In the fast changing realm of media Adobe Stock has established its presence. Having explored the stock photography and video licensing scene I can attest to the importance of grasping the allocation for directors. This intricate process holds significance for individuals in leadership roles within the organization. Lets take a closer look at how Adobe Stock distributes shares and the implications it has for directors.

The Basics of Adobe Stock Shares

Shares of Adobe Stock are included in the companys equity compensation scheme aimed at aligning the interests of its workforce, including directors with the overall success of the business. Here’s a brief overview:

- Equity Compensation: Directors are granted shares as part of their compensation package, which can include stock options or restricted stock units (RSUs).

- Vesting Period: Shares typically come with a vesting schedule. This means that directors earn their shares over time, which encourages long-term commitment to the company.

- Market Value: The value of these shares fluctuates based on Adobe Stock’s performance in the market, which can be both exciting and nerve-wracking.

Based on what I’ve seen the process of allocating shares goes beyond simply handing out portions. It’s about creating a feeling of ownership and drive, within the directors. It serves as a means to make sure that those at the helm of the company are also personally committed to its achievements, in both a symbolic and tangible sense.

Read This: Tips for Success on Adobe Stock

How Directors Benefit from Shares Allocation

For executives at Adobe Stock the distribution of shares goes beyond being a mere monetary incentive. It serves as a valuable advantage that can greatly influence both their careers and personal lives. Here's how.

- Financial Incentives: Shares can appreciate over time, offering a potential for significant financial gain. This aligns the director’s success with that of Adobe Stock.

- Motivation and Engagement: Knowing that their compensation is tied to the company’s performance can drive directors to work harder and make decisions that are in the best interest of the company.

- Long-Term Benefits: The vesting schedule often ensures that directors stay with the company longer, which can lead to stability and continuity in leadership.

Looking back at my experiences with professionals in the field I've witnessed the impact of share distribution on a persons position. It shifts the dynamic into a collaboration where both the organization and the individual benefit mutually.

Read This: How to Return an Image on Adobe Stock

Criteria for Shares Distribution

When it comes to allocating shares at Adobe Stock there’s a careful approach involved. It goes beyond simply distributing ownership; it aims to maintain equity and inspire those driving the companys progress. Based on my insights here’s how the selection process usually works.

- Position and Seniority: Directors and higher-level executives often receive a larger share of the stock. This is because their roles come with greater responsibilities and impacts on the company's success.

- Performance Metrics: Shares are frequently tied to performance evaluations. Directors who meet or exceed their targets are more likely to receive a higher allocation.

- Tenure with the Company: Longevity matters. Directors who have been with Adobe Stock longer are often rewarded with more shares, reflecting their sustained commitment and contribution.

- Company Performance: The overall performance of Adobe Stock can influence shares distribution. A strong financial year might lead to more generous allocations.

Throughout my professional journey I’ve witnessed the significance of these criteria as not mere regulations but as a means to inspire and recognize individuals who play a role in steering the direction of the company. It serves as a gesture to honor their efforts and commitment.

Read This: How to Download Adobe Stock Photos

Factors Affecting the Allocation Process

The allocation of shares is a process that is shaped by various factors. It's similar to preparing a meal with numerous components involved. Let's delve into the aspects that can impact the distribution of shares.

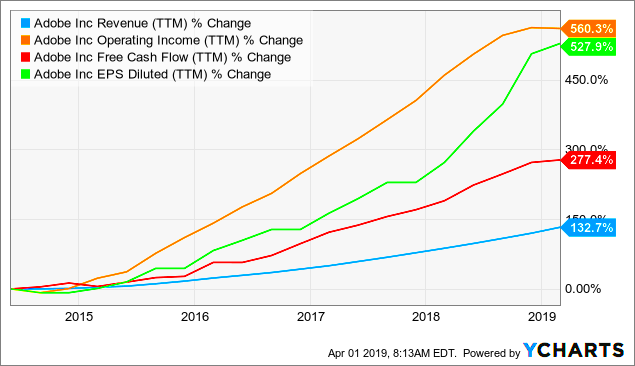

- Company Financial Health: Adobe Stock’s overall financial performance directly impacts shares allocation. Strong financial health can lead to more generous distributions.

- Market Conditions: Economic conditions and market trends can affect the valuation of shares and the quantity allocated. A booming market may lead to higher allocations.

- Individual Contributions: Directors who drive significant value—whether through strategic decisions or exceptional performance—are often rewarded with more shares.

- Internal Policies: The company’s internal policies on equity distribution also play a crucial role. These policies are crafted to align with both the company’s goals and the interests of its directors.

In my view the way resources are distributed is similar to a careful choreography. It strikes a balance between recognizing contributions and showcasing the achievements of the company as a whole making sure that all align with the larger objectives.

Read This: How Much Adobe Stock Images Cost

Managing Your Adobe Stock Shares

Holding shares in Adobe Stock can be an exciting experience but it’s essential to handle them with care. It’s not enough to simply possess them; you need to understand how to utilize them to their fullest potential. Here are some tips on how to manage your shares prudently.

- Understand the Vesting Schedule: Familiarize yourself with when your shares will vest. This knowledge helps in planning your financial strategy and making informed decisions.

- Monitor Market Trends: Keep an eye on Adobe Stock’s performance and broader market trends. This will help you decide the right time to sell or hold your shares.

- Plan for Taxes: Shares come with tax implications. It’s wise to consult with a tax advisor to understand the tax impact and plan accordingly.

- Review Your Portfolio: Regularly review your stock portfolio to ensure it aligns with your overall financial goals. Diversifying your investments can also mitigate risk.

In my view handling stocks is similar to caring for a garden. It demands focus, perseverance and some thoughtful preparation. By staying updated and taking initiative you can maximize the benefits of your Adobe Stock holdings and safeguard your financial well being.

Read This: Discover How Much Your Creative Vision Worth on Adobe Stock

Reporting and Tax Implications

Managing Adobe Stock shares involves certain duties, particularly in terms of tax reporting. It’s similar to cooking where you have to choose the ingredients carefully and stick to the instructions. Here’s what you should be aware of.

- Reporting Requirements: Directors must report their share allocations on their annual tax returns. This includes disclosing the value of shares when they are granted and when they are sold.

- Taxable Events: Shares can trigger taxable events. When shares vest, their market value is considered income, and it’s subject to income tax. Additionally, any gains from selling the shares are subject to capital gains tax.

- Record Keeping: Keeping meticulous records of your shares, including grant dates, vesting schedules, and sales transactions, is crucial for accurate reporting and tax calculations.

- Consulting Professionals: Navigating tax implications can be complex. It’s advisable to work with a tax advisor who understands stock compensation to ensure you’re compliant and making the most of available tax strategies.

Based on what I’ve seen staying on top of tax responsibilities and maintaining tidy records can really ease a lot of the pressure. It’s similar to having a carefully thought out approach that makes it easier to handle the challenges that come your way.

Read This: What Adobe Stock Is for Teams

Real-Life Examples and Case Studies

Grasping the intricacies of share distribution in real life can be eye opening. Concrete cases offer valuable perspectives on how executives handle and reap the rewards of their stock holdings. Allow me to present a few examples that could strike a chord with you.

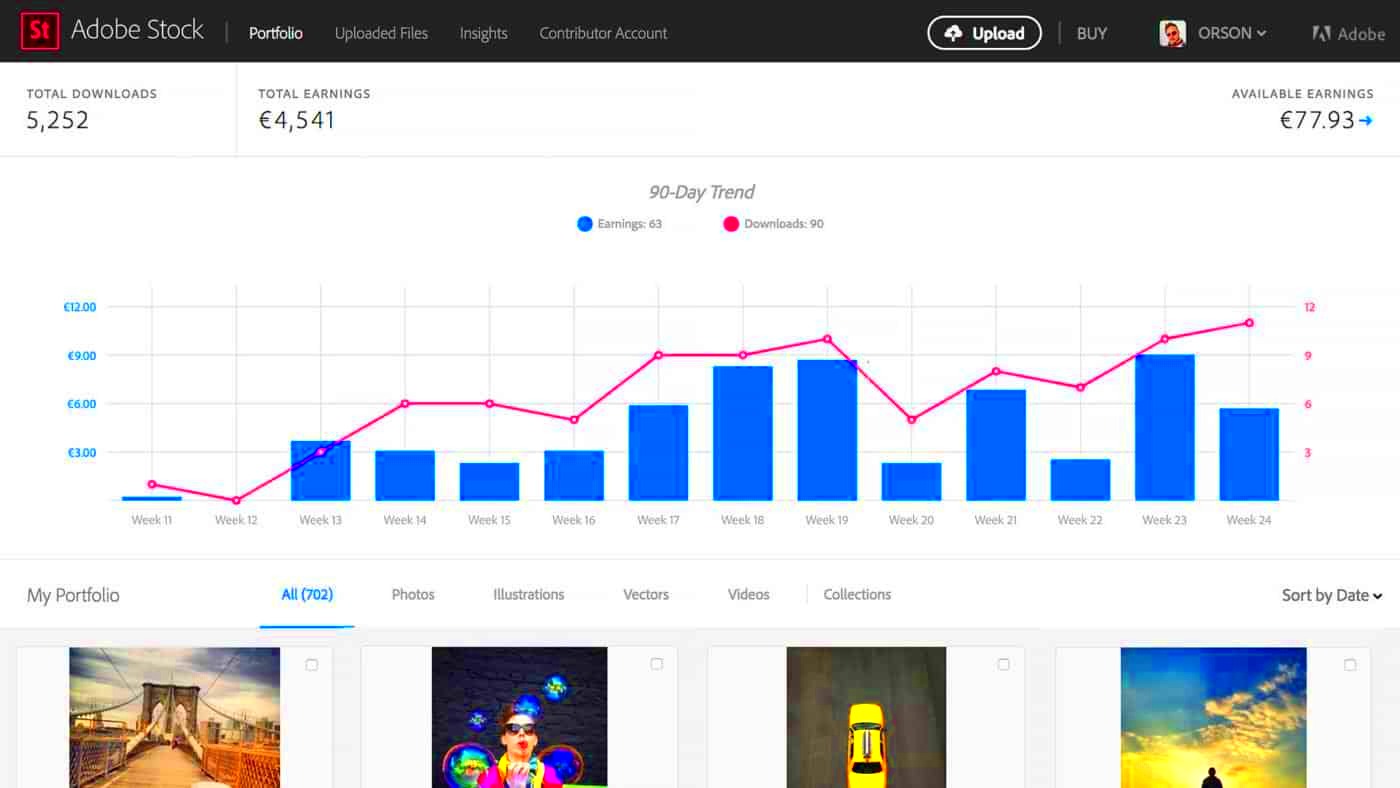

- Case Study 1: An executive at Adobe Stock, who had been with the company for over a decade, received a substantial allocation of shares. Over the years, as the company grew and the share value appreciated, this executive saw a significant financial gain. The shares not only rewarded their long-term commitment but also motivated them to drive further company success.

- Case Study 2: A newer director, who joined Adobe Stock during a high-growth period, received shares as part of their compensation. Despite the initial lower allocation compared to senior executives, they were able to capitalize on the company’s growth, leading to a meaningful financial reward. Their story highlights how shares can benefit both long-term and newer employees, reflecting the company’s overall performance.

These instances demonstrate how distributing shares can effectively reward loyalty and drive performance. They serve as tangible evidence of how offering equity can harmonize personal aspirations with organizational objectives.

Read This: What Are the Top Tools for Batch Downloading Adobe Stock Videos Without Watermarks?

Tips for Maximizing Your Shares Benefits

Investing in Adobe Stock can be an thrilling chance, but to maximize its potential you'll need a well thought out approach. Here are some actionable suggestions to help you make the best out of your shares.

- Stay Informed: Regularly check Adobe Stock’s financial reports and market performance. Being informed helps you make better decisions about when to hold or sell your shares.

- Diversify Investments: Don’t put all your eggs in one basket. Consider diversifying your investments to manage risk. While shares in Adobe Stock can be lucrative, spreading investments can protect against market volatility.

- Set Clear Goals: Define what you want to achieve with your shares. Whether it’s saving for a major purchase, planning for retirement, or reinvesting, having clear goals helps in making strategic decisions.

- Consult Financial Advisors: Engage with financial advisors who can provide personalized advice based on your financial situation. They can offer strategies for optimizing your shares and managing taxes.

Through my personal experiences I’ve discovered that taking approach and being thoughtful with share investments can bring about significant advantages. It’s all about weighing choices with a vision in mind making sure that your shares have a positive impact on your overall financial health.

Read This: Choosing Adobe Stock Backgrounds

FAQ

When it comes to dealing with the complexities of Adobe Stock shares there are a few questions that often come up. To assist in addressing some of the concerns here's a list of frequently asked questions.

- What are Adobe Stock shares? Adobe Stock shares are part of the company's equity compensation plan, given to directors and executives as a form of compensation. These shares can include stock options or restricted stock units (RSUs) that represent ownership in the company.

- How do I know when my shares will vest? Shares typically have a vesting schedule outlined in your equity agreement. This schedule details when you will earn ownership of your shares, usually over a period of time, such as four years with annual or quarterly vesting.

- What are the tax implications of receiving shares? The value of shares received can be subject to income tax at the time of vesting and capital gains tax when sold. It’s important to keep detailed records and consult with a tax advisor to manage these obligations effectively.

- How can I maximize the benefits of my shares? To make the most of your shares, stay informed about the company’s performance, diversify your investments, set clear financial goals, and seek advice from financial professionals to optimize your strategy.

- Can I sell my shares immediately after they vest? Selling shares depends on company policies and any lock-up periods that may apply. Check your equity plan details and ensure compliance with any trading restrictions before selling.

While these frequently asked questions address aspects of the topic its important to get tailored guidance that suits your specific circumstances. Dealing with stocks can be a fulfilling but intricate journey, so being well informed and taking initiative are crucial.

Read This: Should You Buy Adobe Stock Right Now?

Conclusion

Navigating and handling Adobe Stock shares involves a blend of savvy and strategic foresight. By getting a hold of the fundamentals of allocation, dealing with reporting and tax considerations and leveraging insights you can maximize the value of your shares and play a role in shaping your financial future. Seize this chance with self assurance and keep in mind that effectively managing your shares can have a profound influence on both your career and personal life.