If you’ve been keeping an eye on the stock market lately, you might have come across Rumble stock. In this guide, we'll break down everything you need to know about Rumble stock and offer you a clear pathway for making informed investment decisions. Whether you're a seasoned investor or just starting, understanding the ins and outs of Rumble can help you navigate the waters effectively. So, let’s dive in!

Understanding Rumble: Company Overview

Rumble is an emerging player in the digital media landscape, primarily focusing on video hosting and streaming services. Unlike traditional platforms, Rumble champions free speech and aims to create a space where content creators can share their videos without the fear of censorship. Here’s a closer look at what makes Rumble tick:

- Founded: Rumble was established in 2013, initially as a platform for users to upload and share their videos.

- Headquarters: The company is based in Toronto, Canada, which gives it a unique positioning in the North American market.

- Core Mission: Rumble’s mission is to provide creators with a platform that rewards quality content and encourages diverse viewpoints.

In recent years, Rumble has seen significant growth, especially as more users seek alternatives to mainstream services. This growth has not gone unnoticed, as Rumble has attracted attention from both investors and the media.

| Key Metrics | Details |

|---|---|

| User Base: | Over 40 million monthly active users |

| Revenue Model: | Ad-based revenue combined with subscription services |

| Funding: | Secured multiple rounds of investment, boosting its valuation significantly in recent months |

Understanding Rumble’s unique position in the market is essential for potential investors. With its stand on free speech and continuous user growth, Rumble seeks to disrupt the traditional media landscape, making it an intriguing option for your investment portfolio.

Read This: How Did Anthony “Rumble” Johnson Pass? A Tribute to the UFC Fighter’s Legacy

Why Invest in Rumble Stock? Key Considerations

Investing in stocks can sometimes feel overwhelming, especially if you’re unsure about where to put your money. So, why should you consider Rumble stock? Here are some key considerations that might pique your interest:

- Growing Popularity: Rumble, as a video-sharing platform, is experiencing a surge in popularity. It caters to a demographic that prefers alternative platforms to mainstream social media. This growth potential could translate into significant returns as more users join.

- Diverse Revenue Streams: Rumble isn’t just about ad revenue; it’s branching into subscription services and partnerships, providing a more stable financial future. This diversification helps mitigate risks associated with relying on a single income source.

- Strong Brand Identity: With its focus on free speech and providing an alternative to established platforms, Rumble has carved out a unique niche. This brand identity can foster loyal users and attract more investors.

- Market Trends: As the demand for decentralized content platforms rises, Rumble stands to benefit. Investors looking to capitalize on this trend may find Rumble a compelling choice.

- Potential for Growth: Being a relatively new player in the market, Rumble has substantial room for growth. Investing early could yield a handsome return, as the company expands its user base and enhances its offerings.

In summary, Rumble stock could be an attractive option for investors seeking opportunities in the evolving landscape of online content sharing platforms. Just remember, as with any investment, it's important to do your due diligence and consider the risks involved!

Read This: How Old Is Anthony “Rumble” Johnson and What Is His Legacy in MMA?

Step-by-Step Guide to Buying Rumble Stock

If you’re convinced Rumble stock is worth considering, let’s break down the buying process into manageable steps. Here’s your straightforward guide to getting started:

- Research the Stock: Before jumping in, it’s vital to research Rumble’s financial health and market potential. Look at their annual reports, growth trends, and industry comparisons.

- Choose a Brokerage: You’ll need a brokerage account to buy stock. Look for a platform that fits your needs—think about fees, user experience, and customer service. Popular options include:

- Open an Account: Once you’ve chosen a brokerage, you'll need to open an account. This often requires providing personal information and linking a bank account.

- Deposit Funds: Fund your account with the amount you wish to invest in Rumble stock. Make sure to double-check the minimum funding requirements.

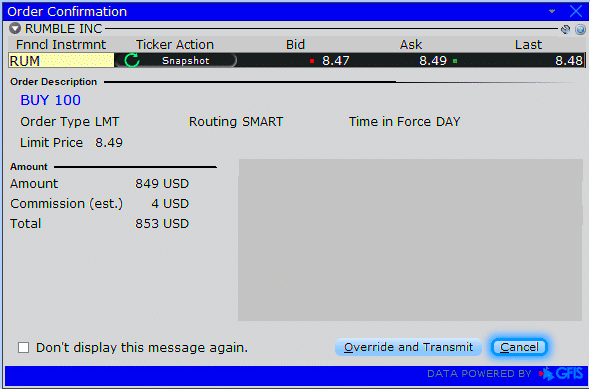

- Search for Rumble Stock: Using the brokerage platform, search for Rumble stock using its ticker symbol. This will help you locate the stock easily.

- Make the Purchase: Decide how many shares you want to buy and place your order. You can choose between a market order (buying at the current price) or a limit order (setting a price limit).

- Monitor Your Investment: After buying, keep an eye on Rumble's performance and related news. Adjust your investment strategy as necessary!

| Brokerage | Commission Fees | Features |

|---|---|---|

| Robinhood | No Fees | Easy-to-use app, instant deposits |

| E*TRADE | Varies | Research tools, educational resources |

| Fidelity | No Fees | Excellent customer service, retirement options |

And there you have it! By following these steps, you'll be on your way to owning some Rumble stock. Happy investing!

Read This: How to Sync Rumble with YouTube: A Quick Guide

Choosing the Right Brokerage for Rumble Stock

When it comes to buying Rumble stock, choosing the right brokerage is a crucial step in your investment journey. A good brokerage platform not only facilitates your transactions but also helps you manage your investments efficiently. So, what should you look for?

- Fees and Commissions: Different brokerages have varying fee structures. Some may charge a flat commission for trades, while others might use a tiered system based on the volume of your trades. Always check for hidden fees that might eat into your returns, especially if you're planning on trading frequently.

- User Interface: An intuitive and user-friendly interface can significantly enhance your trading experience. Look for platforms that offer easy navigation, engaging dashboards, and real-time data analysis tools.

- Research Tools: Solid research resources are essential for informed trading decisions. Choose a brokerage that provides access to market research, analyst reports, news updates, and other tools that can guide you in your investment strategy.

- Customer Support: Having reliable customer service can save you a lot of headaches, especially if you encounter issues during trading. Look for brokerages that offer multiple channels of support, such as live chat, email, and phone assistance.

- Variety of Account Types: Depending on your investment goals, you might want to select a brokerage that offers a variety of account types like individual, joint, or retirement accounts, providing flexibility for your investment plans.

Ultimately, your choice of brokerage should align with your investment style and objectives. It’s worth spending some time researching and comparing options to find the platform that feels right for you.

Read This: What Is Team Rumble in Fortnite? Everything You Need to Know

Analyzing Rumble Stock Performance

Understanding how Rumble stock has been performing is essential before making an investment decision. Here are some key areas to focus on when analyzing the stock:

| Metric | Description |

|---|---|

| Price History | Look at how the stock has performed over time. Check historical price charts to identify trends, support levels, and resistance points. A stock that consistently rises or holds its price can be a good indicator of stability. |

| Market Capitalization | This reflects the total market value of Rumble Inc. and provides insight into the company's size and growth potential. Higher market cap usually suggests greater stability. |

| Earnings Reports | Examine recent earnings reports to evaluate profitability, revenue growth, and expense management. Positive earnings can drive stock prices up, while disappointing reports can do the opposite. |

| Dividend History | If Rumble pays dividends, assess its history. A steady or growing dividend can be an attractive feature for investors seeking income. |

| Industry Conditions | Evaluate the competitive landscape in which Rumble operates, including market trends, challenges, and opportunities for growth. |

Arming yourself with this data can help you make a more informed decision about investing in Rumble stock. Always cross-reference your findings with the latest market news and trends to ensure your analysis is up-to-date.

Read This: Who Is in the Royal Rumble 2024? All Participants Revealed

Risks and Rewards of Investing in Rumble Stock

Investing in any stock comes with its own set of risks and rewards, and Rumble is no exception. As an investor, it's essential to balance these factors to make informed decisions. Let’s break it down.

Rewards:

- High Growth Potential: Rumble has positioned itself as a competitive alternative to mainstream video platforms, which could lead to significant growth as users flock to it for more freedom of expression.

- Market Demand: With increasing issues around censorship on traditional platforms, Rumble caters to a growing market segment that values free speech and diversity of thought.

- Diverse Revenue Streams: By leveraging advertising, subscriptions, and partnerships, Rumble may provide multiple pathways for revenue growth, which could positively impact its stock performance.

Risks:

- Market Competition: Rumble faces stiff competition from giants like YouTube. If they don’t deliver a unique value proposition, they could struggle to gain a substantial market share.

- Regulatory Risks: As a platform dealing with user-generated content, Rumble might face regulatory scrutiny, which can impact its operational freedom and possibly lead to legal issues.

- Volatility: Stocks in the tech and media sectors can be highly volatile, influenced by factors like earnings reports, user growth, and market sentiment.

While investing in Rumble stock harbors exciting rewards, it's also fraught with potential risks. As always, seekers of investment should weigh these factors carefully before diving in.

Read This: What Is Instagram Super Rumble? Understanding the Trend

Frequently Asked Questions about Rumble Stock

Investing in Rumble stock raises numerous questions among potential investors. This FAQ section aims to clarify some of the most pertinent inquiries.

1. What is Rumble?

Rumble is a video-sharing platform that aims to provide users with a space to upload, share, and discover videos without fear of censorship. It has been gaining traction as an alternative for content creators seeking more freedom.

2. Is Rumble publicly traded?

Yes, Rumble went public through a SPAC merger, allowing investors to purchase shares on the stock market.

3. How do I buy Rumble stock?

You can buy Rumble stock through any online broker or trading platform. Just ensure that you have sufficient funds in your account and locate Rumble’s ticker symbol to make a purchase.

4. What should I know before investing?

Before investing in Rumble, consider conducted thorough research on the platform's business model, growth strategies, and potential risks. Understanding the competitive landscape and market dynamics will give you a better idea of its future performance.

5. Is investing in Rumble stock risky?

Like any stock, investing in Rumble comes with risks, such as competition and regulatory challenges. It's crucial to analyze your risk tolerance and conduct due diligence before making investment decisions.

These FAQs should provide a clearer picture of what to expect when considering an investment in Rumble stock. Always stay informed and make well-rounded decisions!

Read This: How Do Rumble Strips Work? Understanding Their Role in Road Safety

Conclusion: Making Informed Investment Decisions

Investing in stocks, including Rumble stock, requires thorough research and consideration of various factors. Understanding the company's performance, market trends, and your own investment strategy are crucial steps in this process. Here are some key points to remember:

- Research the Company: Familiarize yourself with Rumble's business model, revenue streams, and competitive landscape.

- Market Analysis: Monitor market trends and analyze economic indicators that may affect the stock market performance.

- Investment Strategy: Decide on your investment strategy—whether it be long-term, short-term, or a mix of both.

- Fundamental Analysis: Evaluate the company's financial health by reviewing their earnings reports, balance sheets, and cash flow statements.

- Technical Analysis: Use charts and tools to identify price trends, patterns, and potential entry and exit points.

- Diversity: Consider diversifying your portfolio to mitigate risks associated with market volatility.

- Consult Professionals: If in doubt, consult with financial advisors or investment professionals to gain insights and guidance.

By taking these steps, you not only position yourself to make informed decisions but also enhance your potential for successful investing in Rumble stock. Remember, each investment carries risks, and being well-prepared can significantly increase your chances of achieving your financial goals.

Related Tags