Rumble is gaining traction as a prominent video-sharing platform that's often seen as a haven for free speech. Launched in 2013, Rumble has carved out a niche for itself, particularly among content creators who feel constrained by more mainstream platforms' strict content moderation policies. As it captures the attention of more users, the question arises: has investment interest from major players, like BlackRock, influenced Rumble's growth trajectory? Let's explore the evolution of this platform and what has fueled its rapid ascent.

Since its inception, Rumble has focused on democratizing content sharing by allowing creators to upload, share, and monetize videos with minimal interference. Here are some key points about Rumble's growth:

- Content Diversity: Rumble hosts a wide variety of content, from political commentary to lifestyle vlogs, attracting audiences across different demographics.

- Creator-Friendly Policies: With a payout structure that favors creators, many influential personalities have migrated to Rumble to establish their presence.

- Global Reach: Rumble’s expansion into international markets has helped it build a global user base, boosting its visibility and user engagement.

- Attracting Controversial Figures: By welcoming voices often banned from other platforms, Rumble has become synonymous with free speech, igniting conversations around censorship.

Background on BlackRock and Its Investment Strategies

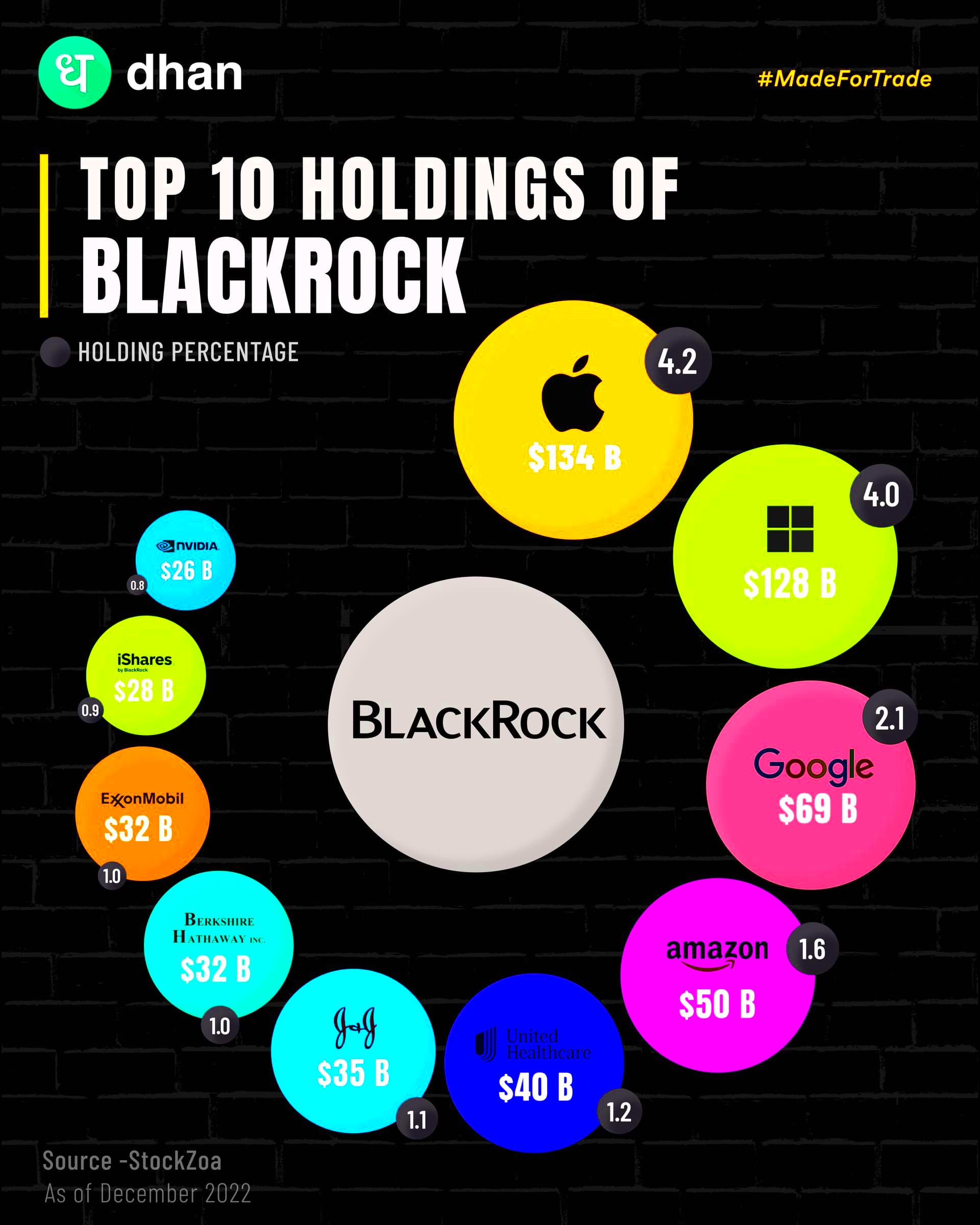

BlackRock is one of the largest investment management firms in the world, with a reputation for wielding considerable influence in financial markets. Founded in 1988, the firm manages trillions of dollars in assets and has a finger in every pie, from stocks and bonds to private equity and real estate. But what does BlackRock look for when considering investments? Let's delve deeper into their investment strategies.

Understanding BlackRock's approach can reveal why the firm might be interested in platforms like Rumble:

- Diversification: BlackRock believes in spreading investments across various sectors to mitigate risks. This strategy helps them explore innovative companies like Rumble.

- Focus on Growth Potential: The firm often invests in companies that are poised for significant growth, making platforms with burgeoning user bases appealing.

- ESG Factors: Environmental, Social, and Governance (ESG) criteria are increasingly critical for BlackRock’s investment decisions, aligning with companies that promote social values, including free speech.

- Market Trends: BlackRock pays close attention to market trends and consumer behavior, allowing them to identify rising stars like Rumble before they fully explode onto the mainstream scene.

Read This: Do You Need PS Plus to Play Crash Team Rumble? A Guide to PlayStation’s Subscription Requirements

Recent News: Did BlackRock Acquire Rumble?

In the ever-evolving landscape of digital platforms, news of significant investments can send shockwaves through the market. Recently, rumors emerged suggesting that BlackRock, the colossal asset management firm, may have set its sights on Rumble, a video-sharing platform known for its commitment to free speech and alternative content. However, like any juicy rumor, it’s essential to sift through the noise for the truth.

As of late October 2023, there has been no official confirmation from either BlackRock or Rumble regarding an acquisition. Reports indicate that BlackRock has been diversifying its portfolio and exploring various media investments, which fueled speculation about them acquiring stakes in Rumble. But here’s where it gets interesting:

- Rumble’s Unique Position: The platform has carved out a niche for itself, particularly among users who are seeking alternatives to mainstream video-sharing services.

- Market Reception: Many analysts have noted that if such an acquisition were to happen, it could enhance Rumble's reach significantly.

- Regulatory Scrutiny: Any potential merger or acquisition would likely come under the microscope of regulatory bodies, especially given the rising concerns surrounding monopolization in the tech space.

In conclusion, while the prospect of BlackRock acquiring Rumble is tantalizing, it remains speculative as of now. The market and Rumble's unique appeal will certainly continue to attract attention, keeping investors and users alike on their toes.

Read This: Did Eren See the Rumbling? Understanding Eren’s Role in the Event

Analyzing Rumble's Business Model and Market Position

Rumble has emerged as a noteworthy player in the digital media landscape, particularly catering to users who prioritize free speech and more diverse content. Let’s dive deep into what makes Rumble tick—from its business model to its market position.

Business Model

Rumble operates primarily on a few key revenue streams:

- Advertising Revenue: Much like YouTube, Rumble generates income through advertisements placed within videos. By offering creators a platform to post content, they attract viewers and advertisers alike.

- Subscription Services: Rumble has introduced a premium subscription model allowing users to enjoy ad-free content and exclusive features for a monthly fee.

- Creator Monetization: They provide financial incentives for content creators through various monetization options, such as revenue sharing, which encourages more creators to join the platform.

Market Position

In terms of market position, Rumble finds itself in a unique and challenging environment:

| Aspect | Rumble | Main Competitors |

|---|---|---|

| User Base | Growing, particularly among conservative audiences | YouTube, Vimeo |

| Content Moderation | Minimal restrictions | Strict guidelines on content |

| Revenue Model | Ad revenue and subscriptions | Ad revenue, premium subscriptions |

In summary, Rumble's ability to cater to an underserved audience combined with a robust business model positions it as a formidable contender in the video-sharing arena. As tensions in the market evolve, observing how these dynamics shift will be crucial for any potential investors or interested users.

Read This: How to Watch Rumble on Roku: A Step-by-Step Guide

Impact of Institutional Investment on Media Platforms

Institutional investment in media platforms like Rumble often sends ripples through the entire media landscape. When large firms like BlackRock invest, it isn’t just about the money—it’s about influence, strategy, and market dynamics. Such investments can lead to significant changes in how content is produced, distributed, and consumed.

Here are a few key impacts of institutional investment:

- Increased Capital for Growth: More funding allows platforms to enhance their features, improve user experience, and expand their reach. This means investing in technology, hiring talent, and possibly acquiring new content.

- Strategic Direction: Institutional investors often bring a strategic vision to the table. They may steer platforms toward more profitable content models or influence the type of content that gets priority, potentially prioritizing mainstream narratives or investor-friendly projects.

- Market Credibility: Support from well-known investment firms can enhance a platform's reputation. It can attract other investors and users, leading to greater user growth and engagement.

- Pressure for Monetization: With the influx of capital comes the pressure to generate returns. This might lead to platforms adopting more aggressive advertising policies or exploring subscription models, which can impact user experience.

- Potential for Censorship: There's a fine line between guiding content and exerting control. Institutional investors may influence content moderation policies, leading to accusations of bias or censorship.

In a nutshell, the impact of institutional investment is multifaceted. While it can lead to innovation and growth, it can also raise questions about editorial independence and the type of content that gets promoted. As media platforms like Rumble navigate these dynamics, their future will likely reflect the interests of their investors as much as the desires of their user base.

Read This: How to Use Rumble: Platform Features and Tips

BlackRock's Interest in Alternative Media

BlackRock, as one of the largest asset management firms globally, is known for its diversified investment strategy. Recently, its interest has been piqued by alternative media platforms, and it seems to be taking a keen look at platforms like Rumble. But why the interest in alternative media?

Here are some reasons that may explain BlackRock's growing interest:

- Untapped Audience: Alternative media platforms often cater to niche audiences that mainstream media overlooks. This presents an opportunity for investors to tap into a segment of the market ripe for growth.

- Resilience in Ad Revenue: With many traditional media outlets struggling, alternative media platforms can be more resilient. They may offer unique advertising opportunities that appeal to specific advertisers looking for targeted audiences.

- Diversity of Content: These platforms frequently feature varied perspectives, which can be attractive for investors wanting to support a more open media landscape.

- Market Disruption: Alternative media is somewhat disruptive to the traditional media model. By investing here, BlackRock may be positioning itself on the cutting edge of a changing media environment.

- Monetization Potential: As alternative media grows, so does the potential for monetization through subscriptions and memberships, adjusting the revenue model into a more stable format that appeals to investors.

In conclusion, BlackRock’s interest in platforms like Rumble highlights a significant shift in the media landscape. The focus on alternative media signifies a recognition of changing consumer preferences and the potential profit that can come from tapping into markets that prioritize free speech and diverse viewpoints. As institutional investment flows into these avenues, we’ll likely see further evolution in how content is created and consumed.

Read This: Does the Rumbling Happen in AOT? Understanding Its Significance in the Story

7. Potential Implications of the Investment for Rumble

The prospect of BlackRock investing in Rumble could have significant implications for the platform and its community. As one of the largest asset management firms in the world, BlackRock’s involvement might mean more than just a financial influx—it could reshape Rumble's operational strategies, marketing techniques, and overall growth trajectory. Here are a few potential implications to consider:

- Increased Resources: With BlackRock’s investment, Rumble could access greater financial resources. This could lead to improvements in platform infrastructure, user experience enhancements, and possibly even new features that attract more content creators.

- Strategic Partnerships: BlackRock might leverage its network to create strategic partnerships that could enhance Rumble’s visibility and credibility in the crowded digital marketplace.

- Content Regulation: An investment from a large institutional player like BlackRock could initiate discussions around content moderation and regulation. Rumble may face pressure to implement stricter guidelines, which could alter its current free speech stance.

- Market Positioning: With increased capital and support, Rumble could emerge as a major alternative to traditional social media platforms, positioning itself more assertively in the content-sharing landscape.

However, there's always the flip side. Rumble’s user base might express concerns about the influence of a large corporation on platform policies, especially if they feel like their freedoms on the platform are at risk.

Read This: What Was That Rumbling Noise? Investigating the Source and Causes

8. Community Reactions and Perspectives

The announcement of BlackRock's investment, whether confirmed or hypothetical, has sparked a wide range of reactions within the Rumble community. From excitement over potential growth to apprehension about corporate influence, the community's perspectives are as diverse as the content hosted on the platform. Here’s a breakdown of some common reactions:

- Optimism: Many users are hopeful that this investment might lead to better resources for creators, more marketing initiatives to grow the user base, and overall improved functionality. These supporters argue that a well-funded platform has the potential to innovate and expand its features, making it more competitive.

- Skepticism: On the other hand, there's a noticeable faction that is skeptical about the motives behind the investment. Some believe that the presence of a large financial entity like BlackRock could prioritize profit over free speech and community standards, leading to potential censorship or undue influence over content.

- Defensive Stance: Some community members have rallied to defend Rumble’s original principles of promoting free speech. Their concern is that an institutional investor could shift the platform away from these values, making it more mainstream and less of a niche alternative.

The diversity of opinions highlights the complex nature of investment in digital platforms. Community forums are buzzing with discussions, and the direction Rumble chooses to take in light of potential investments will be crucial in determining its relationship with its user base moving forward.

Read This: What Is Rumble AP? Understanding the Acronym and Its Uses

Conclusion: The Future of Rumble and BlackRock's Role

The relationship between Rumble, a rising video-sharing platform, and BlackRock, one of the world's largest asset management firms, has stirred significant interest among investors, media, and users alike. Understanding this dynamic sheds light on the evolving landscape of social media and financial investment. Below is a summary of key points regarding the speculation around BlackRock's investment in Rumble:

- Investment Background: BlackRock has been known to diversify its portfolio by investing in various tech platforms, particularly those that promote free speech and alternative media.

- Rumble's Growth: Rumble has rapidly gained users, especially among individuals seeking a platform that champions freedom of expression, setting it apart from competitors like YouTube.

- Financial Implications: An investment or stake by BlackRock could potentially enhance Rumble's credibility and financial standing, allowing for further growth and innovation.

- Market Trends: The rise of decentralized platforms and increased user demand for alternatives to mainstream media suggest that Rumble could be well-positioned for continued success.

- Investor Interest: This speculation may attract other investors, increasing Rumble's market valuation and leading to greater strategic partnerships.

In conclusion, while concrete details about BlackRock’s ownership of Rumble are still unfolding, it’s clear that both entities have the potential to influence each other's futures. If BlackRock indeed invests in Rumble, it could mark a notable shift in how traditional investment firms engage with digital media platforms that cater to niche audiences, paving the way for both growth and challenges in the evolving social media landscape.

Related Tags