Introduction to Amazon Credit Card Management

Managing your Amazon Credit Card effectively can enhance your budgeting and spending awareness. With Quicken, you can easily integrate your Amazon Credit Card, allowing for seamless tracking of your expenses and rewards. Quicken provides a user-friendly platform for monitoring your transactions, budgeting for future purchases, and reviewing your credit card statements all in one place. By logging into your Amazon Credit Card through Quicken, you can take control of your finances and ensure that you maximize your rewards and benefits associated with your card.

Read This: How to Ship to Amazon Locker Instructions

Benefits of Using Quicken for Your Amazon Credit Card

Using Quicken to manage your Amazon Credit Card comes with several advantages:

- Centralized Finance Management: Quicken allows you to view all your financial accounts in one place, including checking, savings, and credit cards like your Amazon account.

- Transaction Tracking: Easily track your Amazon purchases against your budget, making it simple to see where your money goes each month and helping you identify spending patterns.

- Reward Monitoring: Quicken helps you keep tabs on your earned rewards and cashback, ensuring you take full advantage of your card's benefits.

- Budgeting Tools: With Quicken’s budgeting features, you can set spending limits and create financial goals tailored to your Amazon purchases, which helps maintain financial discipline.

- Financial Reporting: Generate reports to analyze your spending habits over time, allowing you to make informed decisions about your finances.

Overall, integrating your Amazon Credit Card with Quicken simplifies budgeting and expense tracking while enabling you to optimize your financial management.

Read This: How to Search for Items and Save Them for Later on Amazon

3. Step-by-Step Guide to Setting Up Quicken for Amazon Credit Card

Getting your Amazon credit card set up in Quicken can feel a bit daunting at first, but don’t worry! We’re here to break it down into simple steps. Follow this guide, and you’ll be managing your finances with ease in no time.

Step 1: Open Quicken

Launch your Quicken application. If you don’t have it installed yet, make sure to download and install the latest version from the Quicken website.

Step 2: Add Account

- In the Quicken Dashboard, look for the option labeled “Accounts” on the left sidebar.

- Click on “Add Account” to begin the setup process.

Step 3: Select Account Type

When prompted to choose the type of account, select “Credit Card.” This option is specifically tailored for tracking your credit card transactions and balances.

Step 4: Search for Your Bank

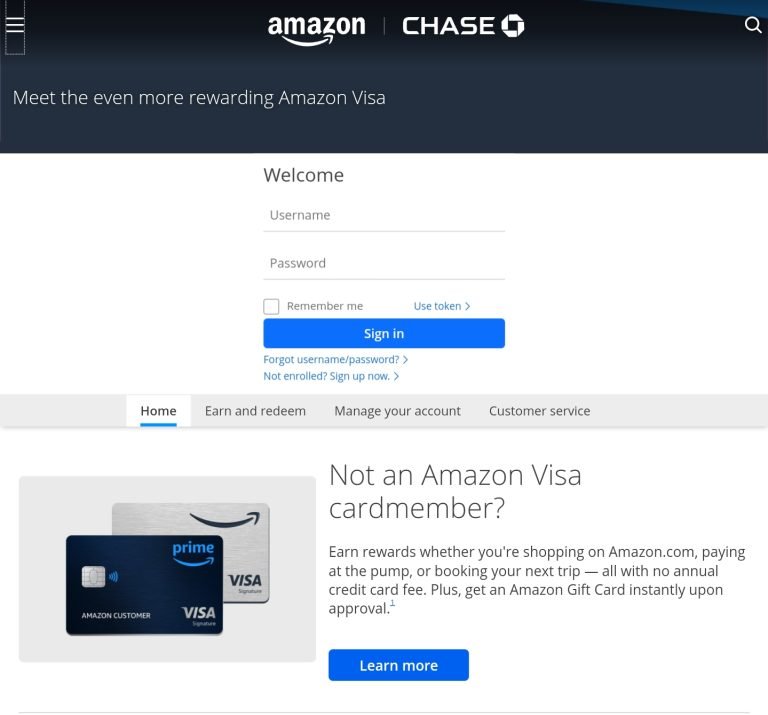

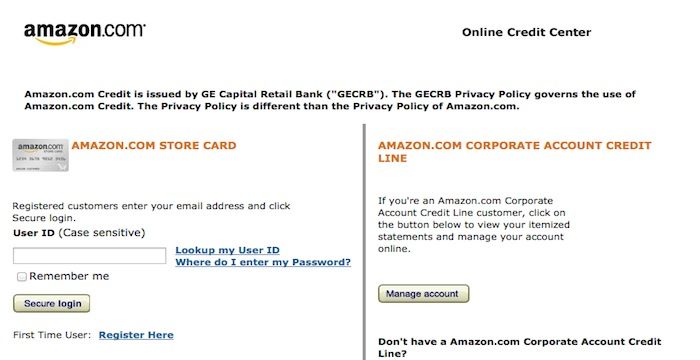

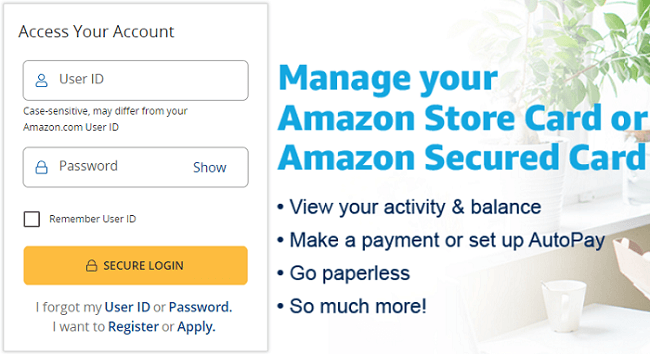

In the next step, you’ll need to search for your bank. Type “Amazon” in the search bar, and select “Amazon Credit Card” from the list that appears. This will connect you directly to your card's online services.

Step 5: Enter Your Credentials

Now, a prompt will appear asking you for your Amazon credit card login credentials:

- Your Amazon username or email.

- Your Amazon password.

Make sure you enter this information correctly to allow Quicken to sync with your account.

Step 6: Follow the Prompts

After entering your credentials, follow any additional prompts to complete the setup process. Quicken may ask you to verify your identity or accept terms and conditions.

Once completed, you’ll have your Amazon credit card transactions feeding into Quicken.

Now you’re all set up! It only takes a few minutes, and soon you’ll be able to track your spending and payments seamlessly.

Read This: How to Put Amazon Prime Video on Kids Fire Tablet

4. Logging into Your Amazon Credit Card Account in Quicken

Now that you've set up your Amazon credit card in Quicken, logging into your account is a breeze! Here’s how to access your Amazon credit card details and transactions with just a few clicks.

Step 1: Open Quicken

Start by launching the Quicken app on your computer. Ensure that you are using the account associated with your Amazon credit card.

Step 2: Navigate to Accounts

On the left sidebar, click on “Accounts.” This section houses all of your linked financial accounts, including your newly added Amazon credit card.

Step 3: Select Your Amazon Credit Card

In your accounts list, locate your Amazon credit card. It should now display along with your other accounts. Click on it to open the details.

Step 4: Update Your Account

If it’s been a while since you logged in, you might want to refresh your transaction data. Click on the “Update” button or use the keyboard shortcut (usually Ctrl+U) to download the latest transactions. This ensures you're looking at the most current spending info.

Step 5: Review Transactions

Once you’ve logged in, you can review your transactions, check your balance, and analyze your spending patterns. Quicken provides various tools, such as:

- Spending categories

- Graphs and charts for visual insights

- Budget tracking features

And there you have it! By following these simple steps, you can easily log into your Amazon credit card account in Quicken. It’s a fantastic way to keep tabs on your spending and manage your finances more effectively.

Read This: How to Report a Stolen Package on Amazon

5. Troubleshooting Common Issues When Logging In

Logging into your Amazon credit card account using Quicken can sometimes be a smooth process, but occasionally, you might run into a few bumps along the way. Here are some common issues you might face and how to resolve them:

- Password Problems: If you’re having trouble logging in, double-check that you're entering the correct password. Make sure there's no accidental caps lock on and that all special characters are input correctly. If you’ve forgotten your password, you can usually reset it through Amazon’s website.

- Connection Issues: Sometimes, Quicken may have temporary connectivity issues. If you encounter an error during login, try to close and reopen the application. You can also check your internet connection to ensure it’s stable.

- Account Sync Problems: If Quicken isn’t syncing your Amazon account, it might be due to outdated software. Ensure you’re using the most recent version of Quicken. You can typically check for updates in the help menu.

- Security Settings: Amazon may have security settings that prevent third-party apps like Quicken from accessing your account. You may need to adjust these settings or even enable multi-factor authentication if prompted.

If you continue experiencing issues after trying these solutions, it might be worth checking Quicken's support forums or reaching out to their customer service for more tailored assistance. Remember, you’re not alone in this – many users encounter similar issues!

Read This: How to Deliver an Amazon Package to UPS Access Point

6. Linking Multiple Accounts in Quicken

Managing multiple accounts can be a breeze when you know how to link them properly in Quicken. Whether you have several Amazon credit cards or different financial accounts you want to keep track of, here’s a step-by-step guide on how to do it.

- Open Quicken: Launch the Quicken application on your computer.

- Go to Account List: Click on Tools in the menu bar, then select Account List to see all your current accounts.

- Add New Account: Click on the Add Account button. You’ll be prompted to choose your account type.

- Select Your Account Type: When prompted, select Credit Card and then choose Amazon Credit Card from the list of options.

- Follow Login Prompts: Enter your login credentials for the new account and follow the prompts to complete the linking. Quicken will guide you through the process of setting it up.

Once linked, you can easily switch between accounts in Quicken, allowing for seamless management of your finances. This not only saves time but ensures you have all your information in one convenient place. If at any point you run into trouble, Quicken provides helpful FAQs and customer support to assist you.

Read This: How to Use an Amex Gift Card on Amazon for Easy Shopping

7. Tips for Managing Your Amazon Credit Card with Quicken

Managing your Amazon credit card with Quicken can enhance your financial oversight and help you leverage the benefits of your card effectively. Here are some *tips* to simplify the process:

- Set Up Automatic Downloads: Make sure to enable automatic transaction downloads from your Amazon credit card account. This will save you the hassle of manually entering transactions and help keep your records up-to-date.

- Categorize Your Transactions: Use Quicken's categorization features to assign expenses to specific categories like shopping, groceries, or entertainment. This will make it easier to track your spending habits and plan your budget effectively.

- Budget for Amazon Purchases: Create a specific budget for your Amazon spending. This can help you keep your finances in check and avoid overspending, which is especially tempting during sales and promotions.

- Monitor Rewards and Benefits: Regularly check the rewards and benefits associated with your Amazon card. Quicken can help you track cash back or reward points earned, ensuring you utilize them before they expire.

- Review Your Transactions Regularly: Set a reminder to review your credit card transactions at least once a week. This practice helps catch any fraudulent activity early and gives you a clearer picture of your spending.

By following these tips, you'll not only manage your Amazon credit card more efficiently but also make the most of the financial insights Quicken provides.

Read This: How to Search for Gift Registries on Amazon

8. Understanding Your Credit Card Transactions in Quicken

Understanding your credit card transactions in Quicken is crucial for effective financial management. Quicken provides a comprehensive view of all your spending, and here's how to make sense of it:

- Transaction Details: Each transaction will show essential details like the merchant name, date, amount, and category. Click on any transaction to see more details and edit categories if needed.

- Transaction Filters: Use filters to sort transactions by date, amount, or category. This can help you quickly find a specific expense or review spending for a particular time frame.

- Assigned Categories: Make sure each transaction is categorized correctly to reflect your spending accurately. Quicken allows you to create custom categories, tailoring your financial reports to fit your needs.

- Alerts and Notifications: Set up alerts for spending limits or due dates. Quicken can notify you if you’re approaching your budget limits or if a payment is coming up, helping you stay on top of your financial commitments.

- Reconcile Regularly: Regularly reconcile your credit card transactions with your bank statements. This practice ensures that all charges are accurate and can help uncover any errors or unauthorized transactions quickly.

By mastering the insights Quicken offers on your credit card transactions, you will gain better control over your finances, leading to informed spending decisions and improved budgeting practices.

```html

Read This: How to Use Amazon Pharmacy Without Insurance

How to Log into Your Amazon Credit Card Using Quicken

Managing your Amazon credit card transactions can be simplified using Quicken, a popular personal finance management software. By linking your Amazon credit card account to Quicken, you can efficiently track your spending, create budgets, and view your transactions all in one place. Here’s a step-by-step guide to help you log into your Amazon credit card using Quicken.

Step-by-Step Instructions

- Launch Quicken: Open the Quicken application on your device.

- Navigate to Account Overview: Click on the “Accounts” tab on the left sidebar.

- Add a New Account: Select “Add Account” or “+” to open the account setup dialog.

- Select Credit Card Type: Choose “Credit Card” as the account type you want to add, then click “Continue.”

- Search for Amazon: In the search field, type “Amazon Credit Card” and select it from the list of options.

- Enter Your Login Credentials: You will be prompted to enter your Amazon credit card account username and password.

- Verify Account Linking: Follow the prompts to verify and link your account.

- Finish Setup: Once linked, you can customize account settings and start managing your transactions.

Troubleshooting Tips

If you encounter issues while logging in, consider the following:

- Ensure your Amazon credit card account credentials are correct.

- Check for any connectivity issues with your internet.

- Update Quicken to the latest version.

By following these steps, you can effortlessly log into your Amazon credit card using Quicken, enabling better financial management and oversight.

Conclusion and Additional Resources for Quicken Users

Logging into your Amazon credit card through Quicken streamlines your budgeting process, allowing for better tracking of spending habits. Utilize the official Quicken support page and community forums for further assistance and tips on optimizing your use of the software.

```

Related Tags