YouTube has become a major platform for creators to share their content and earn income, but with that income comes the responsibility of understanding tax obligations. Across different countries, tax regulations can significantly vary, making it essential for creators to get acquainted with how YouTube manages taxes. At its core, YouTube acts as a media platform that collects revenue on behalf of its creators, while also adhering to local laws and regulations concerning taxation.

YouTube relies on a combination of tax compliance measures and various agreements in order to ensure users are informed about their responsibilities. It’s important to know that YouTube doesn’t handle taxes directly; instead, they provide creators with the necessary tools and resources to manage their own tax liabilities. Below are some key points regarding YouTube's tax policies:

- Monetization Agreements: YouTube creators must agree to monetization policies, which outline the revenue-sharing structure and associated tax implications.

- Form W-8BEN: Non-U.S. creators must fill out this form to certify their foreign status and possibly reduce withholding tax on their earnings.

- Tax Withholding: YouTube may withhold taxes based on the creator's tax residency, meaning creators may receive a reduced amount depending on their location.

- Reporting Requirements: Creators are responsible for reporting their earnings on their income tax returns in their respective countries.

Understanding YouTube's tax policies is crucial for staying compliant and maximizing your earnings while ensuring you meet legal requirements.

Tax Obligations for YouTube Creators

Tax obligations for YouTube creators can seem daunting, but breaking it down into manageable pieces can make it easier to navigate. Regardless of where you are in the world, it’s vital to understand your responsibilities when it comes to reporting earnings and paying taxes. Each creator's tax situation will be different, but common obligations include reporting income, paying estimated taxes, and understanding deductions.

Here’s a deeper look at the typical tax obligations YouTube creators face:

| Obligation | Description |

|---|---|

| Income Reporting | All income earned from YouTube must be reported to the tax authorities in your country, including revenue from ads, sponsorships, and merchandise sales. |

| Estimated Tax Payments | In many jurisdictions, creators are required to make estimated tax payments throughout the year, rather than waiting until tax season to pay everything at once. |

| Deductions | Creators can often deduct certain expenses related to their content creation, such as equipment, internet costs, and even travel for filming. |

| Hiring Professionals | Many creators benefit from hiring a tax professional or accountant who understands the nuances of digital income and can help optimize their tax situation. |

Staying informed about your tax obligations as a YouTube creator is vital for financial health and compliance. It’s always best to consult local tax laws and consider seeking professional advice to tailor a strategy that works for you. This proactive approach can help prevent any surprises come tax season!

Read This: How Much Money Can You Earn from 35 Million Views on YouTube

How YouTube Reports Income to Tax Authorities

When it comes to earning money on YouTube, one thing every creator should know is that YouTube has a system in place for reporting income to tax authorities. YouTube essentially acts as a middleman, collecting payments from advertisers and then disbursing those funds to creators. This process means that YouTube will report your earnings directly to the relevant tax agencies.

Here’s how it works:

- Ad Revenue: Whenever an ad is displayed on your video, YouTube collects revenue from advertisers, which is then allocated based on viewer interactions and other factors. This revenue is calculated and reported.

- Annual Reporting: At the end of the year, YouTube provides creators with a document known as the 1099 form in the United States, or equivalent forms in other countries, which outlines all the income earned through the platform.

- Withholding Tax: Depending on your location and tax residency, YouTube might apply withholding taxes before paying out your earnings. This means a portion of your income could be automatically taken for tax purposes.

Creators need to ensure that they accurately report their earnings from YouTube on their tax returns. It’s advisable to keep track of all income and deductions related to your channel, as this will help in making tax obligations easier to manage. Remember, being proactive about your tax situation can save you from unexpected tax burdens in the future!

Read This: How to Cancel Your YouTube TV Subscription: A Step-by-Step Guide

Impact of Location on Tax Responsibilities

The location where a YouTube creator resides has a significant impact on their tax responsibilities. Tax laws vary widely across different jurisdictions, affecting how much tax one might owe on earnings generated from the platform.

Here are a few key factors influencing tax responsibilities based on location:

- Country of Residence: Your country’s tax regulations will dictate how much tax you owe on your YouTube earnings. For instance, countries like the United States require creators to report income on a federal and possibly state level.

- Tax Treaties: Some countries have tax treaties with the U.S. that can reduce or eliminate certain tax liabilities for non-U.S. creators. Always check if such treaties apply to your situation.

- VAT/GST Implications: Depending on your location, you might be required to charge Value Added Tax (VAT) or Goods and Services Tax (GST) on your services or products sold via YouTube. This could change your overall income after taxes.

It’s crucial for creators to research and understand the tax obligations in their country, as well as how YouTube’s reporting will affect them. Engaging a tax professional can help navigate these complexities, ensuring compliance and optimizing potential deductions. Always remember, ignorance of the law won’t exempt you from it!

Read This: Why Was the Bell Life Banned from YouTube? Investigating YouTube Channel Bans

5. Common Tax Deductions for YouTube Creators

As a YouTube creator, you’re likely aware that taxes can be tricky business. However, the good news is that many expenses can be deducted, ultimately lessening your tax burden. Here are some common tax deductions for YouTube creators that you should consider:

- Equipment Costs: Any gear you purchase for video production, such as cameras, microphones, lighting, and computers, can usually be deducted.

- Software Subscriptions: If you use editing software or graphic design programs, those subscriptions qualify as business expenses.

- Internet and Phone Bills: Since you need these services for your channel, a portion of your bills can be deducted based on what you use for your content creation.

- Home Office Deduction: If you have a dedicated space for your work, you can deduct some expenses related to that space, including rent, utilities, and internet.

- Travel Expenses: If you travel for your channel—be it for events, collaborations, or even shoots—costs like flight tickets, accommodation, and meals may be deductible.

- Marketing Costs: Any money spent on advertising or promoting your content is eligible for deduction.

- Professional Services: If you seek tax advice, legal help, or hire someone for graphic design or video editing, those costs can often be deducted as well.

Make sure to keep receipts and documentation for all your expenses, as they will be crucial during tax filing time!

Read This: How to Upload Videos on YouTube Fast: Speed Up the Upload Process

6. Filing Taxes as a YouTube Creator

Now that you know about deductions, let’s dive into the nitty-gritty of filing your taxes as a YouTube creator. This might seem daunting, but it gets easier with a systematic approach!

- Understand Your Tax Obligations: Depending on your location, the income you earn from YouTube may be taxable. Many creators fall into the self-employment category, which could mean additional responsibilities.

- Track Your Income: Keep a detailed record of all income streams—ad revenue, sponsorships, merchandise sales, and any other sources to ensure you report accurately.

- Choose Your Filing Method: You can either file your taxes yourself (using software like TurboTax or H&R Block) or hire a tax professional, which can be beneficial if your finances are complex.

- Complete IRS Forms: In the U.S., you will typically need to fill out a Schedule C (Profit or Loss from Business) and a Schedule SE (Self-Employment Tax) along with your personal tax return.

- Consider Quarterly Payments: If you're earning significantly from YouTube, don't forget that you might need to make estimated tax payments quarterly to avoid penalties.

- Stay Informed: Rules can change, so it’s essential to stay updated on tax regulations that might affect you as a creator. This will help you make informed financial decisions!

Filing taxes as a YouTube creator doesn't have to be stressful. By keeping organized records and utilizing available resources, you can navigate through it with ease!

Read This: Can You Use Any Music in YouTube Shorts? Copyright Rules Explained

7. Advice for International Creators

If you're an international creator on YouTube, navigating the complex landscape of taxes can feel overwhelming. However, with a few tips, you can make the process smoother and ensure you remain compliant with tax regulations in your country as well as those of the U.S., where YouTube is headquartered.

Here are some key pieces of advice for international creators:

- Know Your Tax Obligations: Research the tax laws in your home country regarding income earned from foreign sources. Some countries have treaties with the U.S. that might affect how much tax you owe.

- Understand U.S. Tax Withholding: YouTube may withhold a portion of your earnings for U.S. taxes. This is typically around 30% for non-U.S. creators. Familiarize yourself with forms like W-8BEN to properly submit your tax info to YouTube.

- Keep Accurate Records: Maintain detailed records of your earnings, expenses, and any taxes withheld. Consider using accounting software to help you keep track of everything easily.

- Consult a Tax Professional: If possible, get in touch with a tax professional who understands international tax laws. They can provide personalized advice based on your specific situation.

- Stay Updated: Tax laws change frequently. Keep yourself informed about any changes that may affect your earnings and tax obligations.

Remember, managing taxes can be complicated, but taking proactive steps can alleviate some of the stress and help you continue focusing on creating amazing content!

Read This: How to Get PAC-12 Network on YouTube TV for College Sports Fans

8. Resources and Tools for Managing Taxes

For YouTube creators, especially those managing international earnings, having the right tools and resources can make a world of difference when it comes to managing taxes effectively. Here’s a roundup of some invaluable resources:

| Resource/Tool | Description |

|---|---|

| IRS Website | A primary resource for U.S. tax information. Offers guides for foreign income tax obligations. |

| TurboTax or H&R Block | Popular tax software that helps you file taxes while considering international income. |

| Accounting Software (e.g., QuickBooks) | Helps in tracking earnings, expenses, and generating reports for tax time. |

| Local Tax Advisors | Working with someone familiar with your local tax laws can save you time and money. |

| YouTube Creator Academy | Offers free resources that can help you better understand monetization and associated tax implications. |

Utilizing these resources can empower you to take charge of your finances, minimize stress, and maximize your earnings as a content creator. So don’t hesitate—invest time in researching and employing the right tools to master your tax responsibilities!

Read This: A Raisin in the Sun on YouTube: How to Watch This Powerful Drama Online

How YouTube Handles Taxes for Creators Worldwide

YouTube has become a significant platform for creators to monetize their content, but with the opportunity of earning income comes the responsibility of understanding taxation. The platform's tax handling policies vary by country and depend on several factors, including the creator's location, earnings, and the tax treaties in place.

Creators on YouTube earn revenue through advertisements, sponsorships, merchandise, and memberships. Here’s a quick overview of how YouTube addresses taxes:

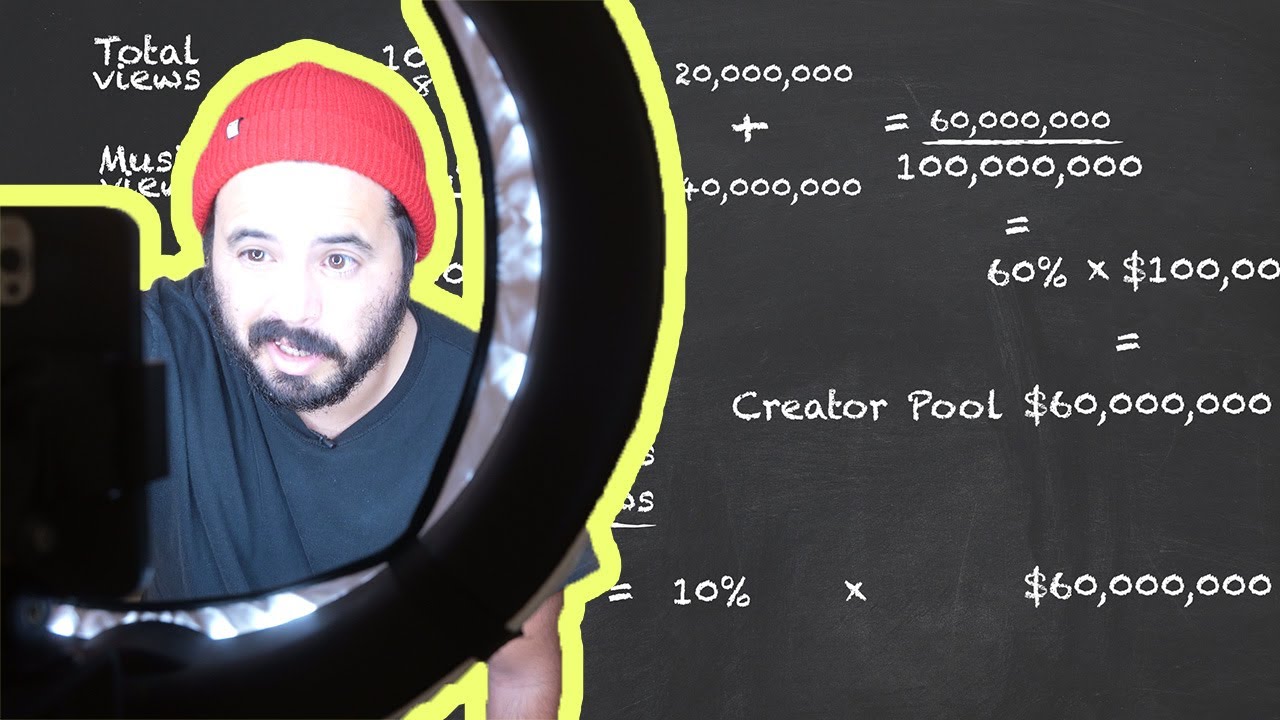

- Ad Revenue: Creators typically receive a 55% share of ad revenue, while Google retains 45%. This revenue is subject to local taxation.

- Tax Identification: Creators may be required to submit tax information during the monetization process. This often includes providing a W-9 form (U.S.-based creators) or a W-8 form (international creators).

- Withholding Tax: Depending on the creator’s country and the tax treaties, withholding tax may be collected on earnings derived from U.S. sources.

- Year-End Reporting: YouTube provides an annual summary of earnings, which creators can use to prepare their tax returns.

It's crucial for creators to be aware of the following:

| Aspect | Details |

|---|---|

| Location | Tax laws vary significantly by country and sometimes region. |

| Earnings Threshold | Different thresholds for filing taxes exist; knowing local laws is essential. |

| Consulting Professionals | It's recommended to seek advice from tax professionals to ensure compliance. |

In conclusion, staying compliant with tax regulations is vital for YouTube creators worldwide. Understanding local laws and requirements, as well as leveraging resources and expertise, helps ensure that creators manage their earnings responsibly and legally.

Related Tags