Amazon's share price is a key indicator of its market value and investor sentiment. This price fluctuates based on various economic factors and company performance. Understanding the components that influence Amazon's share price can help investors make informed decisions.

Understanding Stock Prices

Stock prices represent the value of a company's shares as determined by the market. Each share of Amazon's stock reflects investor expectations about the company’s future performance. These prices can vary widely throughout the trading day based on supply and demand dynamics. Factors such as earnings reports, economic indicators, and major company news can lead to fluctuations in the stock price.

A vital aspect of stock prices is the concept of market capitalization, calculated by multiplying the current share price by the total number of outstanding shares. For Amazon, as one of the largest companies globally, its market capitalization can reach significant heights, emphasizing its influence in the stock market and economy as a whole.

Read This: How to Reach Amazon Customer Service for Assistance

Factors Influencing Amazon's Share Price

Numerous factors can impact the share price of Amazon, including:

- Company Performance: Quarterly earnings reports and overall business growth directly affect investor perception.

- Market Trends: Changes in the technology sector and e-commerce trends can sway stock prices.

- Economic Indicators: Macroeconomic factors like interest rates and inflation can influence stock valuations.

- Competition: Performance and innovations from competitors can alter market perceptions of Amazon's growth potential.

- Global Events: Geopolitical issues, trade policies, and global economic events can affect investor confidence.

Investors should continually monitor these elements as they weigh their strategies for investing in Amazon’s stock. Understanding these influences can enhance decision-making and overall investment outcomes.

Read This: How to Change Your Amazon Password Effortlessly

3. How to Buy Amazon Shares

If you're considering investing in Amazon and want to buy shares, you might be wondering how to get started. The process is pretty straightforward, and here are the essential steps to help you along the way:

- Choose a Brokerage: The first thing you need is a brokerage account. There are numerous online brokers like Robinhood, ETRADE, or Charles Schwab that allow you to trade stocks easily. Look for one that offers low fees and a user-friendly platform.

- Open an Account: Once you've chosen a brokerage, you'll need to open an account. This usually involves providing some personal information, verifying your identity, and linking your bank account for deposits.

- Fund Your Account: After your account is set up, you'll need to deposit funds. This can typically be done via a bank transfer, wire transfer, or sometimes even a check.

- Research Amazon Stock: Before jumping in, it’s good to do some research. Check the current price of Amazon shares, look at its recent performance, and read up on related news. This helps you decide how many shares you want to purchase.

- Place Your Order: When you’re ready, you can place an order for the number of shares you desire. You can choose between different types of orders, like a market order (buying at the current price) or a limit order (setting a price you’re willing to pay).

And there you go! Once your order is executed, you’ll officially own a piece of Amazon. Just remember to regularly review your investments and keep an eye on the market. Happy investing!

Read This: How to Cancel an Amazon Prime Membership

4. Historical Performance of Amazon Stock

Amazon.com, Inc. has been one of the standout stocks in the technology sector, and its historical performance reflects its growth trajectory. Since its IPO in 1997, Amazon has shown remarkable resilience and expansion. Here’s a brief overview of its historical performance:

| Year | Closing Price (Adjusted for Splits) | Annual Growth (%) |

|---|---|---|

| 1997 | $18.00 | N/A |

| 2000 | $26.25 | 45.83% |

| 2010 | $160.00 | 509.09% |

| 2015 | $675.89 | 321.39% |

| 2020 | $3,256.93 | 382.96% |

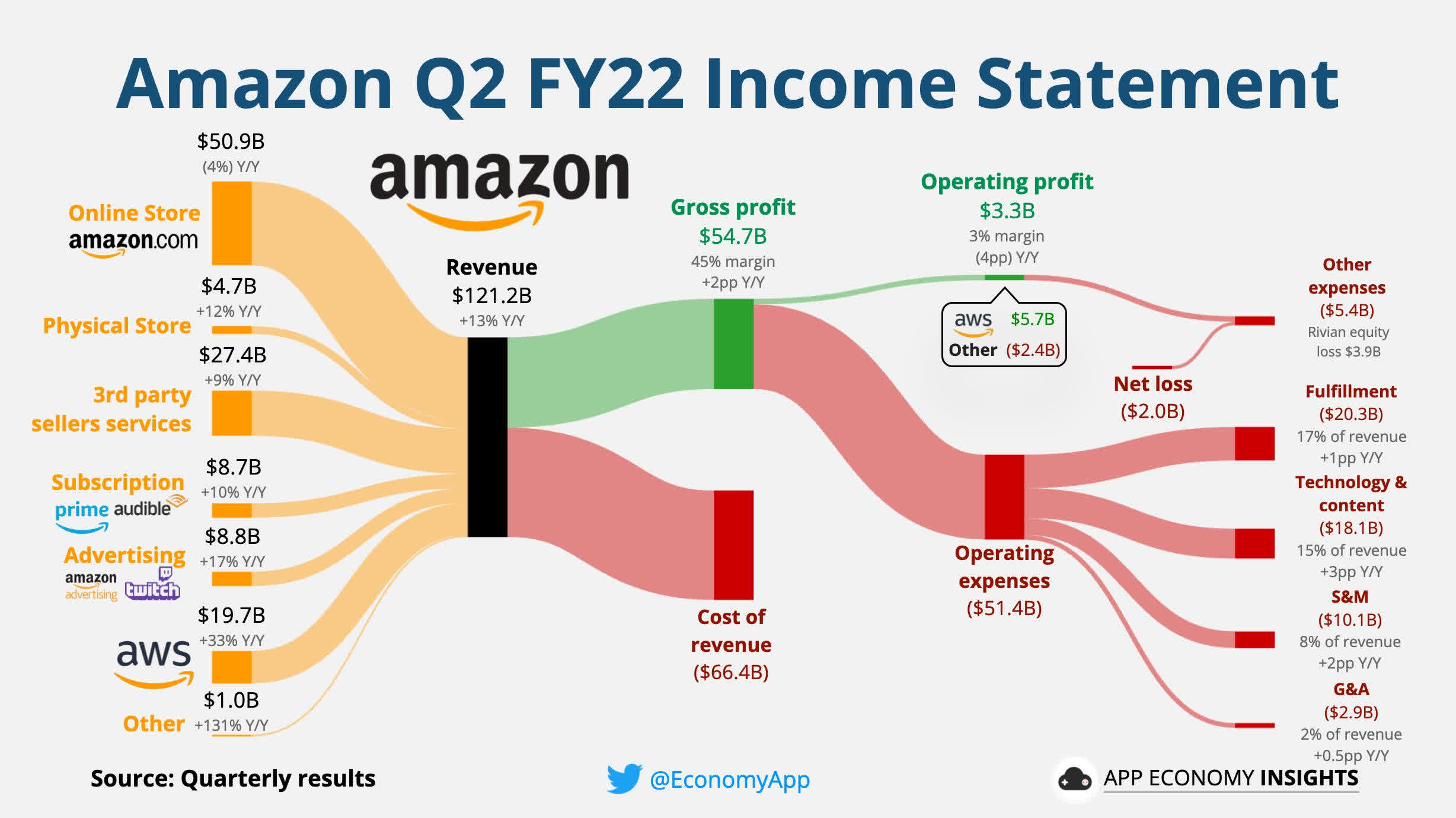

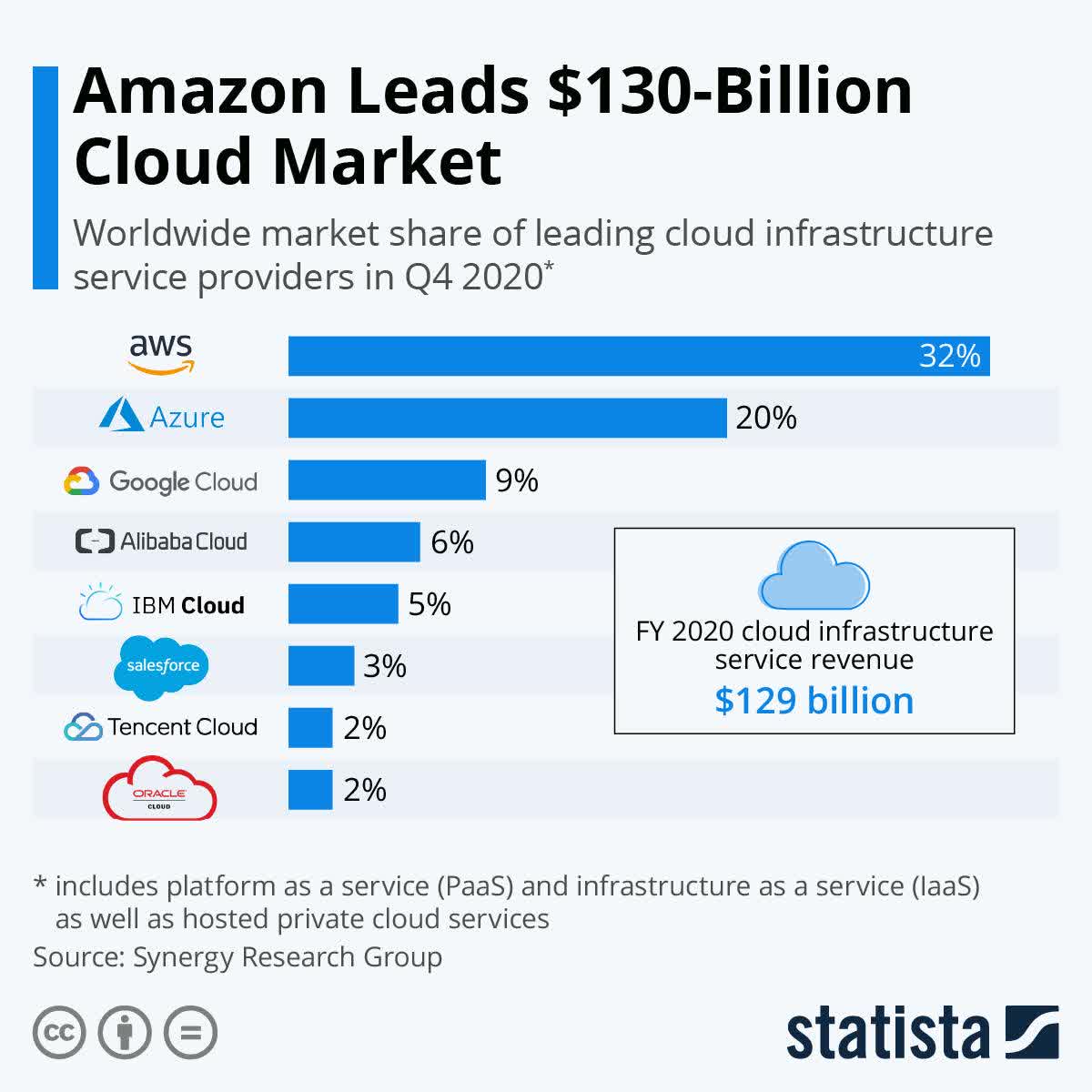

As you can see, Amazon's stock has experienced significant swings, but the overall trend has been upward. Its diversification into various sectors, including cloud computing (AWS), streaming services (Amazon Prime Video), and more recently, grocery with Amazon Fresh and Whole Foods, has played a pivotal role in this growth.

While past performance is not indicative of future results, Amazon's ability to innovate and adapt to market changes has made it a favorite among investors. Just remember, investing in stocks always carries risks, so be sure to do your due diligence before making any investment decisions.

Read This: How to See My Amazon Rewards Money

5. Comparing Amazon with Other Tech Giants

When it comes to investing in technology stocks, Amazon is often compared to other industry heavyweights like Apple, Microsoft, Google, and Facebook. Each of these companies has its own unique strengths and market dynamics, making direct comparisons both enlightening and complex.

Market Position: Amazon dominates the e-commerce space, but its reach extends into cloud computing with AWS (Amazon Web Services), which is a significant driver of its profitability. In contrast, Apple exerts its influence through hardware products and a robust ecosystem, while Microsoft thrives on software and enterprise services. Google excels in advertising revenue through its search and YouTube platforms, and Facebook (now Meta Platforms) is heavily invested in social networking and virtual reality.

Stock Performance: Looking at stock performance, Amazon has shown impressive growth over the years but also faces stiff competition from companies like Microsoft and Apple, which have consistently returned value to shareholders through dividends and stock buybacks. For instance:

- Amazon: High growth, minimal dividends.

- Apple: Steady growth, significant dividends.

- Microsoft: Balanced growth with good dividends.

- Google: Strong revenue growth, no dividends.

In conclusion, understanding where Amazon stands in relation to its competitors is critical for potential investors. While it offers exciting growth prospects, its valuation should be considered in the context of the entire tech landscape.

Read This: How to Use an Amex Gift Card on Amazon

6. Investment Strategies for Amazon Stock

Investing in Amazon stock can be both thrilling and daunting due to its fluctuating nature. Here are some effective strategies to consider whether you're a seasoned investor or just starting out:

1. Dollar-Cost Averaging: This strategy involves consistently investing a fixed amount of money in Amazon stock at regular intervals, regardless of its price. This method reduces the impact of market volatility and can lower your average purchase cost over time.

2. Growth Investing: Amazon is known for its growth potential. If you believe in the company's long-term prospects, focusing on growth investing might be suitable. This means buying shares and holding them for an extended period to capture capital appreciation.

3. Value Investing

4. Diversification: Don’t put all your eggs in one basket. Consider diversifying your portfolio by investing in other tech stocks or different sectors to mitigate risk. This approach can provide stability even when one stock is underperforming.

This combination of strategies can help you navigate the uncertainties of investing in Amazon stock, allowing you to harness its growth potential while managing risk effectively.

Read This: Understanding How Amazon Locker Works

7. The Role of Earnings Reports in Stock Valuation

When it comes to assessing the value of a company's stock, earnings reports* are a crucial piece of the puzzle. These reports are typically released on a quarterly basis and provide investors with insights into the company’s financial health and performance over that specific period. For a company like Amazon, which operates in various sectors ranging from e-commerce to cloud computing, these reports can significantly influence investor sentiment and stock prices.

Here’s why earnings reports matter:

- Performance Indicators: Earnings reports include key metrics such as revenue, net income, earnings per share (EPS), and forward guidance. These indicators help investors gauge whether the company is meeting its financial goals.

- Market Expectations: Analysts often project future earnings based on historical data and market conditions. If Amazon's actual earnings surpass expectations, the stock may surge; conversely, disappointing earnings can lead to declines.

- Investment Strategies: Many investors use earnings reports to drive their investment strategies. A strong report can attract new investors, while a weak one may prompt current shareholders to sell off their shares.

- Long-term vs. Short-term: While some investors focus on immediate stock reactions post-earnings release, others take a long-term view, analyzing trends over multiple quarters to make informed decisions.

In essence, earnings reports are a cornerstone for evaluating Amazon's stock valuation. For anyone thinking about investing, keeping an eye on these reports is not just helpful; it's essential!

Read This: How to Purchase Amazon Stock

8. Potential Risks of Investing in Amazon Shares

Investing in Amazon shares can be appealing, but like any investment, it comes with its own set of risks. Before diving into the world of Amazon stocks, it's important to understand these potential pitfalls to make informed decisions.

Here are some key risks to consider:

- Regulatory Challenges: Amazon has faced scrutiny from regulatory bodies around the globe for concerns about antitrust practices and data privacy. Changes in regulations could impact its operations and profitability.

- Market Competition: The e-commerce and cloud computing markets are incredibly competitive. Rivals like Walmart, Alibaba, and Microsoft continuously challenge Amazon’s market share, which can affect future growth.

- Economic Fluctuations: Amazon's performance is tied to the broader economy. Economic downturns can affect consumer spending, which in turn can impact Amazon’s sales and profits.

- High Valuation: Amazon’s stock is often seen as highly valued compared to its competitors. If growth doesn't meet high investor expectations, the stock price could face downward pressure.

- Dependence on Third-party Sellers: A significant portion of Amazon's revenue comes from third-party sellers. Any shifts in this relationship or seller sentiment could disrupt revenue streams.

While the potential rewards of investing in Amazon can be enticing, always weigh these risks. Doing thorough research and staying informed can help you navigate this exciting but complex investment landscape.

Read This: How to Change Address on Amazon Order

Future Outlook for Amazon Stock

Amazon has established itself as a dominant force in multiple sectors, including e-commerce, cloud computing, and artificial intelligence. As we analyze the future outlook for Amazon stock (AMZN), it's essential to consider various factors that could influence its performance.

Key Factors Influencing Amazon's Future Stock Performance:

- Market Position: Amazon's large market share in e-commerce and AWS (Amazon Web Services) positions it well for sustained growth.

- Innovation: Continuous investment in technology and logistics enhances operational efficiency and customer experience.

- Diversification: Ventures into new markets—like grocery delivery and streaming services—offer avenues for revenue growth.

- Global Expansion: Increasing penetration in international markets could lead to higher sales and profitability.

- Economic Conditions: Fluctuations in consumer spending power and economic stability can impact overall sales.

Analyst Projections:

| Year | Projected EPS | Projected Growth Rate |

|---|---|---|

| 2024 | $5.25 | 20% |

| 2025 | $6.30 | 19% |

| 2026 | $7.50 | 18% |

In conclusion, the future outlook for Amazon stock remains bullish, driven by its robust market position and ongoing innovations. However, investors should remain cautious and consider potential economic headwinds that could impact growth.

Related Tags