Have you ever heard of Rumble, the video platform that's shaking things up? Well, it’s not just about streams and uploads anymore; it’s also about investment opportunities. Rumble stocks are attracting attention as people consider the potential growth of this innovative platform. In this section, we'll take a peek into what Rumble stocks are, why they matter, and how you can get started on your investment journey.

Understanding the Stock Market

Diving into the stock market can feel a bit overwhelming, but it doesn't have to be! At its core, the stock market is simply a place where you can buy shares of companies, like Rumble, which means you own a tiny piece of that business. Understanding the basics can empower you to make informed decisions. Here's a breakdown of essential concepts and terms:

- Stocks: Represents ownership in a company. The more shares you buy, the larger your stake in that company!

- Stock Market: A marketplace where stocks are bought and sold, such as the NYSE or NASDAQ.

- Broker: A licensed individual or firm that executes stock trades for clients, making it possible for you to buy and sell stocks.

- Dividends: Payments made by a corporation to its shareholders, usually from profits.

- Market Capitalization: The total market value of a company's outstanding shares, calculated as share price multiplied by total shares.

The stock market operates on the principle of supply and demand, meaning the price of stocks can fluctuate based on how many people want to buy or sell at any given time. Knowing these basics can help you navigate the quest to buy Rumble stocks confidently. Remember, it's important to do your research and consider your investment goals before jumping in!

Read This: How Long Did the Rumbling Last in Attack on Titan? A Timeline

Why Invest in Rumble?

Investing in Rumble can be an enticing opportunity for various reasons, particularly if you're someone who believes in the potential of digital platforms and user-generated content. Here’s a closer look at some compelling reasons to consider this investment:

- Growing Popularity: Rumble has made a name for itself as a leading video platform that champions free speech. Its user base is steadily increasing, which speaks volumes about its potential for growth.

- Diversified Content: The platform attracts a variety of content creators—from vloggers to professionals—allowing for a wide range of topics and audiences. This diversification can lead to greater opportunities for monetization.

- Market Demand: With the rise of content consumption via mobile devices and the shift towards alternative media platforms, investing in Rumble allows you to tap into a growing sector that shows no signs of slowing down.

- Strong Community: Rumble has cultivated a loyal user community that values its commitment to free expression. This sense of community can lead to user retention and an engaged audience, which are crucial for long-term success.

- Financial Backing: Rumble has received significant investment from private equity firms, suggesting that knowledgeable investors see potential and are willing to back it financially.

So, if you're looking for a stock that embodies innovation, freedom, and the potential for significant growth, Rumble might just be the investment opportunity you're searching for.

Read This: How Many People Are Playing My Hero Ultra Rumble? Insights on Player Numbers

Step 1: Research Rumble’s Financial Performance

Before diving into any investment, it's crucial to perform thorough research, and Rumble is no exception. Understanding the company's financial performance will help you make a more informed decision. Here’s what to look for:

| Key Financial Metrics | Description |

|---|---|

| Revenue Growth | Check Rumble's year-over-year revenue growth to gauge how quickly it’s expanding within its market. |

| Profit Margins | Analyze gross and net profit margins to see how efficiently the company is operating. |

| Cash Flow | Evaluate operating cash flow to understand the liquidity and financial health of Rumble. |

| Market Position | Look at Rumble’s market share in comparison to competitors like YouTube. A growing market position can be a good sign. |

| Analyst Ratings | Consult reviews and ratings from financial analysts to get insights into Rumble’s performance and future potential. |

To gather this data, you can access financial reports, stock market analysis websites, and investor presentations directly from Rumble's corporate site or through reputable news articles. By carefully analyzing these aspects, you’re equipping yourself with the knowledge to make a well-rounded investment decision. Remember, the more informed you are, the better your chances are of making a profitable investment!

Read This: Who Won the Royal Rumble in 2013? Key Highlights from WWE

Step 2: Choose a Reliable Brokerage

Choosing the right brokerage is crucial for a smooth investing experience, especially when you're diving into something like Rumble stocks. With so many options out there, it can feel overwhelming, but don’t worry! Let’s break it down.

First off, think about what you value most in a brokerage. Are you looking for low fees, a user-friendly platform, or maybe robust research tools? Here’s a quick list of factors to consider:

- Fees and Commissions: Look for brokerages that offer low or zero commissions for stock trading. Some platforms might charge inactivity fees or withdrawal fees, so read the fine print!

- User Experience: Is the platform easy to navigate? Many brokers offer mobile apps, so check those out if you prefer trading on-the-go.

- Research Tools: If you want to make informed decisions, choose a brokerage that provides helpful research, like market analysis and stock ratings.

- Customer Support: It's always a good idea to have access to reliable and responsive customer service. Check for live chat, email support, or a dedicated help center.

- Investment Options: While you're currently interested in Rumble stocks, consider a brokerage that allows you to diversify into other investments down the line.

Some top-rated brokerages include Charles Schwab, TD Ameritrade, and E*TRADE. Take some time to compare their features and see which ones match your investing style. Remember, the better the brokerage, the easier it will be to manage your investments!

Read This: When Is the 2025 Royal Rumble? Key Information for Future Fans

Step 3: Open and Fund Your Brokerage Account

Now that you’ve chosen a reliable brokerage, it's time to take the exciting next step: opening and funding your brokerage account. This might sound a bit technical, but I promise it's pretty straightforward!

Here’s a step-by-step breakdown:

- Visit the Brokerage Website: Start by going to the official site of your chosen brokerage. Look for a button that says "Open Account" or something similar.

- Fill Out Your Information: You’ll need to provide personal information, such as your name, Social Security number, address, and financial background. This is all standard, so don’t worry!

- Choose Your Account Type: Most brokerages offer different types of accounts, including individual, joint, and retirement accounts. For Rumble stocks, a regular brokerage account would be sufficient.

- Complete The Verification Process: Many brokerages require you to verify your identity. This can be done using a driver's license or passport. Just upload that info to their secure site.

- Fund Your Account: Once your account is set up, it’s time to add some cash! You can usually fund your account via bank transfer, wire transfer, or sometimes even by check.

Most brokerages will require a minimum deposit, but many now offer no minimums, making it easier to get started. Make sure you review your funding options and pick one that works best for you. Once your funds are cleared, you’re all set to start buying Rumble stocks! Exciting, right?

Read This: Who Won the 2014 Royal Rumble? Highlights and Key Performances

Step 4: Locate Rumble Stocks on Your Brokerage Platform

Now that you have set up your brokerage account and deposited funds, it’s time to find Rumble stocks on your trading platform. This may seem straightforward, but it’s an essential step in the buying process. Each brokerage platform might look a bit different, so let’s break it down together.

Here’s how you can locate Rumble stocks:

- Login to Your Brokerage Account: Start by logging in to your account. If you encounter any trouble, many platforms have customer support ready to help.

- Use the Search Bar: Most brokerage platforms have a search bar at the top. Simply type in “Rumble” or the specific stock symbol (if applicable) that you want to buy. Click on the appropriate result.

- Check Market Listings: If you want a cursory view of Rumble's market activity, look for market listings or a 'Watchlist' feature that your platform may offer.

- Review Relevant Information: Once you find Rumble stocks, take a moment to review key information like the current price, market cap, 52-week range, and any recent news. This data can provide valuable context for your investment.

By following these steps, you’ll be able to locate Rumble stocks quickly and efficiently. Remember, it's entirely normal to take your time exploring, so don’t rush through the process!

Read This: How to Friend People on My Hero Ultra Rumble? Networking with Other Players

Step 5: Decide on the Number of Shares to Purchase

Having located Rumble stocks on your brokerage platform, the next step is to decide how many shares you want to purchase. This part can be a bit daunting, especially if you're new to investing, but don’t worry! Let’s break it down into manageable pieces.

Here are some factors to consider when deciding on the number of shares:

- Your Budget: Start by determining how much money you are comfortable investing in Rumble stocks. Don't forget to account for any transaction fees or commissions that your brokerage may charge.

- Stock Price: Check the current price of Rumble stocks. Divide your budget by the stock price to get an idea of how many shares you can afford. For example, if Rumble stocks are priced at $10 and you have $500 to invest, you could buy 50 shares.

- Investment Strategy: Think about your investment goals. Are you looking for a long-term hold or a short-term gain? Your strategy can influence how many shares you decide to buy.

- Risk Tolerance: Reflect on how much risk you're willing to take. If investing in more shares in Rumble makes you uneasy, consider starting with fewer shares until you feel more comfortable.

Taking these elements into account can help you make a more informed decision. Remember, investing isn't about rushing; it's about making choices that fit your financial goals and comfort level. Feel free to adjust as you go along and always continue learning!

Read This: How Do I Watch Rumble on My TV? A Guide to Streaming Rumble on Your TV Screen

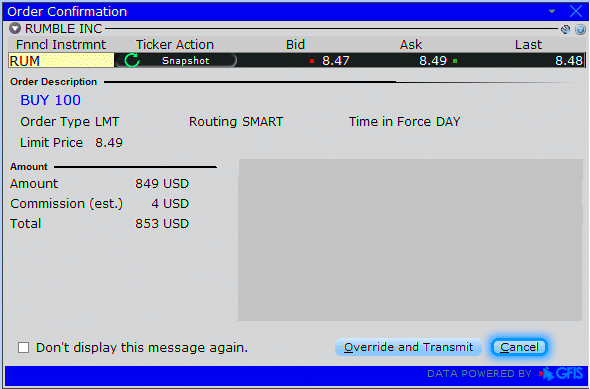

Step 6: Place Your Order

Now that you’ve done your research and chosen the right trading platform, it’s time to actually place your order for Rumble stocks. This step may seem straightforward, but a few factors are worth considering to ensure you make the most out of your investment.

First, let's break down the types of orders you can place:

- Market Order: This order buys the stock at the current market price. It's quick, but the price can fluctuate between when you place the order and when it's executed.

- Limit Order: With this order, you specify the price at which you want to buy the stock. It gives you more control, but it may not execute immediately if the stock doesn't reach your specified price.

- Stop Order: This is a bit different; it triggers a market order once the stock hits your chosen price. This is great for protecting profits or limiting losses.

After deciding on the type of order, enter the quantity of shares you wish to purchase. Always double-check these details before hitting that confirm button! Don't forget to review any applicable fees; some platforms charge a commission per trade that can eat into your returns.

Once you have everything in place, go ahead and place your order. You’ll receive a confirmation once it’s executed, and you’ll officially own a piece of Rumble!

Read This: How Do You Get Paid on Rumble? Understanding the Platform’s Payment Structure for Creators

Step 7: Monitor Your Investment

Congratulations! You've successfully bought Rumble stocks. But your journey doesn't end there. The next step is to keep a close eye on your investment. Monitoring your stocks is crucial to making informed decisions about when to hold, sell, or buy more.

Here are some tips on how to effectively monitor your Rumble stocks:

- Check Regularly: Set aside some time daily or weekly to review your investment. Market trends can change quickly, and it's vital to stay informed.

- Use Alerts: Most trading platforms allow you to set price alerts. This way, you’ll be notified if the stock price reaches a certain threshold.

- Follow News and Trends: For a company like Rumble, staying updated with the latest news can give you insight into potential market movements. Follow financial news outlets, and don’t hesitate to look into user-generated content as well.

Additionally, track other metrics that may influence your investment decision such as:

| Metric | Why It Matters |

|---|---|

| Price Movement | Understanding how your stock price fluctuates can help you identify patterns. |

| Volume | A higher volume often indicates strong buyer interest which can lead to price increases. |

| Market Sentiment | This reflects overall investor confidence and can be a great indicator of stock performance. |

Remember, investing isn't just a set-it-and-forget-it endeavor. Be proactive and engaged, and you’ll be better equipped to make the most out of your investment!

Read This: How Many Users Does Rumble Have in 2024? A Comprehensive Look at the Platform’s Popularity

Conclusion: Tips for a Successful Investment

Investing in Rumble stocks can be a promising opportunity, but it's important to approach it with careful consideration and strategy. Here are some essential tips to help ensure a successful investment in Rumble stocks:

- Do Your Research: Thoroughly investigate Rumble's business model, growth potential, and market position. Understanding the company's fundamentals will help you make informed decisions.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Consider diversifying your investments across different sectors to minimize risk.

- Set Clear Objectives: Define your investment goals, whether they are short-term gains or long-term growth. This clarity will guide your buying and selling decisions.

- Stay Updated: Keep an eye on market trends, news, and changes within the company. Staying informed will help you respond timely to market movements.

- Be Patient: Investing is often a marathon, not a sprint. Avoid making impulsive decisions based on short-term price fluctuations.

Remember: The stock market is unpredictable, and investments carry risks. Consider consulting with financial advisors to tailor an investment strategy that fits your specific circumstances. By following these tips, you can enhance your chances of achieving a successful investment with Rumble stocks.