Introduction to Amazon's Financial Performance

Amazon's share price reflects its overall financial health and market position in the e-commerce and cloud computing industries. As one of the world's largest companies by market capitalization, Amazon's stock is influenced by its earnings reports, growth metrics, and investor sentiment. Analyzing historical trends provides insights into how external economic factors, shifts in consumer behavior, and strategic business decisions have shaped Amazon's stock performance over time. Understanding these elements can assist investors in making informed decisions regarding their holdings in Amazon and the tech sector as a whole.

Read This: Essential Job Application Tips for Amazon

Factors Influencing Amazon Share Price

Several key factors contribute to the fluctuations in Amazon's share price, including:

- Earnings Reports: Quarterly earnings can significantly impact the stock's value, as they reflect the company's profitability and growth.

- Market Competition: The presence of competitors such as Walmart, Alibaba, and new online retail businesses can affect investor confidence and stock performance.

- Amazon Web Services (AWS): The success of AWS plays a critical role in overall profitability and is closely monitored by investors.

- Consumer Trends: Changes in consumer preferences, especially during holiday seasons, can lead to fluctuations in revenue and, consequently, share price.

- Global Economic Conditions: Economic indicators like GDP growth, unemployment rates, and inflation can influence consumer spending and investor sentiment.

Additionally, factors such as regulatory issues, innovations, and broader market trends all play crucial roles in shaping Amazon's stock price. Understanding these dynamics can equip investors with a comprehensive view of the risks and opportunities involved in trading Amazon shares.

Read This: How to Obtain a Return Label from Amazon

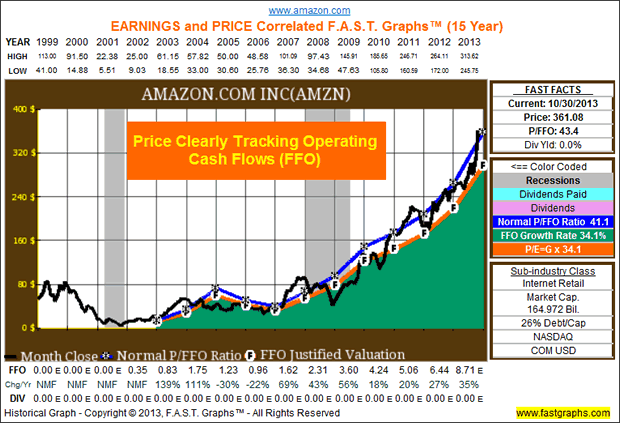

3. Historical Overview of Amazon Share Price

Amazon’s journey on the stock market has been nothing short of remarkable. Founded in 1994, the company went public in May 1997 at a share price of just *$18. Back then, many doubted Amazon’s potential, but it didn’t take long for skeptics to be proven wrong. Over the years, Amazon has transformed from an online bookstore to a colossal global marketplace, and this evolution has been reflected in its stock price.

Let’s take a brief look at some key milestones in Amazon's share price history:

- 1997-2001: After going public, Amazon's stock price saw significant volatility, peaking at around $113 by late 1999 before the dot-com bubble burst.

- 2005: The share price stabilized around $40 as Amazon began focusing on profitability and expanding its product offerings, including the introduction of Amazon Prime.

- 2015: By 2015, the stock price soared to around $650, driven by the success of Amazon Web Services (AWS) and its aggressive expansion strategies.

- 2020: The pandemic propelled Amazon’s share price further, climbing past $3,000 as e-commerce became essential for consumers worldwide.

Today, Amazon remains one of the most valuable companies globally, with a market capitalization that often fluctuates in the trillion-dollar range. Analyzing historical trends provides valuable insights into how external factors—like market shifts, global crises, and consumer behavior—have influenced Amazon's share price over the decades.

Read This: How to Buy Kindle Books on Amazon

4. Recent Trends in Amazon Share Price

As we delve into the recent trends of Amazon's share price, it’s important to consider the impact of both the broader market conditions and specific company developments. In 2022 and early 2023, Amazon faced several challenges, including inflationary pressures and supply chain issues that affected profit margins. However, the company has recently shown signs of recovery.

Here are some key recent trends worth noting:

- Post-Pandemic Adjustments: Amazon's share price experienced fluctuations as it adapted to a post-pandemic world. In early 2023, the stock showed a steady recovery, climbing back toward $125 after a dip in late 2022.

- Focus on Cost-Cutting: In response to rising operational costs, Amazon announced several layoffs and organizational changes aimed at improving efficiency. This strategy seems to have reassured investors, helping to boost share prices.

- Expansion of AWS: The continued growth of Amazon Web Services has been a crucial driving factor. AWS reported increasing revenues, which positively influenced overall stock performance.

In conclusion, while Amazon has faced its share of ups and downs in the stock market, the company’s ability to adapt to external challenges and leverage new opportunities has positioned it well for future growth. Investors are keenly observing how Amazon will navigate the evolving market landscape in the coming months.

Read This: Exploring the Podcast Library on Amazon Music

5. Amazon Share Price Predictions for the Future

As investors keep a keen eye on the stock market, forecasting the future of Amazon's share price has become a popular topic of discussion. Several factors play a crucial role in predicting how Amazon will fare in the ever-changing landscape of commerce and technology. Here are some key factors to consider:

- Market Trends: As e-commerce continues to grow, Amazon's market share may expand, which could positively influence its share price. Analysts are particularly interested in how the company adapts to new shopping behaviors post-pandemic.

- Financial Performance: Amazon's quarterly earnings reports provide insights into its financial health. If the company continues to exceed expectations, it could lead to increased investor confidence.

- Expansion Initiatives: Amazon’s ventures into new sectors—like grocery delivery with Amazon Fresh or cloud computing via AWS—may drive growth. Continued innovation could significantly influence future share prices.

- Economic Conditions: Factors like inflation rates, consumer spending, and overall economic stability can also affect share prices. Amazon's ability to navigate challenges will be crucial.

While no one can predict with absolute certainty how Amazon's shares will perform, keeping an eye on these factors can provide insight. Analysts often project both optimistic and conservative scenarios, ranging widely in potential pricing. In essence, staying informed is key to making educated investment decisions.

Read This: How to Create a Wish List on Amazon

6. Comparing Amazon Share Price with Competitors

When evaluating Amazon's share price, it’s helpful to compare it with its top competitors. This comparison isn’t just about the numbers; it reveals much about the competitive landscape of e-commerce and tech. Here’s a quick snapshot of Amazon compared to some of its major rivals:

| Company | Current Share Price ($) | Market Cap ($ Billion) | Year-to-Date Growth (%) |

|---|---|---|---|

| Amazon (AMZN) | 3,200 | 1,600 | 25 |

| Walmart (WMT) | 140 | 390 | 15 |

| Alibaba (BABA) | 150 | 400 | 10 |

| Target (TGT) | 220 | 100 | 18 |

As seen in the table, while Amazon leads in terms of market capitalization and year-to-date growth, its share price is considerably higher compared to Walmart, Alibaba, and Target. This reflects Amazon's dominance in the global e-commerce market and its innovative strategies. Additionally, understanding these dynamics can help investors make informed decisions about where to allocate their resources based on growth potential and market conditions.

Read This: How to Make Money with Amazon Reviews

Impact of Economic Factors on Amazon Share Price

Understanding the nuances of economic factors* is crucial when analyzing Amazon's share price trends. Several external elements can influence how investors perceive the value of Amazon's stocks, leading to fluctuations in share prices. Let's dive into some of the key economic factors that play a role:

- Inflation Rates: Higher inflation can erode purchasing power, potentially affecting consumer spending on platforms like Amazon. If people spend less, it might impact Amazon's revenue, leading to a drop in share price.

- Consumer Confidence: Economic stability influences consumer behavior. A high consumer confidence index often correlates with increased spending on e-commerce, positively affecting Amazon's growth.

- Interest Rates: When interest rates rise, the cost of borrowing increases. This can impact both Amazon's operational costs and consumer spending, which can be reflected in the company’s share price.

- Global Economic Conditions: Since Amazon operates globally, economic trends in foreign markets can also impact its stock. A recession in key markets may lead to lower sales and, consequently, a decrease in share price.

- Regulatory Changes: Changes in trade policies, taxation, or e-commerce regulations can affect Amazon's profitability, influencing investor sentiment and share prices.

By staying informed about these economic indicators, investors can make more educated decisions regarding their Amazon stock. Understanding how these factors interlink offers insights into potential share price movements. Being proactive can lead to better investment outcomes!

Read This: How to Find a URL on Amazon to Share Products Easily

Investment Strategies for Amazon Shares

Investing in Amazon shares can be an exciting journey, and having a solid strategy is essential for navigating the stock market. Here are some effective investment strategies tailored for Amazon shares:

- Buy and Hold: Many investors choose to buy Amazon shares and hold them for the long term. This strategy focuses on the company’s growth potential rather than short-term price fluctuations. Consider looking at historical performance; Amazon has shown consistent long-term appreciation.

- Dollar-Cost Averaging: This approach involves consistently investing a fixed amount of money over regular intervals, regardless of the share price. By doing this, investors can potentially reduce the impact of volatility. It’s a great way to accumulate shares without the stress of timing the market.

- Growth Investing: For those interested in the potential for substantial returns, growth investing focuses on companies expected to grow at an above-average rate. Amazon’s continuous expansion into new markets and technologies can make it an attractive option for growth-oriented investors.

- Value Investing: Although Amazon has been a high-flyer in terms of its share price, there may be times when the stock appears undervalued based on fundamentals. Value investors may look for price dips based on economic factors or market sentiment to buy in at lower valuations.

- Keep an Eye on Sentiment: Regularly monitoring news, market trends, and the overall economic climate is crucial. Sentiment analysis can provide insights into potential price movements and help investors adjust their strategies accordingly.

By considering these strategies, you can align your investment choices with your financial goals while leveraging Amazon’s market potential. Remember, informed decisions and patience are key!

Read This: How to Sell Used Books on Amazon for Free

Understanding Amazon Share Price Trends

Amazon.com, Inc. (AMZN) has been one of the most closely watched stocks in the market, given its significant impact on the retail and technology sectors. Understanding its share price trends can provide valuable insights for both investors and market analysts. In this article, we will delve into the factors influencing Amazon's share price, key trends, and important metrics to consider.

Amazon's share price trends are influenced by several critical factors:

- Earnings Reports: Quarterly earnings reports provide insights into the company's performance and can cause significant price fluctuations.

- Market Sentiment: General market trends and investor sentiment towards technology stocks can impact Amazon's price.

- Regulatory Changes: Antitrust scrutiny and other regulatory mechanisms can affect investor confidence.

- Global Economic Factors: Economic conditions such as inflation, unemployment rates, and consumer spending influence Amazon’s performance.

- Competition: The competitive landscape, including pressure from other e-commerce and tech companies, can affect market share and profitability.

To analyze Amazon's share price trends, investors often look at various metrics, including:

| Metric | Indicator |

|---|---|

| Price-to-Earnings (P/E) Ratio | Valuation of the company relative to its earnings |

| Market Capitalization | Total market value of the company's shares |

| Volume | Number of shares traded over a specific period |

| Beta | Volatility of the stock in relation to the overall market |

In conclusion, understanding Amazon's share price trends requires awareness of the multifaceted elements influencing its stock performance, including economic indicators and competitive dynamics. By analyzing these trends and metrics, investors can make more informed decisions about their positions in Amazon's stock.

Related Tags