If you’re creating content on YouTube, navigating the tax landscape can feel overwhelming, especially when it comes to understanding what tax documents you may receive. One of the common questions among creators is whether YouTube sends a W-2 form for tax reporting. The short answer is: it depends on how and how much you earn. In this guide, we’ll break down everything you need to know about YouTube’s tax reporting parameters and what to expect during tax season.

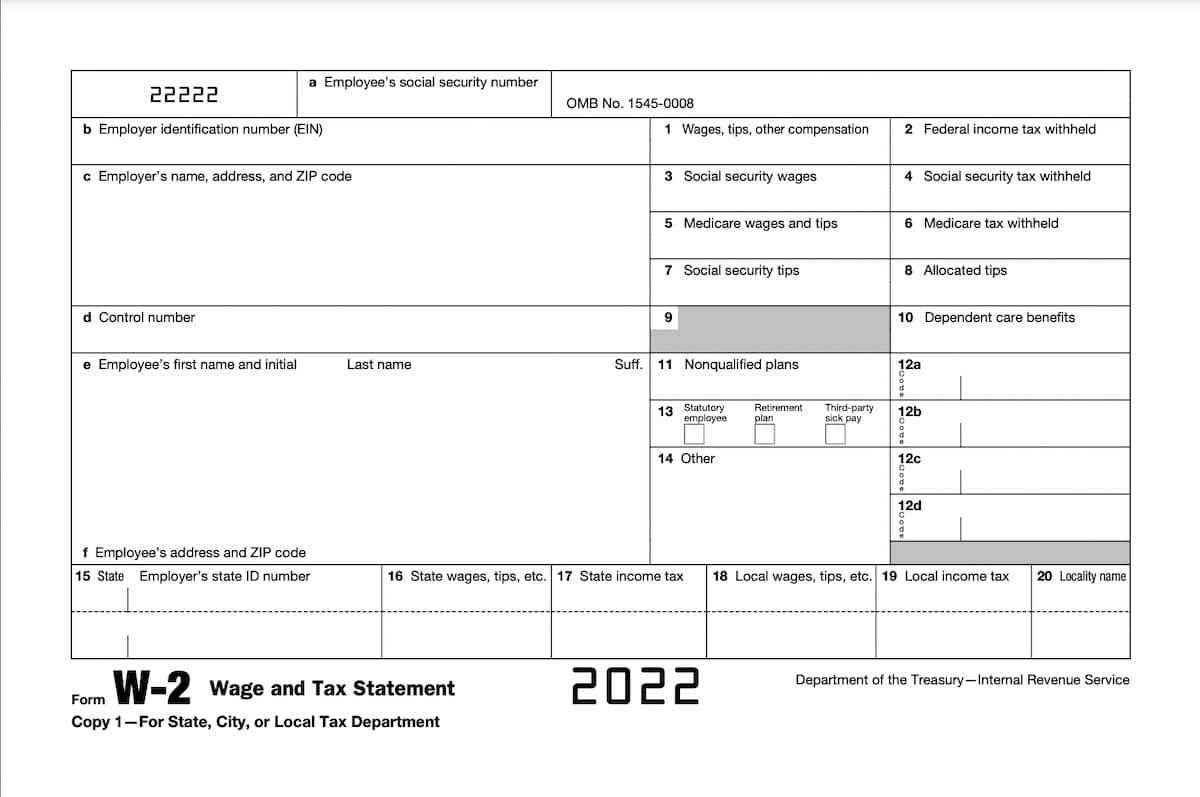

What is a W-2 Form?

A W-2 form is a crucial tax document that employers use to report wages paid to employees and the taxes withheld from them. For traditional employees, this means every year, their employer must send them a W-2 that summarizes their earnings and tax deductions. If you're a creator on YouTube and consider it your job, you might be curious about how this whole process applies to you.

Here’s a quick breakdown of key aspects of the W-2:

- Purpose: The W-2 tells the IRS how much income you've made and what has been deducted for federal, state, and other taxes.

- Who Receives a W-2: Typically, employees that earn wages from a company receive W-2 forms. If you’re classified as an independent contractor or a freelancer, you will likely receive a different document.

- Filing Requirements: If you earn $600 or more as an employee, your employer is obligated to issue a W-2. This form should be sent to you by January 31st of the following year.

So, does YouTube issue W-2 forms? As a creator, you’re often classified differently. It’s essential to understand your status on the platform, as it significantly affects how you manage your taxes and what forms you need to fill out. But don’t worry—we’ll dive deeper into this later!

Read This: How to Go Live on YouTube Without 50 Subscribers and Start Streaming Today

5. Tax Implications for Different Types of Income on YouTube

As a YouTube creator, you might be raking in various streams of income, and understanding the tax implications for each is crucial. YouTube monetization isn’t just a one-size-fits-all situation; different income types can have diverse tax treatments. Here’s a breakdown:

- Ad Revenue: This is the income you earn from ads displayed on your videos. Since ads are managed through Google's AdSense, it's considered business income. You'll report this on Schedule C if you’re a sole proprietor.

- Channel Memberships: When viewers subscribe to your channel for perks, the money you make is also classified as business income. You'll want to keep accurate records of all membership fees received.

- Super Chat and Super Stickers: During live streams, viewers can pay to have their messages highlighted. This direct income is treated similarly to ad revenue in terms of taxes.

- Sponsorships and Brand Deals: If you collaborate with brands, the income from these partnerships can vary. Some contracts may classify this as independent contractor income, meaning you might need a separate 1099 form from the brand if you earn over a certain threshold.

- Merchandise Sales: If you sell branded merchandise through platforms like Teespring or your website, that income should also be reported. Make sure to track costs related to production in terms of deductibles.

It's essential to keep detailed records and consult with a tax professional to navigate these diverse income streams, ensuring you're reporting everything correctly and not missing out on potential deductions.

Read This: Does Embedded YouTube Views Count and How to Boost Video Engagement

6. Understanding Other Tax Documents You Might Receive

As a YouTube creator, your tax documents aren't limited to just the W-2 (which you probably won't receive). Instead, you might encounter several other tax forms, each with its unique purpose. Let’s take a closer look at what you might see come tax time:

- Form 1099: If you earn $600 or more from a specific source, such as sponsorships or freelance gigs, you should receive a 1099 form. This form reports the income you earned and is crucial for your tax filings.

- Form 1040: This is the standard individual income tax return form. As a creator, you’ll usually report your earnings here, detailing your total income from YouTube and any other sources.

- Schedule C (Form 1040): This is where you’ll report your business income and expenses. Deducting eligible business expenses can lower your taxable income, so keep track of all your costs!

- Schedule SE: If you’re self-employed (which most YouTubers are), you’ll need this form to calculate your self-employment tax based on your net earnings.

In addition to these forms, you may receive other documents related to investments or ancillary income sources. Always keep an organized file of these forms to streamline your tax filing process and, if possible, work with a tax professional to ensure you're compliant and making the most of your deductions!

Read This: Why Do YouTube Shorts Glitch? Troubleshooting Short-Form Video Issues

How to Prepare for Tax Season as a YouTube Creator

Preparing for tax season as a YouTube creator can feel a bit daunting, but don't worry! With a little organization and some essential knowledge, you can make the process smoother. Here are some steps to help you get ready:

- Track Your Income: Keep a detailed record of all your income sources. This includes AdSense earnings, sponsorships, merchandise sales, and any other revenue streams. Using a spreadsheet can simplify this task.

- Document Your Expenses: Just like tracking income, you should keep tabs on your expenses. Common deductible expenses may include:

- Video equipment (cameras, microphones, lighting)

- Software subscriptions (editing software, graphic design tools)

- Internet and electricity costs related to content creation

- Travel expenses for events or meetings

- Use Accounting Software: Consider utilizing accounting software like QuickBooks or FreshBooks. These can help you categorize income and expenses easier.

- Understand Your Tax Obligations: Familiarize yourself with the IRS guidelines regarding self-employment income. Depending on your earnings, you may need to pay estimated taxes quarterly.

- Consult a Tax Professional: If your financial situation seems complicated, it’s wise to consult with a tax professional. They can provide tailored advice specific to your situation.

By staying organized and proactive, you can navigate tax season with much more confidence!

Read This: Sling TV vs. YouTube TV: Which Streaming Platform Offers More?

Common Questions About Taxes and YouTube Income

Taxes can be a bit confusing, especially for YouTube creators who may not be used to handling self-employment income. Here are some common questions that often pop up:

| Question | Answer |

|---|---|

| Do I need to file taxes if I only earned a little from YouTube? | Yes! Even if your income is modest, the IRS still requires you to file taxes if you earn over $400 as a self-employed individual. |

| Can I deduct my creative expenses? | Absolutely! Many expenses directly related to your YouTube channel, such as equipment or subscriptions, can be deducted. |

| Will YouTube provide me with a 1099? | Yes, if you are a U.S. creator earning over $600, YouTube will send you a 1099 form. |

| How do I report sponsorship income? | You will report sponsorship income the same way as your YouTube earnings, treating it as taxable income on your tax return. |

| What if I didn't keep receipts for my expenses? | While it’s best to have receipts, you can still estimate your costs based on records. However, it's more challenging to substantiate those expenses if audited. |

Being informed and prepared can significantly ease the stress around taxes as a YouTube creator. If you have more specific concerns, don’t hesitate to ask!

Read This: How Much Is 4 Million Views on YouTube? Estimating YouTube Earnings from Views

Does YouTube Send You a W2? Understanding Tax Documents for Creators

As a YouTube creator, understanding how your earnings are reported for tax purposes is crucial. Many creators wonder whether they will receive a W-2 form from YouTube at the end of the year. The answer is generally no, and here’s why:

YouTube operates as a platform where users upload and monetize their content. When you earn money through YouTube, especially via the YouTube Partner Program (YPP), you're considered an independent contractor rather than an employee. This classification means that:

- YouTube does not withhold taxes from your earnings.

- Creators are responsible for reporting their income.

- Instead of a W-2, you might receive a 1099 form if you earn $600 or more in a year from YouTube.

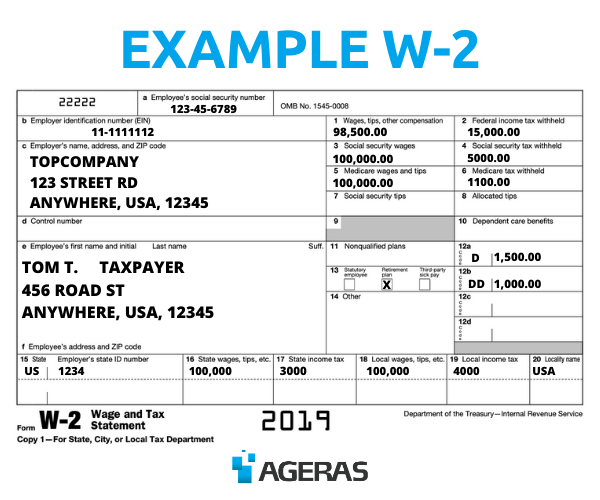

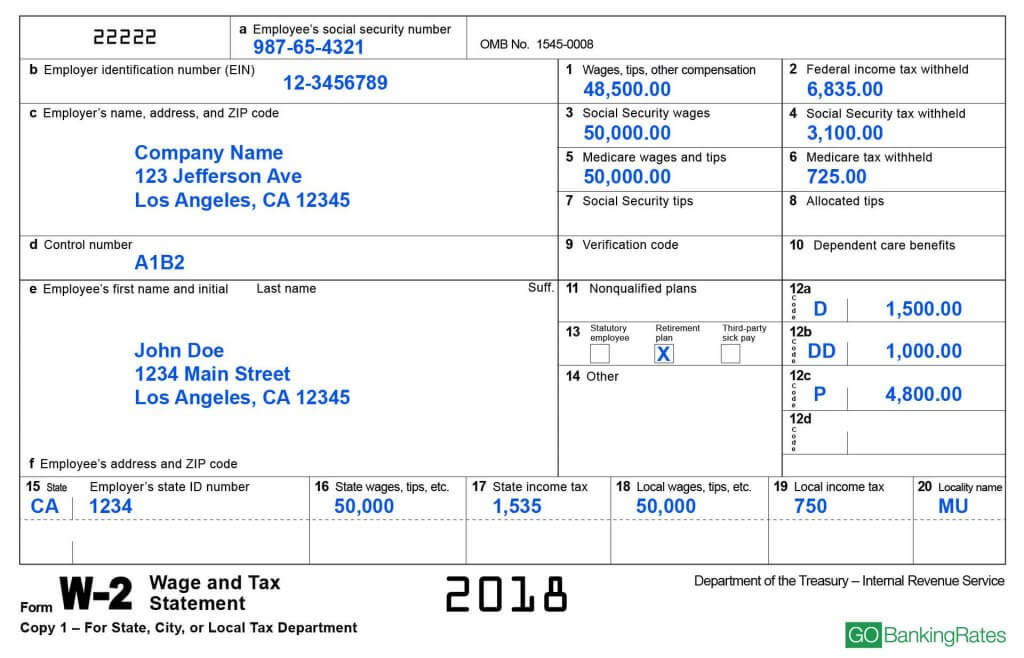

Let’s break down the key tax documents related to YouTube earnings:

| Tax Document | Description | When You Receive It |

|---|---|---|

| W-2 | Your employer provides this if you’re an employee. | Not applicable to YouTube creators. |

| 1099-NEC | Reports non-employee compensation for independent contractors. | If you earn $600 or more from YouTube. |

It's critical for creators to keep accurate records of their income and expenses related to their YouTube activities. This will help in accurately reporting your earnings and maximizing deductions. If you're unsure about your tax obligations, consulting a tax professional can provide clarity and ensure compliance with tax laws.

Conclusion: Staying informed about your tax obligations as a YouTube creator is essential for financial success, ensuring you report income accurately and manage your tax responsibilities properly.

Related Tags