Adobe, a software company known for its creative and productivity applications, is one of the best in the business. The company has been able to attract a lot of investors’ attention because of this. Most of the time, this happens because of their strong brand name recognition around the world as well as having products like Photoshop or Adobe Creative Cloud in every household.

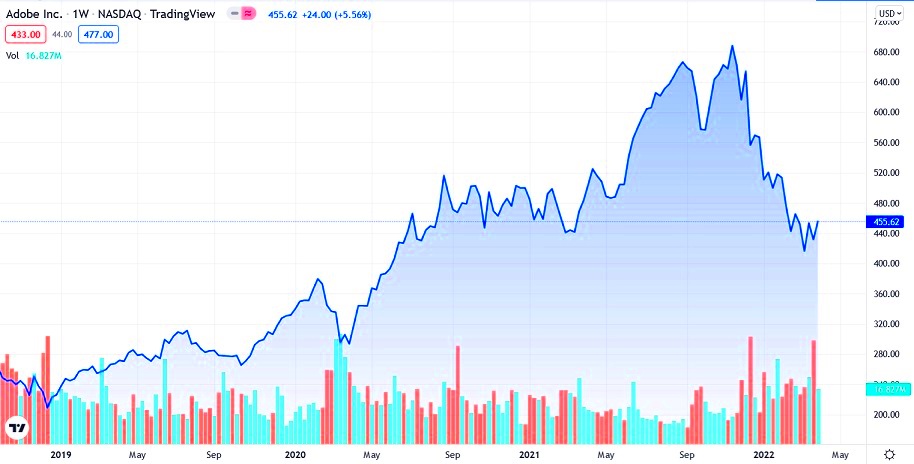

Adobe has always dominated the field of digital media due to the subscription-based business model it employs. And while this might be true, however fluctuating stock prices make it difficult for investors to know when exactly to buy or sell their shares. Nevertheless, understanding such factors will enable an investor to have some insight on how best they can invest in Adobe.

Factors Influencing Adobe Stock Price Trends

Among the several factors that have an effect on Adobe’s share price include:

- Company Earnings: Earnings reports can cause significant price movements. Strong earnings often lead to stock price increases, while disappointing results can drive prices down.

- Market Trends: Trends in the tech industry and consumer behavior can affect stock prices. For example, increased demand for digital media tools can boost Adobe's stock.

- Investors' Sentiment: How investors feel about the company can sway prices. Positive news can lead to buying sprees, while negative news can cause panic selling.

- Competition: The rise of competitors can impact Adobe's market share, thus affecting stock performance.

Read This: Saving Adobe Stock Images to Your Computer

Impact of Economic Conditions on Adobe Stock

The economy plays a vital part in determining the Adobe stock price. Below are some considerations:

| Economic Factor | Impact on Adobe Stock |

|---|---|

| Recession | During economic downturns, companies may cut budgets, affecting Adobe's sales. |

| Interest Rates | Higher interest rates can limit consumer spending, which may impact Adobe's revenues. |

| Global Market Conditions | Global instability can affect international sales and operations for Adobe. |

To wrap up, numerous economic factors have a great impact on the price of stocks belonging to Adobe. Tracking them will allow investors to know the possible dangers and chances.

Read This: Incorporating Adobe Stock Images in Photoshop

Analysis of Adobe's Recent Earnings Reports

Adobe's financial health and performance according to its earnings reports. These reports help investors know how well Adobe is doing in the competitive tech landscape. In recent quarters, Adobe has reported high revenues and user growth but some things have made people raise their eyebrows.

For example, although general earnings have risen, some areas like electronic media have displayed the signs of reduced growth potential. A couple of important indicators are always under the scrutiny of stockholders when looking at these reports:

- Revenue Growth: A consistent upward trend is a good indicator of company health.

- Earnings Per Share (EPS): This reflects the company’s profitability and is a crucial metric for investors.

- Guidance: Future forecasts from Adobe can signal how management views upcoming challenges and opportunities.

Recent reports reveal that although Adobe is still progressively growing, it may not be growing as vigorously as before. This implies that stock price may be volatile due to changing investor sentiments.

Read This: Understanding Adobe Stock Credits PUF

Comparison with Competitors and Market Trends

In order to really comprehend the position of Adobe within the market, there is need for comparisons between it and its closest competitors such as Canva or Corel. Hence, it becomes imperative to know their strengths so that we might be able to analyze Adobe in detail.

| Company | Strengths | Market Share |

|---|---|---|

| Adobe | Comprehensive tools and strong brand loyalty | Approximately 60% |

| Canva | User-friendly interface and affordability | About 30% |

| Corel | Specialized design software | Around 10% |

Moreover, it is necessary to take into account market trends. Certainly, the increment in demand for digital creation tools puts Adobe at an advantage though it faces tough competition. As a result, in order to remain competitive within the industry, a focus on innovation and user experience must be paramount.

Read This: How to Download Images from Adobe Stock

Future Outlook for Adobe Stock

The future of Adobe’s stock is very bright indeed. This can be seen from different angles and perspectives, one being that it's well-known for its success in digital printing and marketing business as well as being among the oldest software companies which have ever existed. Above all other reasons at this moment, digital transformation remains one of those unstoppable trends that change lives overnight sometimes in terms of industrial development; hence there may come a time when people start talking about different types of software including new versions being issued every month or even week. This can then lead to conversation on the importance of constant innovation which can be seen from the plethora of new applications for instance those developed by startups.

Some other things to take account include the following:

- Innovation: Adobe's commitment to innovation, including new features in its Creative Cloud and Document Cloud, will likely drive user engagement.

- Market Demand: As more businesses adopt digital solutions, the demand for Adobe's tools could rise.

- Acquisitions: Strategic acquisitions can bolster Adobe's portfolio and market position.

But, still there are some challenges. Factors affecting stock market performance may include competition, economic state and probable regulatory changes. Generally, if Adobe fashions to transversely these challenges comfortably, then it is possible that its shares will remain outstanding even in future years.

Read This: Is Adobe Stock Audio Free to Use?

Expert Opinions on Adobe Stock Price Movements

For future analysts of how Adobe stocks often rise or fall, any of their opinions would be a diamond that is truly treasured. Because these professionals give out predictions and market caps on their work findings according to what is obtained from the various financial organizations they belong to, Adobe can also be said to attract their attention. Such information will go a long way in guiding investors on how to invest wisely.

A lot of specialists are in consensus that Adobe has an undeniable business model which is good, but that could have some areas for concern:

- Growth Rate Concerns: Some analysts have expressed concern about Adobe's slowing growth rate in key segments, like Creative Cloud, which may affect long-term stock performance.

- Competitive Landscape: The rise of affordable alternatives like Canva has prompted experts to urge Adobe to innovate continually to maintain its market position.

- Macroeconomic Factors: Experts emphasize that broader economic conditions, such as inflation and interest rates, can significantly impact Adobe’s stock price.

Generally speaking, professional opinions indicate a careful but hopeful perspective for Adobe shares. To maneuver through potential price volatility, it is necessary to pay attention to market trends as well as corporate events.

Read This: How to Find High-Quality Vectors on Depositphotos

FAQs about Adobe Stock Price Changes

There could be numerous inquiries about directing funds towards purchasing shares of Adobe. Few of the recurring inquiries that might assist in elucidating are:

- What causes Adobe's stock price to fluctuate? Various factors like earnings reports, market trends, and economic conditions can impact Adobe's stock price.

- How can I keep track of Adobe's stock performance? Financial news platforms, stock market apps, and Adobe's investor relations website are great resources for tracking stock performance.

- Is Adobe stock considered a good investment? This depends on individual investment goals and risk tolerance. Analysts often recommend considering Adobe’s solid market position but also weighing potential risks.

- What should I do if Adobe's stock price falls? Assess the reasons behind the decline. It may be a good time to buy if you believe in the company's long-term potential.

Confidently investing in the stock market is not possible for potential investors without knowledge. That is why we have this FAQ section.

Read This: How to Check Your Stock Credits on Adobe Stock

Conclusion on the Reasons for Adobe Stock Price Falling

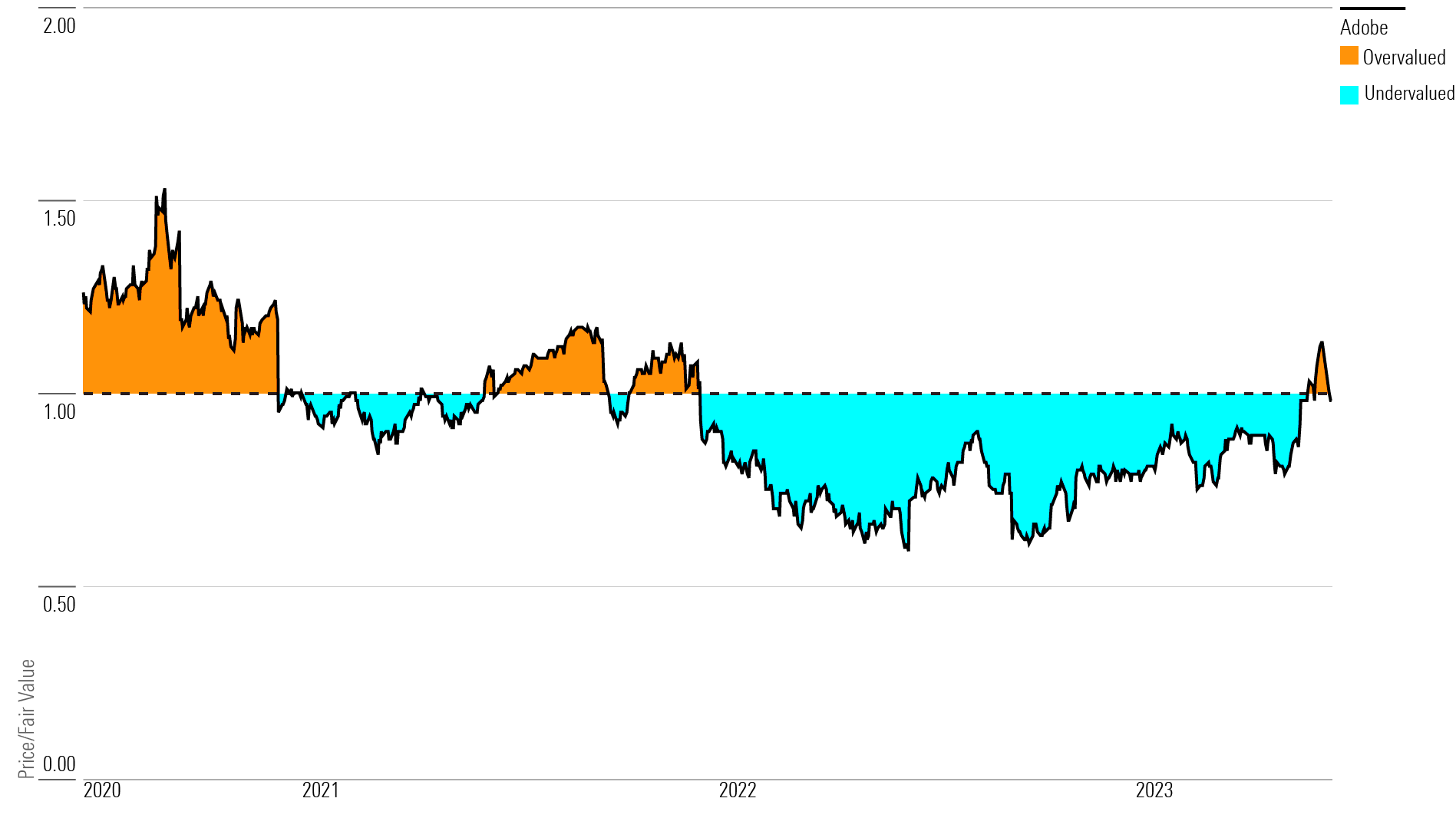

Adobe’s stock price has been going down due to many reasons. The corporation continues to dominate the digital media industry despite certain issues, which include:

- Slowing Growth: Some of Adobe's key segments have shown signs of slowing growth, raising concerns among investors.

- Intense Competition: Competitors offering similar services at lower prices have started to capture market share, putting pressure on Adobe's performance.

- Economic Pressures: Factors like inflation and changes in consumer spending can affect Adobe's revenue and, consequently, its stock price.

Even though these obstacles do exist; however, with reference to strong brand and innovation commitment, Adobe seems poised for growth in the future. Hence, it is imperative for investors to stay updated with market trends and company performance, to ensure they take appropriate steps as time goes on and on.