Are you curious about whether Adobe is a growth stock worth investing in? You're not alone! Many investors are keeping a keen eye on Adobe's performance lately, and it's easy to see why. With its innovative software offerings and a solid market position, Adobe might just be the investment you've been looking for. Let's dive into what growth stocks are and see how Adobe fits into this exciting category. By the end, you'll have a better idea of whether or not you should consider adding Adobe to your portfolio.

Understanding Growth Stocks

So, what exactly are growth stocks? Simply put, growth stocks are shares in companies that are expected to grow at an above-average rate compared to their industry or the overall market. Investing in growth stocks can be rewarding, but it also comes with its own set of risks. To better grasp this concept, let's break it down further:

- High Earnings Potential: Growth stocks usually reinvest their earnings into the company instead of paying dividends, which means they have a lot of potential for capital appreciation over time.

- Market Trends: These companies often operate in sectors that are expanding rapidly due to technological advancements or changing consumer preferences.

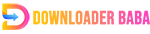

- Valuation Metrics: Growth stocks tend to have higher price-to-earnings (P/E) ratios because investors are willing to pay more upfront for future growth potential.

- Risk Factors: While growth stocks can offer substantial rewards, they can also be volatile. Poor earnings reports or market corrections can lead to significant losses.

To give you a practical perspective, here’s a quick comparison table featuring characteristics of growth stocks:

| Characteristic | Growth Stocks | Value Stocks |

|---|---|---|

| Growth Rate | Above average | Stable or low |

| Dividend Payments | Rarely pay dividends | Often pay dividends |

| Market Sentiment | Highly optimistic | Often undervalued |

Understanding these key aspects of growth stocks can help you make informed decisions when considering investments like Adobe. As we move forward, we'll explore Adobe's specific performance metrics and see how it stacks up against these criteria.

Read This: Cost of Adobe Stock Extended License

Overview of Adobe Inc.

Adobe Inc., widely recognized for its suite of creative software products, has transformed the way individuals and businesses engage with digital content. Founded in 1982, Adobe kick-started its journey with the launch of Adobe Illustrator, a software that revolutionized graphic design. Over the years, it expanded its portfolio to include industry staples such as Photoshop, Acrobat, and After Effects, each becoming essential tools in the arsenal of designers, marketers, and content creators.

Today, Adobe operates primarily through two business segments: Digital Media and Digital Experience. The Digital Media segment is best known for its Creative Cloud and Document Cloud offerings, which allow users to create, manage, and share content seamlessly. Meanwhile, the Digital Experience segment, powered by Adobe Experience Cloud, caters to enterprise-level clients by providing solutions for marketing, analytics, and advertising. This dual focus not only demonstrates Adobe's flexibility in catering to various customer needs but also positions it favorably in both consumer and enterprise markets.

As of now, Adobe continues to innovate, staying at the forefront of digital transformation. The company is investing in emerging technologies like artificial intelligence and machine learning, which it integrates into its products to provide users with more efficient tools and creative solutions. With a solid reputation and a commitment to innovation, Adobe is a name synonymous with creativity and productivity.

Read This: What It Means to License on Adobe Stock

Recent Financial Performance

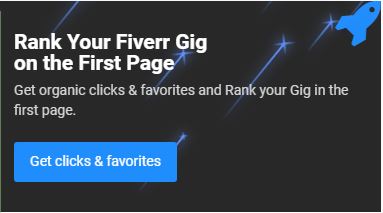

To assess whether Adobe is a growth stock worth investing in, examining its recent financial performance is crucial. Over the past few quarters, Adobe has shown impressive growth metrics that reflect its health and potential for future expansion. Here’s a quick breakdown of some recent financial figures:

| Quarter | Revenue (in billions) | Net Income (in billions) | Earnings Per Share (EPS) |

|---|---|---|---|

| Q2 2023 | $4.82 | $1.32 | $2.70 |

| Q1 2023 | $4.59 | $1.17 | $2.50 |

| Q4 2022 | $4.53 | $1.13 | $2.25 |

As we can see from the table, Adobe’s revenue has seen consistent growth, particularly in its most recent quarter. The company reported $4.82 billion in revenue for Q2 2023, an increase that showcases the robust demand for its subscription-based services. Additionally, the company's net income and earnings per share also reflect a healthy upward trend, which is always a promising sign for investors.

Moreover, Adobe's strong focus on expanding its product offerings has contributed to its impressive performance. The transition to a subscription-based model has not only improved cash flow but also provided a consistent revenue stream. With increasing investments in AI and an expanding product portfolio, Adobe seems well-positioned to capture further market share in the ever-evolving digital landscape. As a result, many investors are keenly watching Adobe as a potential growth stock. After all, a company with strong fundamentals and innovative capabilities is generally a recipe for success!

Read This: Meaning of Standard Assets on Adobe Stock

Market Position and Competitive Advantage

Adobe is a leader in digital media and marketing solutions, boasting a significant market position that sets it apart from competitors. The company primarily operates in the creative software market, where its flagship products like Adobe Photoshop, Illustrator, and Premiere Pro are household names among professionals. With a suite of integrated tools that cater to various industries—from marketing to graphic design—Adobe has built a robust ecosystem that keeps users coming back.

One of Adobe’s significant competitive advantages lies in its subscription model. By shifting from perpetual licenses to a subscription-based service via Adobe Creative Cloud, the company has secured a steady revenue stream and increased customer retention. This model not only enhances cash flow but also allows Adobe to continuously deliver updates and new features, ensuring that its users always have access to the latest technology.

Moreover, Adobe’s commitment to innovation is unparalleled. The company invests heavily in research and development, focusing on emerging technologies like artificial intelligence and machine learning. Adobe Sensei, their AI platform, enhances user experience by providing intelligent features that simplify complex tasks. This focus on innovation, combined with a loyal customer base and a comprehensive suite of products, solidifies Adobe’s position as a dominant player in the industry.

Additionally, Adobe’s strong brand recognition and commitment to customer satisfaction further reinforce its market dominance. Customers are not just investing in software; they are investing in a brand that has a proven track record of quality and reliability. With all these factors working in its favor, Adobe has crafted a competitive edge that is not easily replicated by market entrants.

Read This: What Is the Adobe Stock Trial

Growth Drivers for Adobe

Adobe operates in a rapidly evolving digital landscape, and the company has identified several key growth drivers that position it for future success. First off, the increasing demand for digital content creation has spurred growth in Adobe’s customer base. With more businesses adopting digital marketing strategies, tools like Adobe Creative Cloud are becoming essential for content creators and marketers alike.

Another significant growth driver is the expansion of Adobe Experience Cloud. This suite of analytics, marketing, and content management tools aids businesses in delivering personalized experiences to their customers. As organizations increasingly prioritize customer experience, the demand for Adobe’s comprehensive marketing solutions continues to rise.

Furthermore, the trend towards remote work has opened up new opportunities for Adobe. As more professionals work from home, the need for reliable digital communication and collaboration tools has skyrocketed. Adobe has capitalized on this trend by enhancing its offerings and integrating collaborative features into its products.

To summarize, here are some of the growth drivers for Adobe:

- Rising Demand for Digital Content: The exponential growth in digital content creation and distribution.

- Expansion of Adobe Experience Cloud: Catering to businesses focused on enhancing customer experiences.

- Remote Work Trends: Increasing need for collaboration and productivity tools.

- Focus on AI and Automation: Leveraging AI to enhance product capabilities and user experience.

- Global Market Reach: Expanding its footprint in emerging markets.

With these growth drivers, Adobe is not just keeping pace with change but is actively shaping the future of digital media and marketing.

Read This: Does Creative Cloud Subscription Include Adobe Stock?

Risks and Challenges

When considering any investment, it's essential to weigh the potential risks and challenges that come with it, and Adobe is no exception. While the company has shown strong growth and innovation, there are several factors that could pose risks to its future performance. Here are a few key challenges to keep in mind:

- Competition: Adobe operates in a highly competitive industry. Competitors like Microsoft, Canva, and various startups constantly innovate and offer affordable alternatives. If Adobe can't keep up, it risks losing market share and revenue.

- Economic Sensitivity: Adobe's products cater to businesses and professional users. During economic downturns, companies may cut back on marketing budgets, directly affecting Adobe's sales, especially in its Digital Media segment.

- Subscription Model Risks: Adobe has moved to a subscription-based model, which offers steady revenue but can also create challenges. For instance, if subscribers find value from competitors or struggle financially, churn rates could increase, impacting cash flow.

- Integration Challenges: Continuous acquisitions, while beneficial for growth, can lead to integration difficulties. If the company cannot effectively integrate new technologies or teams, potential synergies and growth may be impaired.

- Data Privacy and Security: As a digital platform, Adobe must contend with data privacy regulations and cybersecurity threats. Any major breach could harm customer trust and lead to legal complications.

In summary, while Adobe has several factors favoring its growth, it's crucial for investors to consider these risks carefully and stay informed about the broader market trends that could impact the company.

Read This: Cost of Adobe Stock Videos Explained

Analyst Opinions and Price Targets

When it comes to making investment decisions, it's invaluable to look at what analysts have to say about Adobe. Analysts typically assess a company's performance, growth prospects, and the general market climate to provide insights that can guide investors. Here’s a snapshot of the current landscape regarding Adobe’s analyst opinions and price targets:

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Morgan Stanley | Overweight | $600 |

| Goldman Sachs | Buy | $580 |

| JPMorgan Chase | Neutral | $520 |

| Raymond James | Outperform | $590 |

As you can see, most analysts hold a positive outlook on Adobe, suggesting strong growth potential. For instance, Morgan Stanley recently upgraded its price target to $600, highlighting confidence in Adobe's innovative direction and robust product portfolio. However, there is some variability, as JPMorgan Chase maintains a more cautious stance with a “Neutral” rating and a lower price target of $520.

In conclusion, while the general sentiment leans towards optimism, it’s crucial for investors to continuously monitor these opinions and adjust their strategies accordingly. Keeping an eye on analyst insights can provide valuable context to help you navigate your investment decisions in Adobe.

Read This: Selling Illustrations on Adobe Stock

Conclusion: Is Adobe a Buy?

Evaluating whether Adobe is a growth stock worth investing in involves analyzing several key factors, including its financial performance, market position, and future prospects. Adobe has consistently demonstrated strong growth through its innovative product offerings and strategic acquisitions, which have allowed the company to expand its suite of services.

When considering an investment in Adobe, here are a few essential points to take into account:

- Financial Performance: Adobe has showcased impressive revenue growth in recent years, driven by its subscription-based model. With a consistent increase in subscribers across its Creative Cloud and Document Cloud platforms, the company maintains a robust financial foundation.

- Market Leadership: Adobe is a dominant player in the creative software industry, offering a comprehensive range of products that cater to different segments, from individual creatives to large enterprises. This market leadership helps to mitigate competition and ensures a loyal customer base.

- Innovation and Adaptation: Adobe invests heavily in research and development, regularly updating its products and introducing new features that meet evolving consumer needs. This commitment to innovation positions Adobe favorably against competitors.

- Strong Cash Flow and Profit Margins: The company’s strong cash flow allows for reinvestment in growth opportunities and provides a buffer against economic downturns, while high profit margins indicate operational efficiency.

In conclusion, when assessing Adobe as a potential investment, its strong financial performance, market dominance, commitment to innovation, and healthy cash flow make it a compelling candidate for growth stock investment. However, as with any investment, potential investors should conduct thorough research and consider market conditions before making decisions.

Related Tags