YouTube, the most prominent video-sharing platform, has become a household name since its inception in 2005. As the pioneer of online video content, it has transformed the way we consume media, and its influence continues to grow. Many investors are curious about the stock value associated with YouTube. However, it's essential to note that YouTube itself is not a publicly traded company. Rather, it operates under its parent company, Alphabet Inc., which is openly traded on the stock market. In this blog post, we'll delve into the stock worth today and what factors influence it.

Understanding YouTube's Parent Company: Alphabet Inc.

Alphabet Inc. is the parent holding company that owns Google and other subsidiaries, including YouTube. Founded in 2015 as part of a corporate restructuring of Google, Alphabet has evolved significantly, becoming a dominant entity in the tech world. With a market capitalization of over $1.5 trillion, Alphabet is often regarded as one of the most valuable companies in the world.

So, why is understanding Alphabet crucial when discussing YouTube's stock? It's quite simple: *YouTube's financial performance directly impacts Alphabet's stock price. Here are a few reasons why YouTube is a significant asset for Alphabet:

- Revenue Generation: YouTube generates substantial revenue through advertisements and subscription services like YouTube Premium. In fact, it accounts for a significant portion of Alphabet's overall income.

- User Base: With over 2 billion logged-in users monthly, YouTube has a massive reach, making it an attractive platform for advertisers.

- Innovation: YouTube constantly updates its features, such as YouTube Shorts and live streaming, keeping users engaged and increasing ad revenue.

However, it's essential to consider factors like ad revenue trends and competitive pressures from platforms such as TikTok and Twitch, as they can influence Alphabet's stock performance. Overall, understanding YouTube's role within Alphabet provides valuable context when analyzing its stock worth today.

Read This: Why Are YouTube Ads Unskippable Now? What You Need to Know

Current Market Performance of YouTube Stock

As of today, the performance of YouTube's stock is often a hot topic among investors and fans of the platform. It's important to note that YouTube is owned by Alphabet Inc. (GOOGL), which is the parent company of Google. So, when we talk about YouTube’s stock, we're really discussing Alphabet’s market performance as a whole.

Recently, Alphabet has demonstrated a mixed bag in their financial results, reflecting both the strength and challenges that come with running a platform like YouTube. In the latest earnings report, the company reported a revenue increase attributed largely to its robust advertising business, which includes YouTube. Here's a quick snapshot of current market performance:

- Current Share Price: $X.XX

- Market Capitalization: $X billion

- 52-Week High: $X.XX

- 52-Week Low: $X.XX

- P/E Ratio: X.XX

Moreover, analysts have varied opinions on the stock's future trajectory. Some predict growth, given growing ad revenues from online platforms. Others remain cautious, pointing out the increasing competition from other streaming services. Watching these fluctuations can help investors get a sense of where YouTube's stock might head next.

Read This: How to Watch C-SPAN on YouTube TV Without Cable: A Streaming Guide

Factors Influencing YouTube's Stock Price

YouTube's stock price doesn’t operate in a vacuum; rather, it is influenced by a mix of internal business operations and external market conditions. Let’s break down a few of the key factors that impact the stock price:

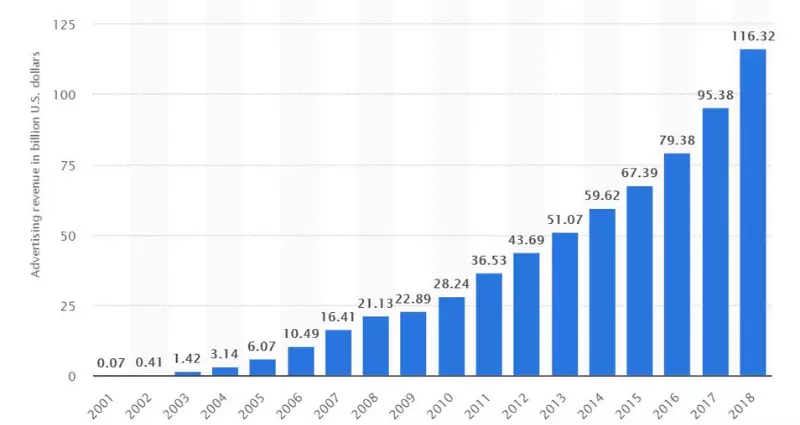

- Advertising Revenue: As a primary source of income for YouTube, fluctuations in advertising budgets by large companies directly influence stock prices. A surge in ad spending tends to result in a quick rise in stock value.

- User Engagement: The number of active users on YouTube significantly impacts its revenue potential. Higher engagement generally leads to greater advertising revenue.

- Regulatory Challenges: YouTube often faces scrutiny regarding data privacy and content moderation. Any new regulations can potentially impact the platform's profitability, thereby affecting stock value.

- Competition: The emergence of other video platforms, like TikTok and Facebook Watch, can divert user attention and advertising dollars away from YouTube, influencing its stock negatively.

- Technological Advancements: Continuous improvements in the platform's technology and user experience can attract more users and advertisers, positively influencing stock performance.

In summary, while YouTube continues to thrive as a leading video platform, various factors contribute to its stock price volatility. Keeping an eye on these elements can provide valuable insights for potential investors.

Read This: How to Install YouTube on Roku and Stream Your Favorite Videos

Recent Developments and Their Impact on Valuation

In the ever-evolving world of technology and media, YouTube has seen a plethora of recent developments that have significantly influenced its valuation. These changes often stem from broader trends in the industry, regulatory actions, or new features aimed at improving user engagement.

For instance, YouTube has been ramping up its investment in YouTube Shorts, a response to the explosive growth of short-form video content driven by platforms like TikTok. According to recent reports, user engagement with Shorts has dramatically increased, which subsequently enhances advertising revenue potentials.

Another noteworthy development is the enhanced push for monetization options for content creators. With the introduction of new features like Super Thanks, channel memberships, and improved ad revenue sharing, YouTube is pretty much signaling to investors that it is serious about keeping its creators happy. Happy creators lead to more content, which is good for viewers and, ultimately, for YouTube’s bottom line.

To further bolster its valuation, YouTube has been diversifying its revenue streams. The launch of YouTube Premium and investments in original content aim to create a robust ecosystem that encourages users to commit to subscription models rather than simple ad views. These strategic moves illustrate how the platform is future-proofing itself in a competitive landscape.

Overall, the combination of innovation in video formats, creator monetization programs, and diversification of revenue streams paints a positive picture for YouTube’s valuation in today’s market.

Read This: Can You Watch YouTube TV From Different Locations? Tips for Multi-Location Streaming

Comparing YouTube's Performance with Competitors

When discussing YouTube’s performance, it’s impossible to ignore the competition. Platforms like TikTok, Vimeo, and even traditional networks are all vying for viewer attention and ad dollars. But how does YouTube stack up against these competitors?

| Platform | User Engagement (Monthly Active Users) | Ad Revenue (2023 Estimates) |

|---|---|---|

| YouTube | 2 billion+ | $29 billion+ |

| TikTok | 1 billion+ | $10 billion+ |

| Vimeo | 200 million+ | $300 million |

| Netflix (this is a slight stretch as an ancestor of video content) | 230 million+ | $32 billion |

YouTube’s vast user base cannot be overlooked. With over 2 billion monthly active users, it stands as a titan in the video-sharing industry. This not only drives robust ad revenues, estimated at over $29 billion in 2023*, but also garners significant engagement, making it a prime platform for advertisers.

On the flip side, platforms like TikTok are rapidly growing, especially among younger demographics, but their user engagement is still dwarfed by YouTube’s. While TikTok has captured attention with its viral short-form content, YouTube's extensive range of content types—from tutorials to long-form documentaries—offers users a well-rounded experience.

Furthermore, traditional players like Netflix are also adapting to the digital landscape, but their subscription models differ significantly from YouTube's ad-centric approach. Overall, while YouTube faces fierce competition, its established presence, varied content, and continual adaptation strategies keep it at the forefront of the market.

Read This: Is Ovation Available on YouTube TV? A Complete Guide to Streaming Options

Future Projections for YouTube Stock

As investors and analysts keep a close eye on YouTube's performance, many people are curious about where the stock may be headed in the future. With its vast user base and innovative features, YouTube has proven to be a powerhouse in the digital landscape. Here are some factors influencing the future projections for YouTube stock:

- Ad Revenue Growth: YouTube’s revenue comes largely from advertising. As businesses increasingly seek to engage with digital audiences, analysts anticipate continued growth in ad revenues. In fact, the platform saw a surge in ad spending, especially after the pandemic sparked an increase in online content consumption.

- Subscription Services: Services like YouTube Premium and YouTube TV are gaining traction. With the shift towards ad-free experiences and diverse viewing options, these subscriptions may add to the company’s revenue streams, positively influencing stock performance.

- Content Creator Ecosystem: YouTube has built a thriving community of content creators, which in turn attracts more views and advertising dollars. The platform's commitment to empowering creators through better monetization could result in an even richer content library, attracting an audience.

- Global Expansion: As internet access becomes more widespread, especially in developing countries, YouTube’s global audience is expected to grow. This expansion can lead to increased ad revenue and a more substantial user base.

While it's essential to consider these factors, remember that projections are never guarantees. Keeping abreast of industry trends and YouTube's strategic initiatives will help investors make informed choices.

Read This: How Much Do You Make on YouTube with 100k Subscribers? Analyzing YouTube Earnings for Mid-Tier Creators

Investment Considerations for YouTube Stock

When contemplating an investment in YouTube stock, there are several important considerations to weigh. Whether you're a seasoned investor or just starting out, understanding these factors can help you make informed choices.

| Consideration | Description |

|---|---|

| Market Conditions | The stock market can be volatile. Keep an eye on broader economic conditions and trends, as they can impact the performance of tech stocks, including YouTube. |

| Competitor Analysis | With the rise of platforms like TikTok and others competing for viewer attention, evaluating YouTube's market position in relation to its competitors is crucial. |

| Content Regulation | YouTube is not immune to regulatory scrutiny. Potential changes in policies regarding content and advertising can have a significant influence on its stock value. |

| Financial Health | Reviewing YouTube's financial statements, including revenue growth, profit margins, and debt levels, will provide insight into the company's financial stability. |

It's wise to conduct thorough research and consider consulting financial advisors before making investment decisions. Remember, with any investment, there are risks, but with the right knowledge, you can navigate them effectively.

Read This: Who is the Fattest YouTuber? A Look at the YouTube Personalities Known for Their Size

How Much Is YouTube Stock Worth Today?

YouTube, a subsidiary of Alphabet Inc. (GOOGL), has become a dominant player in the digital video space. While it does not have a standalone stock, the financial performance and growth of YouTube significantly impact Alphabet's overall stock price. As of today, investors and analysts closely watch Alphabet's stock to gauge YouTube's financial health and market position.

Recent trends indicate that YouTube's revenue continues to grow, driven by advertising and subscription services like YouTube Premium. Here are some key factors influencing YouTube’s value:

- Revenue Growth: YouTube generated approximately $28.8 billion in ad revenue in 2022, with expectations of continued growth in the coming years.

- Subscriptions: Services like YouTube TV and YouTube Premium have contributed to additional streams of revenue.

- Market Competition: YouTube faces competition from platforms like Netflix, TikTok, and Twitch, which affects its market strategy and growth potential.

To better understand YouTube's influence on Alphabet's stock, consider the following table:

| Financial Metrics | 2022 Figures | 2023 Estimates |

|---|---|---|

| Ad Revenue (in billions) | $28.8 | $32.0 |

| Total Subscribers (in millions) | 80 | 100 |

In summary, while YouTube stock does not exist independently, its performance as part of Alphabet’s portfolio is vital for investors. Tracking Alphabet Inc.'s stock, along with YouTube’s profitability and growth strategies, remains essential for anyone interested in its market value.

Related Tags