Adobe is a company that most people are familiar with even if they don’t know it. Whether you’ve dealt with PDFs, tweaked a picture or witnessed someone showcasing their graphic design skills Adobe has likely played a role in your life in some way. I still recall my initial attempt at using Photoshop during my college years. It felt like I was wielding a tool even though I was completely clueless about how to use it! Since then Adobe has made significant progress constantly adapting to the changing times.

Established in 1982 Adobe has evolved from a company into a prominent player in the software solutions arena. Its lineup features popular applications such as Adobe Photoshop, Illustrator and Premiere Pro. Throughout the years Adobe has transformed its approach by moving away from selling software licenses towards adopting a subscription based model through Adobe Creative Cloud. This shift was not merely a decision but rather a groundbreaking one. Presently Adobe is regarded as a force, in the creative sector catering to a diverse range of clients from solo artists to major corporations.

How Adobe Has Performed in the Stock Market

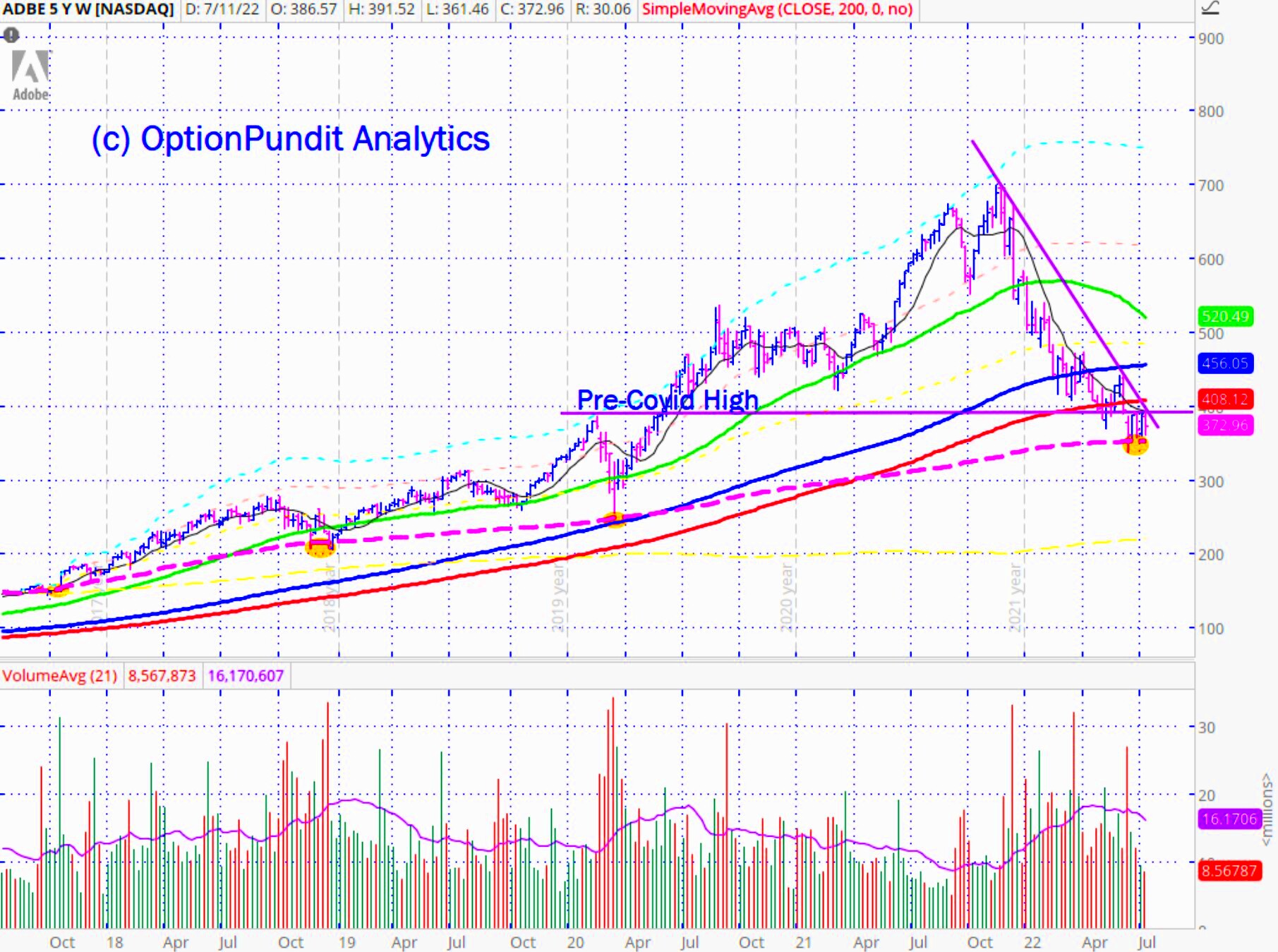

Let’s dive into the figures here because if you’re thinking about putting your money into Adobe, it’s important to consider its track record. The journey of Adobe’s stock has been quite eventful with a narrative of growth overall. I’ve been keeping an eye on Adobe’s stock for a while now and I have to say it’s one of those investments that makes you question whether you should have gotten on board earlier! With its consistent rise over the past ten years and occasional dips during tech market downturns, Adobe has shown remarkable resilience.

A significant moment for Adobe came when they transitioned to a subscription based approach. This shift made their revenue more consistent and investors were thrilled with it. As a result their stock price steadily increased and Adobe gained popularity, in the technology industry. To put things into perspective;

- 2010: Adobe stock was hovering around $30.

- 2020: Adobe hit over $500 per share.

- 2021 onwards: Though it faced some dips due to global market conditions, it stayed strong.

As an investor in the long run I've found Adobe to be a consistent performer. However, similar to other tech stocks it does experience its share of ups and downs. Personally I believe in striking a balance between the thrill of the market and the virtue of patience. Adobe has certainly put that balance to the test!

Read This: Editing Adobe Stock Images in Photoshop

Key Factors Affecting Adobe’s Stock Price

There are various elements that can impact the value of Adobe shares and as an investor its crucial to stay informed about them. The stock market goes beyond mere figures; it revolves around the narrative that accompanies those figures. Adobes narrative is influenced by the following key factors:

- Product Demand: The demand for Adobe’s products, especially in the creative and marketing industries, plays a big role. The more people rely on Creative Cloud, the better the stock performs. For instance, during the pandemic, as more people turned to digital platforms, Adobe saw a surge in demand.

- Subscription Model Success: Adobe’s move to a subscription-based service has been crucial to its financial stability. This shift has created recurring revenue, which is something investors love.

- Competition: While Adobe is a leader, it faces stiff competition from other tech giants like Microsoft and emerging startups offering creative tools. Every time a competitor releases a new feature or product, Adobe’s stock can react.

- Market Sentiment: Let’s be real – the stock market can be emotional. If investors feel tech stocks are at risk due to global issues, even strong companies like Adobe might see their stock drop temporarily.

- Innovation and Acquisitions: Adobe is known for continuously innovating and acquiring companies that add to its ecosystem. When Adobe makes a big acquisition, like when they bought Figma, you can see the stock move based on how investors react.

While Adobe’s stock tends to be stable its price can vary based on certain factors. In my opinion it’s crucial to grasp the perspective. When I view Adobe I perceive a company that’s not merely following trends but actually shaping them. It’s a stock worth monitoring although like with any investment timing and market awareness are essential!

Read This: Steps to Get 5 Free Adobe Stock Images

Comparing Adobe with Other Tech Stocks

When it comes to investing in technology stocks Adobe is frequently mentioned alongside heavyweights like Microsoft, Apple and Google. However is Adobe truly on the same level? The answer is both yes and no. While Adobe's market capitalization may not match up to the giants in the industry it stands out as a leader, in its specific niche. I recall having a conversation about stocks with a friend who is a staunch supporter of Apple and I kept reminding him that although Adobe may not be as showy it is silently ruling the creative software realm.

What sets Adobe apart is its emphasis. Unlike Apple and Microsoft who venture into various areas like hardware and cloud services, Adobe remains true to its core – creative tools and digital advertising. This concentrated strategy has allowed Adobe to establish a distinctive presence in the technology industry. Lets delve into the details:

- Microsoft: Known for its enterprise software like Office 365 and Azure, Microsoft has a broader range of products. However, in creative software, Adobe still holds the upper hand.

- Apple: A household name for its consumer electronics, Apple’s focus is primarily on hardware. While they have some creative tools like Final Cut Pro, they don’t match the variety and depth of Adobe’s offerings.

- Google: More about data, search, and ads. Google’s play is in a completely different field, but it does compete with Adobe’s marketing and analytics software through its own suite of tools.

To sum up Adobe may not be a “do it all” company like some of its competitors but it definitely excels in its field. Think of it as being a pro instead of a jack of all trades and that level of expertise often leads to steady stock performance.

Read This: Exploring Adobe Stock Assets

Potential Risks of Investing in Adobe

No investment is flawless and Adobe is no different. If you're considering investing in Adobe it's crucial to grasp the potential risks at play. To be candid there have been times when I believed Adobe was an obvious choice but then the market surprised me with an unexpected turn. Being mindful of the obstacles is equally vital.

Competition is always a risk in the tech world. Sure, Adobe is a leader in its space, but other companies are catching up. Tools like Canva, which are much more user-friendly for beginners, pose a threat to Adobe’s dominance. I’ve seen many small business owners ditch Adobe’s tools for these cheaper alternatives.

Another factor is economic downturns. When the global economy faces a slowdown, even well-performing companies like Adobe feel the heat. People might cancel their subscriptions, and businesses could cut down on their spending, impacting Adobe’s revenue.

Technological disruptions are also something to keep an eye on. Adobe’s software is robust, but the tech landscape is always shifting. Who knows, a new startup could come along and change the game entirely. I remember when I first heard about Figma, which has now grown into a serious competitor to Adobe in design collaboration.

Lastly, there’s always the risk of stock volatility. As a tech stock, Adobe is vulnerable to the mood swings of the market. It can rise dramatically but also drop unexpectedly. So, if you're someone who doesn’t like roller coasters, this might be something to consider.

Investing in a tech company is similar to any other investment. There are potential gains, but also risks involved. In my opinion its crucial to stay updated on industry trends and maintain a mindset when it comes to investments.

Read This: Crediting Artists for Adobe Stock Photos

Adobe’s Future Growth Prospects

As I contemplate what lies ahead for Adobe I can’t help but feel hopeful. The company has shown an ability to adapt to evolving trends and I believe they will continue doing so in the future. There are various reasons that could support Adobe’s ongoing success. However it’s important to remember that nothing is certain in the tech industry.

First and foremost, the shift towards digital transformation is still accelerating. Businesses are increasingly relying on digital solutions for everything from marketing to remote work, and Adobe’s suite of tools plays a crucial role here. The more the world moves online, the more Adobe stands to benefit. Just think about how indispensable PDFs and digital marketing have become – Adobe’s bread and butter.

Another area where Adobe is expanding is artificial intelligence. They’ve been integrating AI features into their tools for a while now, and it’s making a real difference. I remember using Adobe’s AI-powered editing tools for the first time – it blew my mind how much time I saved! Features like content-aware fill in Photoshop or AI-driven analytics in Adobe Experience Cloud are steps in the right direction.

There’s also potential in international markets. While Adobe already has a global presence, there’s still room for growth in regions like Asia and South America. As internet access and digital literacy continue to grow in these areas, so too could Adobe’s customer base.

That being said progress requires work. Adobe will have to continue pushing boundaries to remain relevant in a fiercely competitive environment. However based on their history I believe they are more than capable of achieving this. The future appears promising yet it's always prudent to exercise caution and stay vigilant regarding market trends.

Read This: Sharing Adobe Stock Libraries with Others

What Experts Are Saying About Adobe Stock

When it comes to making investment choices we often find ourselves turning to the opinions of experts dont we? I recall my initial thoughts about investing in Adobe; I immediately sought out the views of professionals. To be frank their perspectives were quite compelling. Numerous financial analysts view Adobe as a solid stock with potential for growth over time although there are always a few who take a more cautious stance.

Many professionals view Adobe's transition to a subscription model positively. They see it as a move that has brought stability to the company's income flow. A case in point is Goldman Sachs, which has consistently given Adobe a "buy" rating throughout the years highlighting the company's prowess in retaining a stronghold, in the creative software industry.

Conversely there are those who highlight the obstacles Adobe encounters especially in the realm of design where competitors such as Figma are making progress. Certain analysts also express reservations about the industry as a whole due to the fluctuations weve witnessed. Nevertheless the general sentiment appears to be optimistic. The majority of experts believe that Adobes capacity to innovate coupled with its robust range of products positions it ahead of the game.

While there might not be a unanimous agreement among experts, most tend to agree that Adobe is a worthwhile investment. This is particularly true for individuals seeking stability in a rapidly growing industry. In my view it's crucial to consider the timing and conduct thorough research before making a decision. The insights from experts certainly play a role in influencing that choice.

Read This: Should You Buy Adobe Stock Right Now?

FAQ About Adobe Stock Investments

When it comes to investing in stocks there are a few questions that tend to pop up. I’ve had friends and family ask me these when they were thinking about buying Adobe stock. So let’s dive into some of the key ones.

- Is Adobe a good long-term investment?

Many believe Adobe’s subscription model and its dominance in the creative space make it a solid choice for long-term growth. As the digital world grows, so does Adobe’s potential. - Does Adobe pay dividends?

No, Adobe does not currently pay dividends. Instead, they reinvest earnings into growth, which has worked out well for the stock price so far. - What are the risks of investing in Adobe?

Like any stock, Adobe has risks. These include competition from other software companies, changes in technology, and market volatility. It's important to keep an eye on these factors. - How has Adobe stock performed in the past?

Historically, Adobe has been a strong performer, especially after transitioning to a subscription-based model. Over the last decade, its stock price has risen significantly, although like all tech stocks, it’s had its ups and downs. - Is it too late to invest in Adobe?

Many experts believe Adobe still has growth potential, but the stock isn't exactly cheap. Timing is key, and some might wait for a market correction before jumping in.

Read This: Why Is Adobe Stock Up Today?

Final Thoughts on Whether Adobe Is a Good Stock to Buy

After going through all this data what’s the verdict? Is investing in Adobe a smart move? Having followed its progress for quite some time I believe it’s definitely worth a look. However it’s important to keep in mind that it all comes down to how you view things. Adobe isn’t the kind of stock that will shoot up in value; it tends to be a consistent and steady performer over time.

In my opinion Adobe is a company that has its roots firmly planted in the realm. Be it crafting content, enhancing videos or promoting goods Adobe's software is essential. With the world gradually transitioning to a more digital landscape the need for Adobe's services is bound to grow.

That said its crucial to recognize the potential downsides. The technology industry tends to be unpredictable and Adobe is not exempt from market changes. However if you possess the ability to wait and have a perspective Adobe might be a valuable asset for your investment portfolio. In my view it stands out as a stock that values steadiness – not just in the companys performance but also in your approach as an investor.

To sum it up, Adobe seems to be a promising stock purchase but as with any investment it's important to thoroughly research, assess the potential risks and determine what aligns best with your financial objectives. Personally I view Adobe as a long term investment and believe it will continue to thrive as the digital landscape evolves.