Investing in stocks can be an exciting journey, especially with new platforms like Rumble gaining traction in the investment community. Rumble is a video-sharing platform that promotes free speech and encourages content creators who share diverse viewpoints. But did you know that you can also explore Rumble stocks as a promising investment opportunity? In this section, we'll dive into what Rumble stocks are, why they're gaining popularity, and how you can leverage them to enhance your investment portfolio.

Rumble stocks refer to the shares of the company that operates the Rumble platform. As the demand for alternative social media platforms grows, so does the interest in companies like Rumble. Investors are looking to diversify beyond traditional tech giants, and Rumble provides a fresh and unique option. Some key points to consider include:

- Market Potential: With an increasing number of users dissatisfied with mainstream platforms, Rumble is positioned to attract more content creators and viewers.

- Innovative Business Model: The platform's monetization strategies for creators open up various revenue streams, which can potentially lead to stock price appreciation.

- Community Engagement: Rumble fosters a strong sense of community, making it attractive to both users and investors alike.

As more people seek alternatives to traditional social media, investing in Rumble stocks might just be the right move for you to ride the wave of new trends in the digital landscape.

Understanding the Stock Market Basics

Getting to grips with the stock market is crucial for any investor looking to navigate their way through buying and selling shares. While it might seem daunting at first, understanding the stock market basics is simpler once you break it down into manageable chunks. Think of the stock market as a giant marketplace where you can buy and sell pieces of companies, known as shares.

Here are some foundational concepts that will help you understand how the stock market operates:

- Shares: When you purchase shares in a company, you own a small piece of that company. This means you may benefit from its success through price appreciation and potential dividends.

- Stock Exchanges: Think of stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ as the venues where stock trading takes place. Companies list their shares here, and investors can buy and sell them.

- Market Capitalization: This refers to the total value of a company's outstanding shares. It helps categorize companies into large-cap, mid-cap, and small-cap, informing investors about risks and potential returns.

To visualize the stock market's performance, investors often look at indexes like the S&P 500, which tracks the performance of the 500 largest companies. Understanding these basics sets a solid foundation for making informed investment decisions. So, whether you're eyeing Rumble stocks or others, knowing the fundamentals is your first step toward becoming a savvy investor. Happy investing!

Read This: Do You Think the Rumbling Was Worth the Trouble? Analyzing the Impact of the Rumbling Event

What Are Rumble Stocks?

If you've stumbled upon the term "Rumble Stocks," you're likely curious about this emerging investment trend. Rumble Stocks are essentially shares of companies that are involved in alternative social media platforms aiming to challenge mainstream giants. These platforms, like Rumble itself, focus on free speech, uncensored content, and often attract a niche audience that feels underserved by traditional social media channels.

But why the buzz around these stocks? Here’s a quick breakdown:

- Market Disruption: Rumble Stocks represent potential growth as they seek to disrupt the status quo of social media, tapping into a demographic that's growing increasingly wary of censorship and data privacy issues.

- Audience Engagement: These platforms draw users who are actively engaged and loyal, which is a key ingredient for sustainable growth.

- Profit Potential: As these companies expand their user bases and introduce monetization strategies, there's significant upside for investors.

Investing in Rumble Stocks is akin to placing a bet on the future of free speech in digital expression. While there’s no guarantee of success, many investors find the risk and potential rewards appealing.

Read This: Why Isn’t Rumble Working Today? Troubleshooting Tips

Researching Rumble Stocks

When it comes to investing in Rumble Stocks, knowledge is your best ally. With the right research, you can make informed decisions that can impact your financial future. Here are some steps and tools to help you get started:

- Understand the Company: Look into the core values and mission statements of the companies you're considering. How do they position themselves in the social media landscape?

- Financial Health: Analyze their financials—this includes revenue growth, profit margins, and debt levels. You can find these details in their quarterly reports or financial statements.

- Market Trends: Stay informed about market trends in the social media space. Are consumers gravitating towards platforms that emphasize free speech?

- Community Feedback: Check out user reviews and community feedback. Active user engagement often correlates with a company’s success.

- Industry News: Subscribe to industry news sources or follow analysts specializing in tech and media to be updated on any relevant developments.

Utilize tools like stock screeners or investment apps to track price changes, news feeds, and other pertinent information. Remember, investing isn’t just about numbers; it’s about understanding the potential and the mission behind these companies. Keep your eyes peeled, and happy investing!

Read This: What Is HD Rumble? Understanding High Definition Rumble Features

Creating Your Investment Plan

Alright, let’s dive into the nitty-gritty of creating your investment plan for Rumble stocks. An investment plan is essentially your map to guide you through the often turbulent seas of stock trading. Think of it as your personal financial strategy tailored specifically for your investment goals and risk tolerance. So, how do you create one? Let’s break it down!

- Define Your Investment Goals: What do you want to achieve? Are you looking for short-term gains, or are you more interested in building a portfolio for the long haul? Setting clear objectives is crucial.

- Assess Your Risk Tolerance: Be honest with yourself. Consider how much risk you're willing to take. Rumble stocks can be volatile, so know your comfort level with ups and downs.

- Determine Your Budget: How much are you willing to invest? A good rule of thumb is to only invest money you can afford to lose. Define a clear budget to avoid emotional trading.

- Research Rumble Stocks: Take time to understand Rumble and the industries it operates in. Look at its financial health, competitive position, and future prospects.

- Set a Timeline: Establish a timeline for your investment goals. Are you investing for retirement, vacation, or buying a house? Having a deadline can help you stay focused.

Once you've laid the groundwork, review and adjust your plan as necessary. The market is always changing, and remaining flexible will help you navigate through various market conditions.

Read This: What Channel Is WWE Royal Rumble on? TV and Streaming Info

Choosing the Right Investment Platform

Now that you have your investment plan in place, it’s time to talk about choosing the right investment platform for buying Rumble stocks. The right platform is like finding the perfect pair of shoes—it needs to fit well and support your unique journey. Here are some key factors to consider:

- Fees: Different platforms have varying fee structures. Look for low commission fees to maximize your profits. Pay attention to any hidden charges!

- User Experience: You want an intuitive interface. Choose a platform that feels comfortable to use—too complicated can lead to mistakes.

- Research Tools: A good platform should provide research tools and resources. This can help you stay informed about Rumble stocks and market trends.

- Mobile Access: Today’s world is mobile, and you might want to trade on the go. Check if the platform offers a reliable mobile app.

- Account Types: Some platforms offer various account types such as IRAs, margin accounts, and standard brokerage accounts. Pick one that suits your investment goals.

Take your time comparing platforms, read reviews, and even consider signing up for free trials where available. Making the right choice may set you up for a successful investment journey in Rumble stocks!

Read This: Why Does Eren Start the Rumbling in Attack on Titan? Understanding His Decision

Strategies for Investing in Rumble Stocks

Investing in Rumble stocks can be an exciting endeavor, especially for those who are keen on diversifying their portfolios. Here are some effective strategies to consider as you embark on this journey:

- Research and Analysis: Before jumping in, do thorough research. Look into Rumble's business model, growth potential, and overall market conditions. Websites like Yahoo Finance, Seeking Alpha, and even Rumble's own investment announcements can offer valuable insights.

- Dollar-Cost Averaging: Instead of investing a lump sum, consider spreading your investment over time. This strategy, known as dollar-cost averaging, helps mitigate the risks associated with market volatility. You consistently purchase shares at regular intervals, leading to potentially lower average costs.

- Diversify Your Portfolio: Don’t put all your eggs in one basket! Complement your Rumble stocks with investments from different sectors to safeguard against fluctuations. A balanced portfolio can cushion falls in one area with growth in another.

- Set Clear Goals: Determine whether you're aiming for short-term gains or long-term growth. Clear objectives will inform your investment choices and help you stay focused.

- Stay Updated: Keep abreast of news related to Rumble and the broader market. Changes in management, new product launches, or shifts in user engagement can all impact stock performance. Utilize financial news platforms to stay informed.

In the end, investing in Rumble stocks should be approached with a strategic mindset. By considering these strategies, you can position yourself for success and make informed decisions along your investment journey.

Read This: Does the Rumble Seat Come with Lower Adapters? What You Should Expect

Monitoring Your Investments

Once you've invested in Rumble stocks, it's crucial to keep an eye on your investments. Here are some tips on how to effectively monitor your portfolio:

- Use Tracking Tools: Invest in reliable portfolio tracking tools. Platforms like Robinhood, Webull, or even spreadsheet applications allow you to monitor your investments in real time. Make it a habit to check your portfolio regularly to see how your stocks are performing.

- Set Up Alerts: Most trading platforms offer alert features. You can set up notifications for price changes, earnings reports, or major news events related to Rumble. This way, you're informed about significant market movements without having to constantly check your accounts.

- Review Performance Regularly: Schedule a monthly or quarterly review of your investments. Evaluate how Rumble stocks are performing relative to your goals and the broader market. This helps you adjust your strategy if needed.

- Stay Informed About Market Trends: Understanding trends in the media sector can provide context for your investments. Follow industry news, analyst reports, and community forums to stay connected with what's happening in the space.

- Be Prepared to Adapt: The stock market can change rapidly. Be ready to reconsider your strategies based on your monitoring findings. If something isn't performing as expected, it might be time to reassess your position.

In summary, proactive monitoring of your investments is essential for minimizing risks and maximizing returns. By staying informed and being adaptable, you enhance your chances of success in investing in Rumble stocks.

Read This: How to Play Rocket League Rumble and Win the Game with Powerful Abilities

Understanding Risks and Challenges

Investing in Rumble stocks—just like any other stock investment—comes with its own set of risks and challenges. It’s crucial to be aware of these factors before diving in. So, let’s break down some of the main risks to consider.

- Market Volatility: Rumble stocks can be subject to significant price fluctuations. Market sentiment can swing drastically due to news, earnings reports, or even broader economic factors. This volatility can be daunting, especially for new investors.

- Regulatory Risks: As a platform that deals with user-generated content, Rumble may face various regulatory challenges. Changes in regulations could impact its revenue model and stock performance.

- Competition: Rumble operates in a competitive landscape. Major players like YouTube and TikTok have substantial resources and user bases. If Rumble fails to capture the interest of its target audience, its growth prospects could diminish.

- Economic Factors: Macroeconomic issues such as inflation, interest rates, and overall market conditions can influence the performance of Rumble stocks. A downturn in the economy often translates into a climate of uncertainty for stocks.

- Long-Term Sustainability: It's essential to evaluate the long-term viability of Rumble's business model. If the platform doesn't evolve or adapt to market changes, it could struggle to maintain its user base and advertisers.

Being aware of these risks allows you to prepare and manage your investment effectively. Always remember, it's advisable to consult with a financial advisor before making any significant investment decisions.

Read This: How to Play Rapid Rumble? Tips for Mastering the Game

Conclusion: Starting Your Investment Journey

So you've got the lowdown on investing in Rumble stocks, and now it’s time to take that first step! Starting your investment journey can be both thrilling and overwhelming, but with some groundwork, you can feel confident in your choices.

Here’s a quick checklist to get you started:

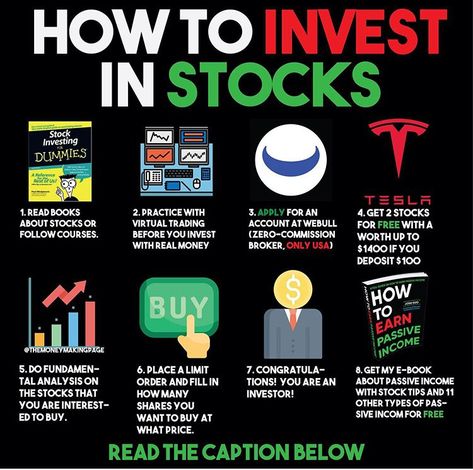

- Educate Yourself: Understand the basics of stock market investing. Read books, watch videos, and even consider online courses.

- Set Clear Goals: Determine your investment goals. Are you looking for short-term gains, or is the long game your strategy? Knowing this will help shape your decisions.

- Do Your Research: Stay informed about Rumble’s performance, industry trends, and competitor movements. Knowledge is power!

- Start Small: If you’re new, consider starting with a small investment. This approach allows you to learn the ropes without risking too much capital.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Invest in various assets to minimize risk.

- Monitor and Adjust: Keep an eye on your investments. Markets change, and being flexible with your strategy is essential.

Remember, every investor starts somewhere. With patience, research, and a bit of courage, you'll soon find yourself on the journey toward building a prosperous investment portfolio. Happy investing!

Related Tags