When selling on Amazon, understanding government tax implications is crucial for compliance and financial planning. Taxes can vary based on location and type of goods sold. Proper knowledge of these taxes helps sellers price their items accurately and avoid potential legal issues.

What is Government Tax on Amazon Sales

Government tax on Amazon sales refers to the various taxes imposed by federal, state, and local authorities on the sale of goods through Amazon’s platform. These taxes are crucial for funding public services and infrastructure. Sellers on Amazon need to be aware of their tax obligations to ensure compliance and proper reporting to tax authorities. The tax landscape can be complex, as it varies by jurisdiction and can include several components such as sales tax, income tax, and import duties.

Read This: Discovering the Length of the Amazon River

Types of Taxes Applicable to Amazon Sellers

There are several key types of taxes that Amazon sellers may encounter:

- Sales Tax: A state-imposed tax on the sale of goods purchased within that state. Rates vary by state and sometimes locality.

- Income Tax: Tax on the income generated from sales after deducting expenses. Sellers must report this income on their tax returns.

- Use Tax: A tax on the use of goods purchased out of state but used within the seller's state, often complementing sales tax.

- Import Duties: Taxes on goods brought into the country, applicable for sellers sourcing products internationally.

- Franchise Tax: A type of tax imposed on businesses for the privilege of operating within certain states.

Understanding these taxes will help sellers navigate the regulatory landscape and maintain compliance.

Read This: Ultimate Guide to Amazon Delivery Tracking

3. How Government Tax Affects Amazon Sellers

When you sell products on Amazon, understanding how government tax impacts your business is crucial. Taxes can significantly affect your profitability and overall financial strategy, so let’s break it down!

First, let’s talk about *sales tax. This is the tax that consumers pay when they purchase goods. As an Amazon seller, you are required to collect sales tax in certain states, depending on where your customers are located. Amazon has implemented a Marketplace Tax Collection (MTC) system, which automatically calculates, collects, and remits sales tax for sellers in most instances. However, it’s essential to ensure you’re compliant with the specific rules and regulations in your state. Ignoring these can lead to hefty fines.

Next, we have income tax. Income tax is based on your total earnings after expenses. As an Amazon seller, every dollar you make from sales is subject to income tax. It’s essential to keep detailed records of your sales, expenses, and any taxes you’ve paid. Depending on your overall income, this tax can vary greatly.

Here’s a quick summary of key points:

- Sales Tax: Collected on sales; varies by state; often handled by Amazon for sellers.

- Income Tax: Based on your net profit; more complex and requires thorough record-keeping.

- Compliance is Key: Know both state and federal tax obligations to avoid penalties.

Overall, understanding these tax implications not only helps you stay compliant but also allows you to strategically plan for your business’s financial future.

Read This: How to Remove a Card from Amazon

4. Sales Tax vs. Income Tax for Amazon Sellers

As an Amazon seller, it's vital to grasp the difference between sales tax and income tax because they affect your business in very different ways. While they both involve the government taking a portion of your earnings, they apply to different aspects of your sales process.

Let’s clarify:

| Aspect | Sales Tax | Income Tax |

|---|---|---|

| Who pays it? | Consumers | Sellers (on their profits) |

| When is it collected? | At the point of sale | Annually or quarterly based on net income |

| How is it calculated? | Percentage of the sale price (varies by state) | Based on total income minus expenses |

| Who is responsible for remittance? | Sellers must ensure compliance (often automated by Amazon) | Sellers must file tax returns with the IRS |

Understanding the distinctions between these two types of taxes can help you manage your finances better. For example, you’ll need to set aside the collected sales tax for remittance to the appropriate state rather than considering it part of your income.

Being proactive about your tax responsibilities — whether sales or income — will not only keep you compliant but can also help you optimize your business's tax efficiency. If necessary, consult with a tax professional to navigate these complexities and develop the best strategy for your unique situation!

Read This: Enhance Your Reading Skills with a Readability Tutor on Kindle

5. How to Calculate Your Taxes as an Amazon Seller

Calculating your taxes as an Amazon seller can seem overwhelming, but with a systematic approach, you can make it manageable. Here’s how you can tackle it:

1. Understand Your Tax Obligations:

First things first, familiarize yourself with the basics. As an Amazon seller, you may be subject to different types of taxes, including:

- Sales tax

- Income tax

- Self-employment tax (if applicable)

2. Keep Accurate Records:

Having precise sales records is vital. Utilize tools such as:

- Amazon's Seller Central reports

- Spreadsheets for tracking expenses

- Accounting software like QuickBooks or Xero

3. Sales Tax Calculation:

Depending on where you are selling, you might need to collect and remit sales tax. Use tools available on Amazon, like the Marketplace Tax Collection, which automates sales tax calculations based on the buyer's location.

4. Estimate Your Income Tax:

Track your income and expenses throughout the year. At the end of the year, calculate your gross income (total sales) and subtract any deductions (like costs of goods sold, shipping, and other operational expenses) to determine your taxable income.

For example:

| Item | Amount |

|---|---|

| Total Sales | $50,000 |

| Cost of Goods Sold | ($20,000) |

| Net Income | $30,000 |

5. Consult a Tax Professional:

As tax law can be complex, consider consulting with a tax professional who specializes in e-commerce to ensure you're compliant and taking advantage of all available deductions.

Read This: How to Get in Touch with Amazon Customer Service

6. Best Practices for Handling Government Taxes on Amazon

When it comes to managing taxes as an Amazon seller, having a plan is essential. Here are some best practices to keep you on the right track:

1. Stay Informed About Tax Laws:

Tax regulations can change frequently, especially for online sales. Regularly check local, state, and federal updates that may impact your obligations.

2. Use Reliable Accounting Software:

Invest in accounting software tailored for Amazon sellers. These programs help automate tax calculations, track invoices, and categorize expenses, making your life much easier.

3. Keep Personal and Business Finances Separate:

To simplify your accounting, maintain separate bank accounts and credit cards for your Amazon business. This keeps your expenses organized and can save you a headache during tax season.

4. Educate Yourself on Deductions:

Familiarize yourself with potential deductions that can reduce your taxable income. Some common deductions include:

- Cost of goods sold

- Shipping costs

- Amazon fees

- Home office expenses (if applicable)

5. File Regularly and Timely:

Set reminders for tax due dates to avoid penalties. Depending on your income and structure, you may need to file quarterly estimated taxes.

By following these best practices, you can navigate the sometimes tricky waters of taxes on Amazon sales with confidence and ease. Remember, knowledge is power when it comes to staying compliant and maximizing your profitability!

Read This: Create Your Amazon Storefront for Success

7. State-Specific Tax Regulations for Amazon Sellers

Navigating the complex world of state-specific tax regulations can be a daunting task for Amazon sellers. Each state has its own set of rules regarding sales tax, and understanding these can save you both headaches and money. Here are some key points to keep in mind:

- Sales Tax Nexus: This is the connection or presence a seller has in a state that obligates them to collect sales tax. Nexus can be established through physical presence, such as warehouses, or economic presence, like making a certain amount of sales in that state.

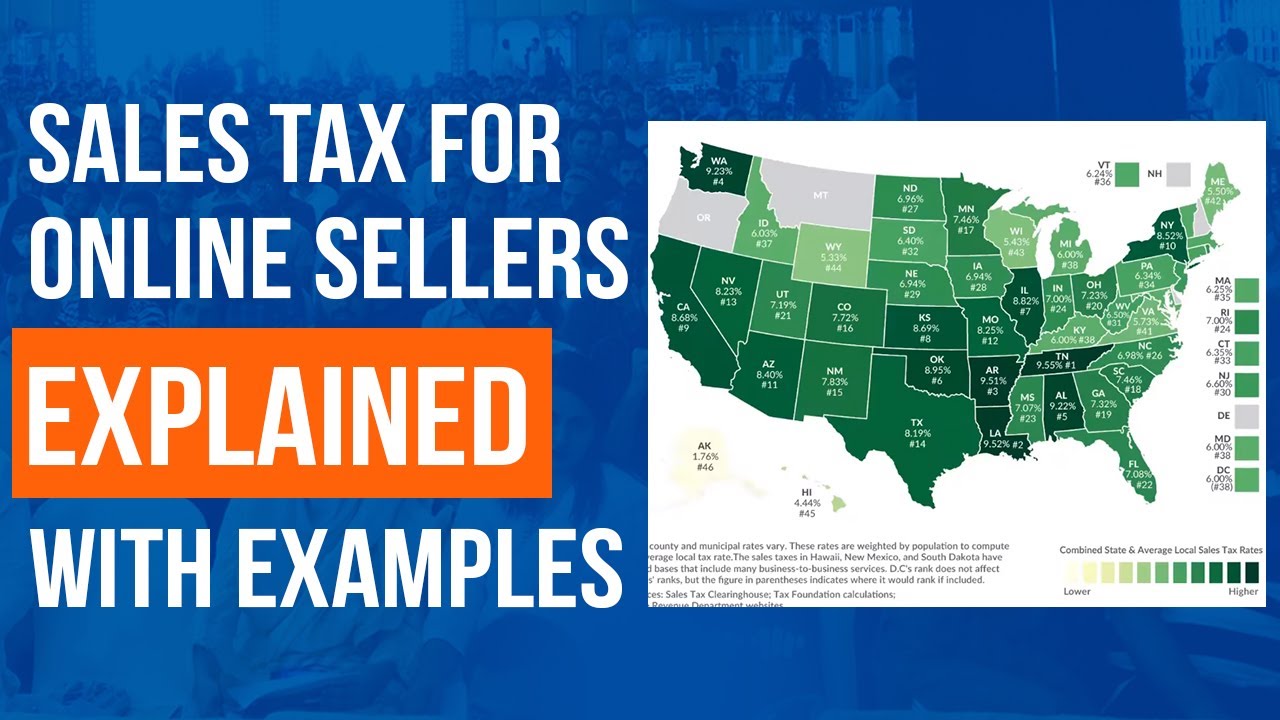

- Rate Variability: Sales tax rates vary significantly from state to state. For example, California has one of the highest sales tax rates in the country, while Delaware does not impose any sales tax at all. Always check the latest rates for the states you are selling in.

- Tax Exemptions: Some items may be exempt from sales tax, particularly goods like food or clothing in certain states. Familiarize yourself with these exemptions to ensure compliance and potentially reduce costs.

- Filing Frequency: States differ in how often businesses must file sales tax returns (monthly, quarterly, or annually). Knowing your obligations helps you avoid late fees and penalties.

To stay compliant, consider using tax automation software that integrates with your Amazon Seller account. This can help you monitor sales in different states and ensure you're collecting the right amounts. Always consult a tax professional familiar with eCommerce to get tailored advice!

Read This: Become a Successful Amazon Reviewer

8. Common Mistakes to Avoid with Amazon Taxes

Filing taxes for your Amazon sales can be tricky, and it’s easy to make mistakes along the way. Here are some common pitfalls to look out for:

- Neglecting Sales Tax Collection: Assuming that Amazon handles everything can be a deadly mistake. While Amazon collects and remits taxes in some states, it’s still your responsibility to know where you have nexus and collect accordingly.

- Inaccurate Record Keeping: Keeping poor records is one of the biggest missteps sellers make. Track all sales, expenses, and fees accurately. Utilize spreadsheets or accounting software to simplify this process.

- Misclassifying Products: Not all products are subject to tax in the same way. Ensure you’re classifying your items correctly to avoid issues with state tax authorities.

- Missing Deadlines: Staying on top of your filing deadlines is crucial. Setting reminders and maintaining a calendar can help you avoid late fees.

- Overlooking State Laws: Each state has different laws regarding taxation. Ignoring state-specific regulations can lead to severe penalties, so it’s wise to do your homework!

By staying aware of these common mistakes, you can maintain compliance and focus on growing your Amazon business. When in doubt, consult with a tax professional who specializes in eCommerce to guide you through the tax landscape.

Read This: How to Change Your Amazon Order Address Effortlessly

9. Resources and Tools for Managing Amazon Taxes

Managing taxes on your Amazon sales can feel overwhelming, but thankfully, there are a number of resources and tools designed to simplify the process. Here are some key options that can help you stay organized and compliant:

- Accounting Software: Tools like QuickBooks or Xero help you track income and expenses, making tax time much easier.

- Tax Preparation Services: Websites like TaxJar or Avalara offer specialized services tailored for e-commerce sellers, helping you calculate sales tax based on regulations in different states.

- Amazon's Seller Central Resources: Don’t overlook the resources provided directly by Amazon. Their Seller Central platform has a dedicated help section that includes tax guides and FAQs.

- E-commerce Tax Blogs and Forums: Engaging with communities on platforms like Reddit or specialized Tax forums can be a treasure trove of shared knowledge and experiences from other sellers.

- Professional Tax Advisors: Consider consulting with tax professionals who have experience in e-commerce. They can provide personalized advice and ensure you meet compliance standards.

Remember, keeping thorough records throughout the year can greatly reduce the stress of tax season. Utilize these tools to ensure that you’re not only compliant but also maximizing your potential deductions!

Read This: How to Set Amazon Prime Alerts for the Best Deals

10. Future Trends in Tax Regulations for E-commerce Platforms

The landscape of tax regulations for e-commerce is continually evolving, and it’s essential to keep an eye on these trends if you're selling on platforms like Amazon. Here are some key trends* to watch out for:

- Increased State Tax Collection: Many states are tightening their tax collection regulations, meaning that more sellers might find themselves subject to sales tax in additional jurisdictions.

- Global Tax Compliance: As e-commerce expands globally, international tax regulations are becoming more significant. Expect stricter rules around VAT and GST for cross-border sales.

- Digital Goods and Services Taxation: There’s a growing trend toward taxing digital products, which could affect how sellers price their offerings.

- Automation of Tax Calculations: With advancements in technology, automated systems for calculating taxes based on current regulations are becoming more common. This will ease the burden on sellers trying to keep up with compliance.

- Policy Changes Driven by Consumer Behavior: As consumer buying habits shift, lawmakers may adjust tax policies to adapt to new economic realities, particularly in response to the gig economy and online marketplaces.

Staying informed about these trends not only helps you remain compliant but can also shape your business strategy moving forward. Adaptability will be key in navigating the complex world of e-commerce taxes!

Related Tags