Accurately reporting your income from Etsy is essential for compliance with tax regulations and maintaining financial clarity. This guide provides key insights into the requirements and best practices for tracking and reporting your Etsy earnings, ensuring you stay organized throughout the process.

Understanding Etsy Income Reporting Requirements

When selling on Etsy, it's crucial to understand the income reporting requirements set by the IRS and other tax authorities. The main points to consider include:

- Income Threshold: You must report all earnings, regardless of the amount. However, if your gross sales exceed $600 in a calendar year, Etsy will issue you a Form 1099-K.

- Deductible Expenses: You can deduct business-related expenses from your gross sales to determine your taxable income. This includes materials, shipping, and fees paid to Etsy.

- Self-Employment Tax: If you earn money from Etsy, you may be subject to self-employment tax in addition to income tax.

- Record Keeping: Maintain accurate records of all transactions, expenses, and receipts to substantiate your reported income.

Read This: Effective Strategies to Improve Your Etsy Shop

Tracking Your Etsy Sales and Earnings

Effective tracking of your sales and earnings on Etsy involves utilizing various tools and strategies. Consider the following:

- Etsy Shop Dashboard: Regularly check your Etsy dashboard for up-to-date sales statistics, including gross sales, taxes collected, and customer insights.

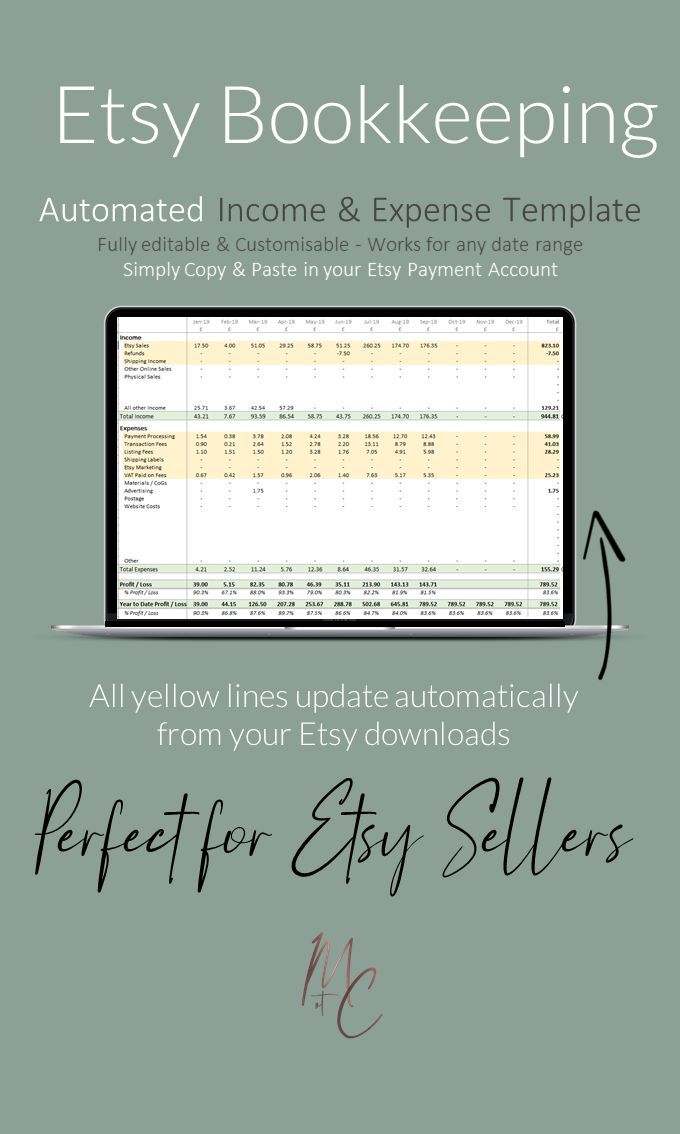

- Spreadsheets: Create a simple spreadsheet to log each sale, including sale date, item sold, amount earned, and associated expenses.

- Accounting Software: Use accounting tools like QuickBooks or Wave to automate your income tracking and streamline reporting.

- Invoices: Issue invoices for each sale, if applicable, to keep professional records and better track income.

By following these steps, you can confidently report your Etsy income while maximizing potential deductions and ensuring compliance with tax obligations.

Read This: How to Set Up a Shop on Etsy

3. Calculating Your Total Etsy Income

Calculating your total Etsy income might seem overwhelming at first, but once you break it down into simple steps, it becomes much easier! Let’s dive right in.

First, start by gathering all your sales data. This includes:

- Gross Sales: The total amount earned from sales before any fees or expenses.

- Shipping Income: Any shipping fees collected from buyers.

- Refunds or Cancellations: Subtract any amounts from refunds or canceled orders.

Your total income for the year can be calculated using the formula:

Total Etsy Income = Gross Sales + Shipping Income - Refunds/ Cancellations

Once you've gathered all this information, sum it up. Remember to use the reports section on your Etsy dashboard to help you pull accurate data quickly. It provides a nice overview of your sales over specified periods, which can simplify the process.

To keep track of your income throughout the year, consider creating a simple spreadsheet. Here’s a basic layout you can follow:

| Month | Gross Sales | Shipping Income | Refunds | Total Income |

|---|---|---|---|---|

| January | $X | $Y | -$Z | $Total |

By regularly updating this spreadsheet, you can ensure that you always have a clear picture of your income, making tax season much less stressful!

Read This: How to Pay on Etsy Effectively

4. Common Deductions for Etsy Sellers

As an Etsy seller, it’s crucial to maximize your deductions to minimize your tax liability. Understanding what you can deduct can save you a significant amount of money. Here’s a handy breakdown of common deductions that you might qualify for:

- Materials and Supplies: Any items you purchase to create your products, like fabric, beads, or paint, can be deducted.

- Shipping Costs: The postage and packaging costs you incur while sending out products can also be deducted.

- Etsy Fees: Etsy charges listing fees, transaction fees, and payment processing fees that can all be deducted from your income.

- Advertising Expenses: If you pay for ads to promote your Etsy shop, such as Etsy Ads or social media promotions, these costs are deductible.

- Home Office Deduction: If you run your Etsy business from home, you may be able to deduct a portion of your home expenses, such as rent or utilities, based on the space used for business.

- Professional Services: Fees for services like accounting or consulting can also be deducted.

It's essential to keep detailed records of all business-related expenses. Consider using accounting software or even a simple spreadsheet to log your spending throughout the year. This will not only help with your taxes but will also give you a clearer understanding of your business’s financial health.

Always consult with a tax professional to ensure you’re maximizing your deductions and complying with all tax regulations!

Read This: How to Close My Etsy Shop Effectively

5. Filing Your Taxes: What You Need to Know

Filing your taxes as an Etsy seller can feel overwhelming, but it doesn't have to be! Understanding the basics will help simplify the process. Here are some key points to keep in mind:

- Know Your Tax Obligations: As an Etsy seller, you're considered a small business. This means you'll need to report your income on your personal tax return using Schedule C (Form 1040). Be aware of local sales tax laws, too!

- Report All Income: It's essential to report every dollar made. Even if you think a sale was too small to matter, it's better to include it. The IRS requires you to report all income, regardless of whether you received a 1099 form.

- Keep Accurate Records: Set aside time each month to update your records. Keep all receipts, invoices, and any expenses associated with your Etsy shop. This will not only help you when it’s time to file but also assist in maximizing your deductions.

- Deductions Matter: You may be able to deduct certain business expenses like materials, shipping, Etsy fees, and even a portion of your home if you use it for your business. Make sure to track these expenses throughout the year!

- Consider Estimated Taxes: If you anticipate owing more than $1,000, you may need to make estimated tax payments quarterly. This prevents a big tax bill in April and potential penalties.

If you're unsure about your tax obligations or how to maximize deductions, consider consulting with a tax professional who has experience with small businesses. This can save you time and potentially money!

Read This: Etsy Shop Startup Guide for New Entrepreneurs

6. Using Software Tools for Income Reporting

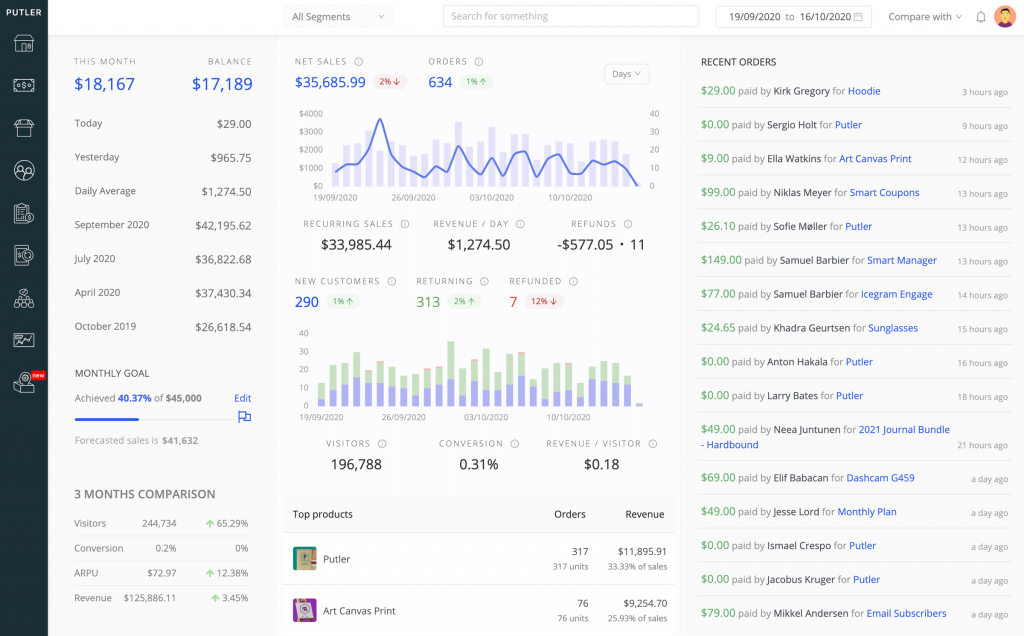

Managing your Etsy income can be made much easier with the right software tools. Here’s a rundown of some options that can help streamline your income reporting process:

| Software Tool | Features | Pricing |

|---|---|---|

| QuickBooks | Invoicing, expense tracking, tax calculations, robust reporting | Starts at $25/month |

| Wave Accounting | Free accounting software, invoicing, receipt scanning | Free with optional paid services |

| TaxJar | Sales tax reporting, automated calculations, user-friendly dashboard | From $19/month |

| GoDaddy Bookkeeping | Easy income tracking, expense management, integrates with Etsy | Starting at $4.99/month |

When choosing a software tool, consider what features matter most to you. Do you want simple income tracking, or do you need your tool to manage multiple aspects of your business? Many of these platforms offer free trials, so take advantage of that to find the perfect fit!

By using these tools, you not only save time but also reduce the stress of reporting your Etsy income. Automated reports can make tax season much less daunting!

Read This: Understanding the Cost of Running an Etsy Shop

7. Tips for Accurate Income Reporting

When it comes to reporting your Etsy income, accuracy is key. Not only do you want to be compliant with tax regulations, but you also want to ensure that you’re making informed decisions about your business. Here are some essential tips to help you report your income accurately:

- Keep Detailed Records: Maintain a thorough record of your sales, including receipts, invoices, and any expenses related to your business. A simple spreadsheet can work wonders for tracking this information.

- Use Accounting Software: Consider using accounting tools like QuickBooks, FreshBooks, or specialized Etsy accounting apps that can integrate directly with your shop. These tools can automate many parts of your income tracking.

- Track Expenses: Don’t forget to document all business-related expenses. This includes supplies, shipping costs, and Etsy fees. These deductions can significantly reduce your taxable income.

- Separate Personal and Business Finances: Open a separate bank account for your Etsy income and expenses. This separation helps simplify the reporting process and keeps your finances organized.

- Review Etsy Reports: Etsy provides robust reporting tools in your shop dashboard. Regularly review these reports to stay updated on your income and trends within your shop.

- Consult a Tax Professional: If you’re unsure about any part of the reporting process, consider seeking help from a tax professional who understands e-commerce income.

By following these tips, you’ll be well-prepared to report your Etsy income accurately, making tax time a little less stressful!

Read This: How to Reopen Your Etsy Shop Successfully

8. Understanding State and Local Tax Obligations

Navigating your state and local tax obligations can feel overwhelming, especially as an Etsy seller. However, it’s crucial to understand these responsibilities to ensure compliance and avoid any unpleasant surprises. Here’s a breakdown of what you need to consider:

- Sales Tax: Most states require you to collect sales tax on physical goods sold. Check with your state’s tax authority to determine the local sales tax rate and whether you need to collect it.

- Tax Nexus: If you have a significant business presence (or "nexus") in a state—like a physical location or frequent shipments—you may be required to register and collect sales tax in that state.

- Income Tax: Depending on your state, you might need to report your Etsy income as part of your state income tax return. Be aware of the tax rates and filing requirements in your area.

- Local Taxes: Some cities or municipalities impose additional local taxes. Familiarize yourself with any local tax obligations to ensure you're in compliance.

- Filing Deadlines: Keep track of filing deadlines for both state sales tax and income tax. Missing a deadline can lead to penalties and interest.

Understanding your state and local tax obligations is essential for running your Etsy business effectively. Always stay informed and lean on resources available from your state’s tax authority to help guide you through the process.

Read This: How to Start Selling on Etsy

Resources for Etsy Sellers on Taxation

When you run an Etsy shop, managing your income and expenditures effectively is crucial not just for profitability but also for tax purposes. Understanding how to report your Etsy income can help you avoid complications with tax authorities and ensure that you're maximizing your deductions. Below are invaluable resources and tips that can assist Etsy sellers in navigating the intricacies of taxation.

Essential Tax Resources for Etsy Sellers

- IRS Website: The IRS provides guidelines on self-employment income, which is relevant for Etsy sellers.

- Tax Software: Consider using tax software like TurboTax or H&R Block that can help streamline the reporting process.

- Online Courses: Websites like Skillshare and Udemy offer courses specifically focused on taxes for small businesses.

- Etsy Seller Community: Join forums and groups on social platforms like Facebook or Reddit to share experiences and tips with fellow sellers.

Important Tax Considerations

| Consideration | Description |

|---|---|

| Income Tracking | Keep a detailed record of all sales, including transaction fees and shipping costs. |

| Deductions | Document all business-related expenses to maximize deductions. |

| Sales Tax | Understand the sales tax obligations in your state and ensure compliance. |

Being proactive about understanding and managing your Etsy shop's taxes can lead to smoother reporting. Utilize the resources mentioned, and don't hesitate to consult with a tax professional to optimize your taxation strategy.

Related Tags