How to Get Paid in Rumble? Earning Opportunities on the Platform

Step 4: Place Your Order for Rumble Stock

You've made it to the exciting part—placing your order for Rumble stock! But before you hit that big “Buy” button, let’s take a moment to discuss how to do this wisely. The good news? It's pretty straightforward.

First, log into your brokerage account. You’ll be greeted by a dashboard filled with charts and stock tickers. Search for Rumble stock using its ticker symbol. If Rumble is publicly traded at the time of your search, it'll pop right up!

Next, decide how many shares you want to purchase. It’s important to consider your budget and how much of your portfolio you want to allocate to Rumble. Here's a quick way to think about it:

| Strategy | Investment Amount | Number of Shares |

|---|---|---|

| Conservative | $100 | 1 share (if priced at $100) |

| Moderate | $500 | 5 shares (if priced at $100) |

| Aggressive | $1,000 | 10 shares (if priced at $100) |

Now choose between a market order and a limit order. A market order buys shares at the current market price, while a limit order allows you to set a specific price at which you want to buy. If Rumble is soaring, you might want to wait for a limit order to get a better deal.

Finally, review your order to ensure everything looks correct. Double-check the stock symbol, number of shares, and type of order. If all looks good, press that “Place Order” button and voilà! You’re officially a Rumble stockholder. Just remember to keep an eye on your investment, and happy trading!

Read This: How to Delete Your Rumble Account: A Step-by-Step Tutorial

Step 5: Monitor Your Investment

Congratulations on purchasing Rumble stock! But the journey doesn't end there. Just like tending to a garden, keeping an eye on your investment is crucial to ensure it grows and thrives. Here’s how you can effectively monitor your investment in Rumble.

First off, you’ll want to track Rumble’s stock price. There are several resources available:

- Stock Market Apps: Utilize apps like Robinhood, E*TRADE, or Yahoo Finance that provide real-time stock data.

- Financial News Websites: Websites such as Bloomberg, MarketWatch, and CNBC offer up-to-date information and market analysis.

- Brokerage Account: Most brokerage platforms have their own dashboard where you can view your portfolio performance at a glance.

Next, it's essential to stay informed about Rumble's business developments. Follow company news through press releases, earnings calls, and updates from their corporate website. Social media platforms like Twitter or LinkedIn can also offer timely insights.

You should also consider setting up price alerts. Many trading platforms allow you to set notifications based on specific price targets. This way, you won’t miss a chance to buy more shares if the price dips or sell if it reaches your profit target.

Lastly, keep an eye on the overall market trends and the social media landscape, especially since Rumble is a content-sharing platform. Changes in user engagement, regulatory news, or competition can significantly affect stock performance. By staying engaged and informed, you can make smart decisions about your investment.

Read This: Does Eren Regret the Rumbling? Exploring Eren’s Emotions and Thoughts on the Catastrophic Event

Conclusion: Making Informed Investment Decisions

Investing in Rumble stock can be an exciting venture filled with potential rewards, but it's crucial to approach it with a well-informed mindset. As we've discussed, taking the right steps before and after your investment is essential to navigate the stock market effectively.

Remember, investing is not just a one-time event; it's a journey. Here’s a quick recap of what to consider:

- Research: Understand the company, its business model, and its competitive landscape.

- Financial Planning: Determine how much you're willing to invest and set realistic financial goals.

- Diversification: Avoid putting all your eggs in one basket. Diversifying your portfolio can mitigate risks.

- Regular Review: Monitor your investment and stay updated with company news and market trends.

Above all, prioritize due diligence and never rush into decisions based solely on emotions or hype. By doing your homework and staying proactive, you can make informed choices that align with your financial goals. Happy investing!

Related Tags