Taxes can be a daunting topic for Etsy sellers, but understanding them is vital for your business's success. This guide breaks down the essentials of Etsy taxes, focusing on what you need to know about your tax obligations and the basics of sales tax applicable to sellers on the platform. By becoming informed, you can ensure compliance and avoid potential pitfalls.

What You Need to Know About Etsy Taxes

As an Etsy seller, you are responsible for reporting your income on your tax return. The income you earn from your Etsy shop is considered self-employment income, and it is crucial to keep accurate records of your sales, expenses, and any associated taxes. Additionally, Etsy typically provides sellers with a yearly 1099-K form if you meet the revenue threshold, which must be reported on your tax return.

It’s also important to consider state and local tax obligations, which can vary depending on your location and where your customers are based. In some cases, you may need to collect and remit sales tax on your sales, requiring you to register for a sales tax permit. Keeping abreast of these regulations can help prevent legal issues and fines.

Read This: Maximizing Your Sales with Etsy Vacation Mode

The Basics of Sales Tax for Etsy Sellers

Sales tax is charged on the sale of goods in many states, and as an Etsy seller, you may need to collect this tax from your customers based on their location. Here are some essential points to remember:

- Sales tax is determined by the customer's shipping address, not your address.

- Many states require sellers to register for a sales tax permit before collecting taxes.

- Etsy has automated sales tax collection for certain states, but sellers should still verify compliance.

- Be aware of tax-exempt customers and how to manage their purchases.

Understanding and correctly applying sales tax is crucial for maintaining good standing with tax authorities and ensuring your shop operates smoothly.

Read This: How Many Orders Can You Cancel on Etsy

3. How to Determine Your Tax Obligations

Understanding your tax obligations as an Etsy seller can feel overwhelming, but it’s crucial for running a compliant business. To get started, consider the following steps:

- Know Your Local Laws: Tax regulations can vary significantly depending on your location. Some states or countries have specific sales tax laws for online sales. Make sure to research the requirements for your particular area.

- Sales Tax Eligibility: Typically, if you have a physical presence (like a home office or warehouse) in a state, you may need to collect sales tax from customers in that state. Etsy helps sellers by automatically calculating sales tax at checkout based on the buyer's location, but it’s still your responsibility to understand when and where you need to charge it.

- Understand Income Tax: Regardless of where your sales are made, you're generally required to report your earnings to the IRS (or your country’s tax authority). This includes all income from your Etsy sales, regardless of whether you meet a minimum threshold.

- Use Accounting Tools: Consider utilizing accounting software or tools specifically designed for Etsy sellers. These can help you track sales, expenses, and generate reports, making it easier to assess your tax obligations.

Lastly, it can be really beneficial to consult with a tax professional, especially if you're just starting out. They can provide personalized guidance tailored to your specific situation, helping you navigate the often-complex world of taxes.

Read This: How to Write a Review on Etsy

4. Reporting Earnings and Expenses on Etsy

Accurate reporting of your earnings and expenses is essential for running a successful Etsy shop, not just for tax purposes, but for your overall business strategy. Here’s how to effectively manage this process:

1. Track Your Earnings

Every sale you make contributes to your total income. Make sure to:

- Keep Accurate Records: Use Etsy's "Shop Stats" feature to get insights into your sales performance.

- Include All Sources: Don't forget to account for other income such as shipping fees or custom orders.

2. Document Your Expenses

Tracking expenses is just as important as keeping tabs on your earnings. Common deductible expenses include:

- Materials and supplies

- Shipping costs

- Etsy fees (listing fees, transaction fees, and advertising fees)

- Home office expenses (like a portion of rent or utilities if applicable)

3. Organize and Report

Once you have all your records, it's time to prepare your report:

- Use Spreadsheets: Keeping an organized spreadsheet can help you summarize your income and expenses clearly.

- Consider Tax Software: Programs like TurboTax or QuickBooks can simplify the tax reporting process, especially with integrated expense tracking.

At the end of the year, compiling this information will help ensure that you are compliant with tax regulations and can make informed business decisions going forward. Remember, the more organized you are, the easier tax season will be!

Read This: How to Get Your Etsy Shop Noticed

5. Filing Your Taxes as an Etsy Seller

Filing your taxes as an Etsy seller might seem daunting at first, but with a little organization and knowledge, you can navigate the process with ease. Here are some key points to keep in mind:

- Understand Your Tax Responsibilities: As an Etsy seller, you are considered a self-employed individual. This means you will need to report your income and, potentially, pay self-employment taxes.

- Keep Accurate Records: Throughout the year, maintain accurate records of your sales, fees, and expenses. This will make it much easier to fill out your tax forms. Consider using accounting software or a simple spreadsheet to track your transactions.

- Choose the Right Tax Form: Most Etsy sellers will use Schedule C (Form 1040) to report their business income or loss. If you expect your business to grow, you might want to consider forming a LLC, which could affect your tax filings.

- Estimate Your Taxes: If you expect to owe more than $1,000 in taxes, the IRS may require you to make estimated quarterly tax payments. Keep track of your revenue so you can plan accordingly.

- Consider Working with a Professional: If tax season feels overwhelming, don't hesitate to consult a tax professional who understands e-commerce. They can provide valuable advice and ensure you’re complying with all necessary regulations.

In summary, filing your taxes as an Etsy seller requires attention to detail and a bit of preparation. By staying organized and informed, you can confidently handle your tax responsibilities.

Read This: Maximize Your Shopping Experience with Etsy Gift Cards

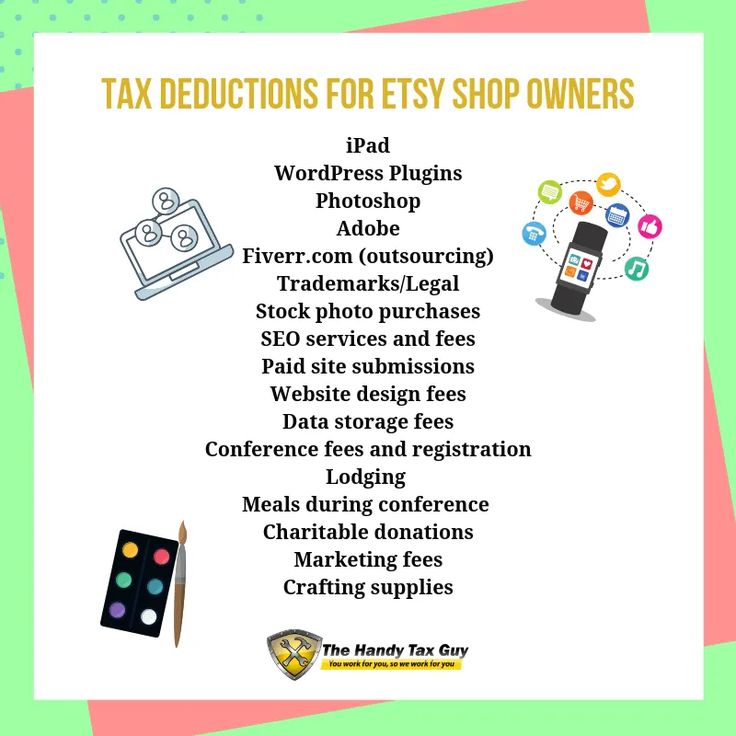

6. Common Tax Deductions for Etsy Entrepreneurs

One of the best parts of being an Etsy seller is the potential to claim tax deductions and lower your taxable income. Here are several common deductions you might qualify for:

- Cost of Goods Sold (COGS): This includes the cost of materials and supplies used to produce your products. Keep your receipts!

- Shipping Costs: Any shipping fees you pay to send products to customers can be deducted. Make sure to document each transaction.

- Etsy Fees: Don’t forget to account for Etsy's listing fees, transaction fees, and payment processing fees. These are directly related to your business expenses.

- Home Office Deduction: If you operate your Etsy shop from home, you might qualify for a home office deduction. This can include a portion of your rent/mortgage, utilities, and internet costs.

- Advertising and Marketing Expenses: Any money spent on promoting your shop—like social media ads or promotional materials—can often be deducted.

It's essential to keep detailed records and receipts related to your expenses, as this will help substantiate your deductions if you are ever audited. Remember, maximizing your deductions not only reduces your taxable income but also helps you reinvest in your business. Happy selling!

Read This: How to Get Your First Etsy Sale

7. State-Specific Tax Considerations for Etsy Sellers

When you’re running your Etsy shop, it’s essential to understand that taxes aren’t one-size-fits-all—*state laws can vary significantly. Here are some key points to keep in mind:

- Sales Tax: Many states require you to collect sales tax from customers based on where the buyer is located. Research your state’s specific sales tax regulations and be sure you’re applying the right rates.

- Destination-Based vs. Origin-Based: Some states are destination-based, meaning the tax rate is based on the buyer's location. Others are origin-based—where the tax rate is based on where you ship from.

- Tax Exemptions: Certain buyers, like non-profits or resellers, may be exempt from paying sales tax. Check your state’s guidelines to ensure you’re handling these transactions correctly.

- Thresholds for Collection: Some states impose a sales tax obligation only if your sales exceed a certain threshold (e.g., $100,000). Make sure to monitor your sales and be aware of your responsibilities in each state.

Keeping Up with Changes: Tax laws frequently change, so it’s a good idea to stay informed. Follow resources like your state’s revenue department or consult a tax professional for the most accurate information. Remember, taking the time to understand these nuances can save you from potential headaches down the line!

Read This: How to Sell My Products on Etsy

8. Tools and Resources for Managing Etsy Taxes

Managing taxes as an Etsy seller can feel overwhelming, but luckily, there are plenty of tools and resources available to simplify the process. Here are some you might find helpful:

- Tax Software: Programs like QuickBooks, TurboTax, and H&R Block offer user-friendly interfaces specifically designed to help small business owners manage their taxes efficiently.

- Etsy’s Sales Tax Tool: Etsy provides built-in settings to help you automatically calculate and collect sales tax for orders. Make sure to enable this feature to save time!

- Online Calculators: Websites like TaxJar and Avalara can help you determine the appropriate sales tax rates based on your location and the products you sell.

- Community Forums: Engage with other sellers through forums like Etsy Community or Reddit to share experiences and tips related to tax management.

Tax Professionals: Don’t underestimate the value of hiring a tax professional. If your situation becomes complex, consulting an accountant who specializes in e-commerce can provide you with peace of mind and assurance that you’re handling everything correctly.

Remember, staying organized and up-to-date with your taxes can help you focus more on what's important: growing your Etsy business!

Read This: Understanding Etsy Fees and Charges for Sellers

9. Staying Compliant with Tax Regulations

When selling on Etsy, understanding and adhering to tax regulations is essential for your business's success and longevity. Compliance* ensures that you avoid potential penalties and can focus on what you love—creating and selling your unique products.

Here are some key points to consider:

- Familiarize Yourself with Local Laws: Different regions have different tax laws, so it's crucial to research the requirements in your country, state, and even city. This may include income tax, sales tax, or additional taxes specific to your product type.

- Collecting Sales Tax: If you sell to customers in a state where you have economic nexus (which means you do a certain amount of business in that state), you may need to collect sales tax. Etsy helps by automatically calculating sales tax for many states, but understanding how this works is still critical.

- Document Everything: Keep thorough records of your sales, expenses, and tax collected. This documentation can be crucial during tax season and in case of an audit.

- File on Time: Be mindful of tax filing deadlines. Missing deadlines can lead to penalties, so set reminders for yourself to ensure you stay on track.

Finally, consider consulting a tax professional, especially if your store grows. Their expertise can help you navigate complex tax scenarios and ensure compliance with all regulations, allowing you to focus more on your craft.

Read This: How to Earn on Etsy

10. Frequently Asked Questions About Taxes on Etsy

As you embark on your Etsy journey, you may have several questions about taxes. Below are some of the most common inquiries to help clarify your understanding:

| Question | Answer |

|---|---|

| Do I need to pay taxes on my Etsy sales? | Yes, in most cases, you are responsible for paying taxes on your earnings, which may include income tax and sales tax. |

| How do I calculate my sales tax? | Sales tax is typically based on the total sales price of your product. Etsy automatically calculates this for many states, but it's important to confirm the rates for areas you sell to. |

| What if I live outside the U.S.? | If you live outside the U.S., you should research the tax obligations in your country regarding online selling. Some countries require VAT or GST registration. |

| Do I need a business license? | This depends on your location and the scale of your business. Some places require a small business license, so check with your local authorities. |

Remember, staying informed and organized with your taxes can help you manage your Etsy shop more effectively. Don’t hesitate to ask questions or seek help from professionals when in doubt—you’re not alone in this!”

Related Tags