The price of Amazon stock is influenced by various factors that reflect the company's performance, market conditions, and investor sentiment. Understanding these factors can provide insights into the stock's valuation and potential future movements. This overview will explore the influences on Amazon’s stock price and its historical performance.

What Influences the Price of Amazon Stock

The price of Amazon stock is impacted by several key factors:

- Financial Performance: Quarterly earnings reports and revenue growth are critical. Strong sales and profits often drive stock prices higher.

- Market Trends: Changes in the overall stock market and investor behavior can affect Amazon's price. Bullish markets often lead to increased valuations.

- Competition: The performance of competitors in the e-commerce and cloud computing sectors can influence investor confidence and stock price.

- Economic Indicators: Inflation rates, employment numbers, and consumer spending trends play a role in shaping the environment Amazon operates within.

- Investor Sentiment: News, analyst ratings, and market speculation can change perceptions about Amazon's future growth potential.

- Innovation and Expansion: New products, services, and markets can lead to positive perceptions and increased stock value.

Read This: How to Do Exchanges on Amazon

The Historical Performance of Amazon Stock

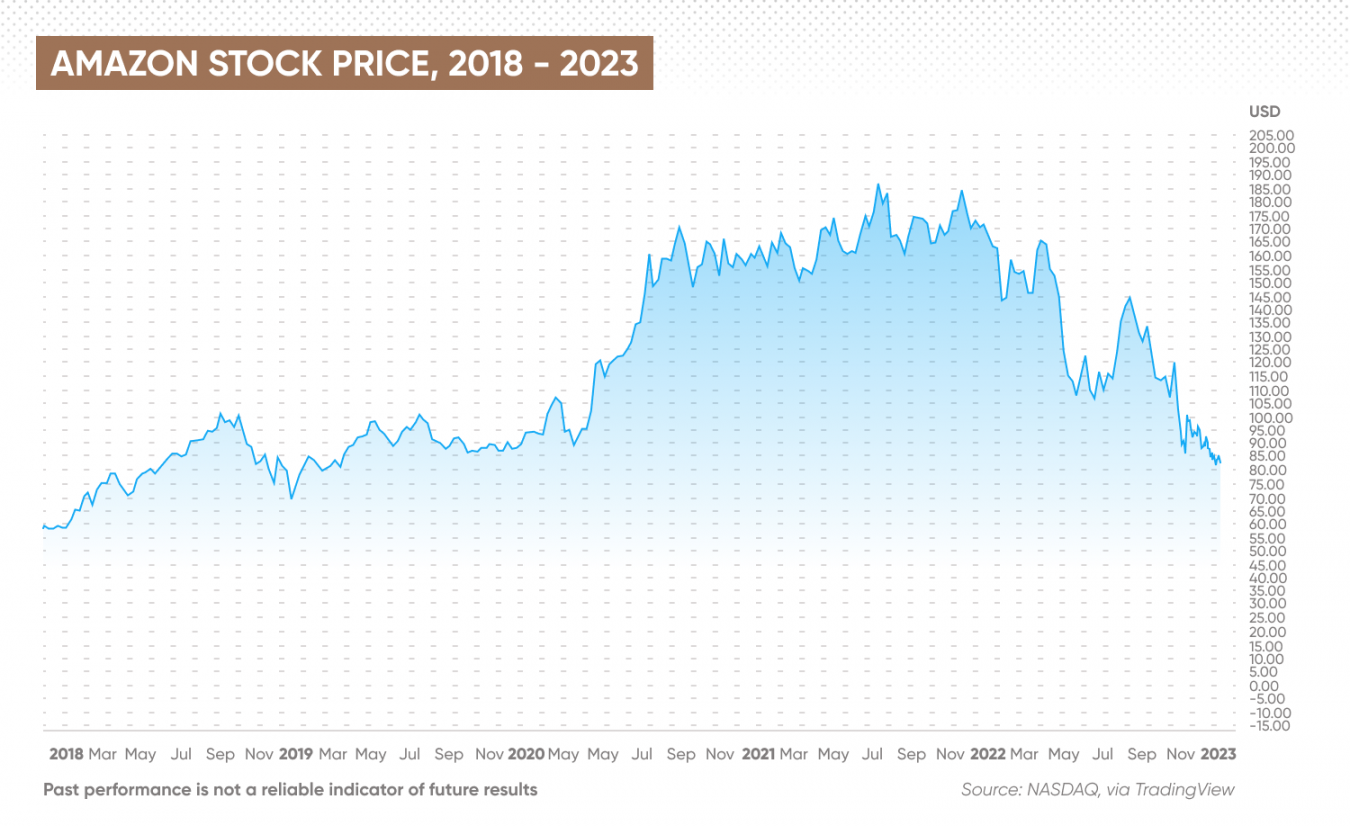

Amazon, founded in 1994, has shown remarkable growth since going public in 1997. Initially priced at $18 per share, its stock has experienced significant fluctuations, reflecting both market conditions and business expansion. Key points in its history include:

| Year | Notable Event | Stock Price (Approx.) |

|---|---|---|

| 1997 | IPO at $18 | $18 |

| 2001 | First profitable year | $10 |

| 2010 | Acquisition of Zappos | $130 |

| 2018 | Amazon Prime reaches 100 million members | $1,200 |

| 2021 | Market capitalization over $1.5 trillion | $3,300 |

Overall, Amazon's stock has been a strong performer over the decades, reflecting its dominant position in the e-commerce and cloud computing industries. Understanding its historical performance can help investors gauge future potential.

Read This: How Amazon Ships So Quickly Explained

3. How to Buy Amazon Stock: A Beginner's Guide

Investing in Amazon stock can feel daunting, especially if you’re new to the stock market. But don't worry—it's easier than you might think! Here’s a simple step-by-step guide to get you started on your journey toward owning a piece of this e-commerce giant.

Step 1: Educate Yourself

Before diving in, take some time to learn about Amazon’s business model, its financial health, and market trends. Reading up on recent news and analyzing its quarterly earnings reports can provide valuable insights into your potential investment.

Step 2: Choose a Brokerage

To buy Amazon stock, you'll need to create an account with a brokerage. There are many options available:

- Traditional Brokers: Offer personalized services but typically charge higher fees.

- Online Brokers: Generally more favorable for beginners due to lower fees and user-friendly platforms. Examples include Robinhood, ETRADE, or TD Ameritrade.

- Robo-Advisors: Automates investing based on your risk tolerance and financial goals.

Step 3: Fund Your Account

After selecting a brokerage, link your bank account and transfer funds. Ensure you have enough capital to cover your intended purchase and any fees.

Step 4: Place Your Order

Once your account is funded, search for Amazon's stock ticker symbol, which is AMZN. Decide how many shares you want to buy and place your order. You can choose from different types of orders, like:

- Market Order: Buy the stock at the current market price.

- Limit Order: Set a specific price to buy; your order executes only if the price meets your criteria.

Investing in Amazon stock can be a rewarding venture. Just remember to remain informed and patient, as stock prices fluctuate!

Read This: How to Return a Gift on Amazon

4. Comparing Amazon Stock to Other E-commerce Giants

When considering an investment in Amazon, it’s vital to compare its performance with other e-commerce giants. Let’s take a look at how Amazon stacks up against its top competitors like Alibaba and eBay.

| Company | Market Cap (approx.) | Revenue (most recent year) | Growth Rate |

|---|---|---|---|

| Amazon (AMZN) | $1.5 Trillion | $514 Billion | 20% YoY |

| Alibaba (BABA) | $300 Billion | $109 Billion | 10% YoY |

| eBay (EBAY) | $40 Billion | $10 Billion | 5% YoY |

Performance Analysis:

- Market Capitalization: Amazon clearly dominates the e-commerce space with a market cap significantly higher than its competitors, indicating investor confidence and dominance in the market.

- Revenue: Amazon’s revenue far exceeds that of Alibaba and eBay, showcasing its extensive customer base and variety of offerings from retail to cloud services.

- Growth Rate: Amazon continues to experience robust growth, even as the e-commerce landscape matures. In contrast, competitors like eBay are experiencing slower growth, which might indicate a more mature market.

Overall, while each company has its merits, Amazon’s extensive growth and market presence make it a compelling option for investors looking to enter the e-commerce space.

Read This: Comparing FedEx and Amazon Prices for Shipping Services

5. Analyzing Amazon's Financial Health and Growth Prospects

When considering investing in Amazon stock, it's essential to dive deep into the company's financial health and growth potential. Amazon isn't just an e-commerce giant; it's also a leader in cloud computing through Amazon Web Services (AWS), digital streaming, and more. By examining several key factors, investors can gauge whether Amazon's stock is a worthy addition to their portfolio.

First, let’s look at Amazon's revenue growth. The company has consistently reported strong year-over-year growth, outpacing many competitors in various sectors. In 2022, for instance, Amazon’s revenue reached over $514 billion, reflecting a diverse business model that mitigates risks associated with any single market.

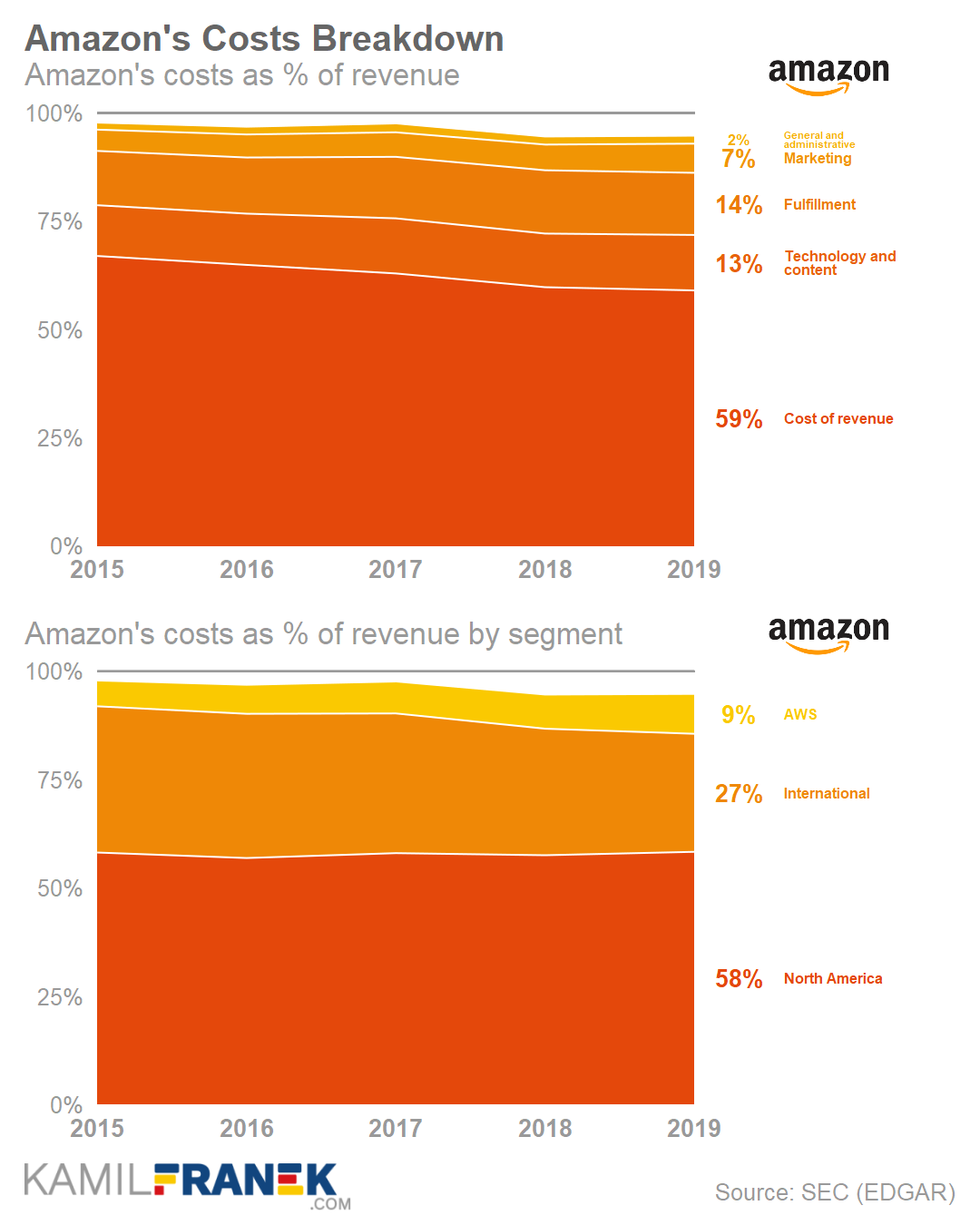

Next, consider profit margins. While Amazon typically operates on thin margins in retail—due to price competition and high logistics costs—its AWS division boasts significantly higher margins, contributing greatly to the overall profitability. As a result, it’s important to watch how Amazon manages costs and operational efficiencies across its different segments.

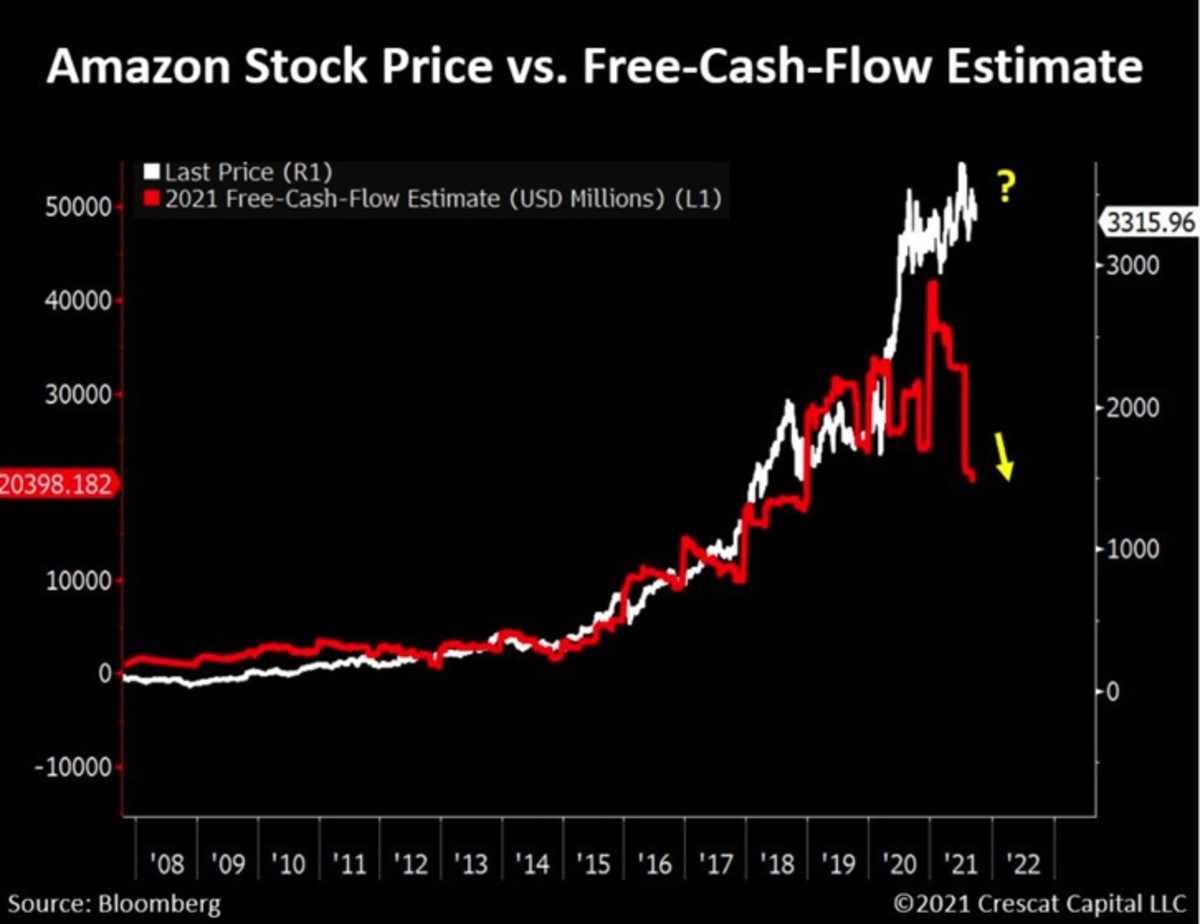

Cash flow is another crucial metric to analyze. Strong cash flow provides Amazon with the flexibility to invest in new projects, R&D, and potential acquisitions without needing to rely heavily on debt. This ability opens the door for innovation and expansion, which can drive future growth.

Lastly, keep an eye on market trends and consumer behavior. With the shift towards online shopping and cloud computing accelerating due to the pandemic, Amazon is positioned to thrive. However, external factors like economic downturns, changes in consumer spending habits, or increased regulation could impact its growth trajectory.

Read This: Finding Amazon Pay Over Time

6. Investment Strategies for Amazon Stock

Investing in Amazon stock can be a smart move, but like any investment, it requires a clear strategy. Here are some effective strategies that can help guide your investments in Amazon:

- Buy and Hold: This classic strategy involves purchasing shares and holding them long-term. Amazon has shown a history of strong growth, making this a potentially rewarding approach over time.

- Dollar-Cost Averaging: This investment strategy involves regularly buying a fixed dollar amount of Amazon stock, regardless of its price. This method reduces the impact of volatility and can lead to a lower average cost per share over time.

- Growth Investing: Focus on Amazon's potential for growth, especially in sectors like AWS and advertising. This approach is about identifying candidates that could deliver significant returns due to improving profitability and expansion.

- Value Investing: While Amazon tends to trade at high valuations, identifying moments when the stock is undervalued can be smart. Pay attention to price-to-earnings (P/E) ratios and other financial metrics to find entry points.

Finally, it’s essential to stay updated on Amazon’s earnings reports and major news*. Significant developments can impact stock performance, making timely adjustments to your strategy crucial. In essence, whether you’re a cautious or aggressive investor, having a well-defined strategy will help you navigate the dynamic landscape of Amazon stock effectively.

Read This: How to Cancel Your Seller Account on Amazon

7. Risks and Considerations When Investing in Amazon

Investing in Amazon can be an exciting opportunity, but like any investment, it's essential to understand the risks involved. Here are some key considerations to keep in mind:

- Market Volatility: The stock market can be unpredictable, and Amazon is no exception. Its stock price can be influenced by broader market trends, economic conditions, and investor sentiment.

- Competition: Amazon operates in a competitive landscape, facing challenges from companies like Walmart, Alibaba, and other online retailers. A new competitor’s entry or changes in a competitor's strategy could impact Amazon's market share.

- Regulatory Scrutiny: Amazon has faced increasing scrutiny from regulators around the globe, particularly concerning antitrust issues. Legislative changes or fines could potentially harm their profitability or operational strategies.

- Profit Margin Pressure: As Amazon continues to grow, maintaining its impressive profit margins could be challenging, especially with investments in technology, logistics, and employee wages.

- Economic Factors: Economic downturns can affect consumer spending, which in turn impacts Amazon’s sales, especially in discretionary categories.

In conclusion, while Amazon offers significant growth potential, investors should weigh these risks carefully and consider their own financial situation and risk tolerance before diving in.

Read This: How to Report a Missing Package on Amazon

8. The Future Outlook for Amazon Stock Prices

Looking ahead, the future outlook for Amazon stock prices is a topic of much discussion among analysts and investors. Here are some factors that may influence Amazon's trajectory:

- Continued E-commerce Growth: The shift toward online shopping is unlikely to reverse. As more consumers embrace e-commerce, Amazon stands to benefit from increased sales.

- Expansion into New Markets: Amazon's ventures into sectors like grocery (Whole Foods) and streaming (Amazon Prime Video) have opened up new revenue streams. Continued expansion could bolster its financial performance.

- Cloud Computing Dominance: Amazon Web Services (AWS) remains a leader in cloud services. As businesses increasingly migrate to the cloud, AWS's growth could significantly contribute to Amazon's overall profitability.

- Technological Innovations: Investments in technology, including AI and logistics, could enhance operational efficiency and customer experience, driving further growth.

Analysts have mixed opinions regarding specific stock predictions, often influenced by quarterly earnings reports, global economic conditions, and consumer sentiment. However, many believe that as long as Amazon continues to innovate and adapt, it has strong potential for future growth.

Read This: How to Take Package Placement Photo for Amazon Key Delivery

Frequently Asked Questions About Amazon Stock

Investing in Amazon stock can be an attractive option for many investors, but understanding its pricing dynamics is essential for making informed decisions. Below are some frequently asked questions that delve into the complexities surrounding the cost of Amazon stock in the market.

1. What factors influence the price of Amazon stock?

The price of Amazon stock is influenced by a variety of factors, including:

- Company Performance: Earnings reports, revenue growth, and profit margins can affect investor sentiment.

- Market Conditions: Broader market trends, economic indicators, and investor psychology can sway Amazon's stock price.

- Competition: The performance and strategies of competitors in the e-commerce sector can impact Amazon's market share and stock value.

- Regulatory Changes: New laws or regulations can create uncertainty, influencing stock price volatile.

- Global Events: Economic events, geopolitical tensions, or significant news can lead to fluctuations in stock prices.

2. How is Amazon's stock valued?

The valuation of Amazon's stock is typically assessed using various financial metrics:

| Metric | Description |

|---|---|

| Price-to-Earnings (P/E) Ratio | Compares the company's current share price to its earnings per share. |

| Market Capitalization | Total market value of the company's outstanding shares. |

| Price-to-Sales (P/S) Ratio | Compares the company's stock price to its revenue per share. |

3. Is Amazon stock a good investment?

Determining whether Amazon stock is a good investment depends on individual financial goals, risk tolerance, and market conditions. Potential investors should conduct thorough research before investing.

Conclusion

Understanding the cost of Amazon stock involves analyzing various financial metrics, market influences, and macroeconomic factors. As the company continues to evolve in the competitive landscape, keeping informed on these aspects can enhance your investment strategy.

Related Tags