Rumble is making waves as a video-sharing platform that’s not just about cat videos or vlogs. It offers an alternative to the mainstream giants like YouTube, and it’s gaining popularity for its commitment to freedom of speech and user-generated content. Founded in 2013, Rumble has rapidly positioned itself as a go-to platform for users looking for diverse perspectives and a platform that supports creators without heavy censorship. If you're curious about investing in this rising platform, you’re in the right place! Let's explore what makes Rumble tick and why it might be a smart addition to your investment portfolio.

Understanding Rumble's Business Model

Diving into Rumble's business model can help you grasp how this platform intends to not only attract users but also generate revenue. Here are the key aspects you should consider:

- User-Generated Content: Rumble relies heavily on its community of users to create and upload videos. This model reduces content creation costs while fostering a diverse range of perspectives.

- Monetization Options for Creators: Creators can earn money through advertising, sponsorships, and subscription services. This approach encourages high-quality content while retaining talented creators on the platform.

- Ad Revenue: Similar to other platforms, Rumble uses ad revenue to fund its operations. The difference here is the platform aims for less stringent ad regulations, appealing to content that may not be mainstream.

- Subscription Services: Rumble offers users the chance to subscribe to exclusive content for a fee, providing additional income for creators and a steady revenue stream for Rumble.

In summary, Rumble's business model emphasizes user engagement, creator monetization, and diversification of revenue streams. This unique approach positions it as a strong competitor in the digital content space, making it an intriguing option for investors looking for growth opportunities.

Read This: How Many People Are in the Royal Rumble? Participants Breakdown

Assessing the Stock's Potential

Before diving headfirst into purchasing Rumble stock, it's crucial to assess its potential thoroughly. This step is akin to performing due diligence; you want to ensure that your investment is likely to yield good returns. Here are some factors to consider:

- Company Background: Familiarize yourself with Rumble's journey. Founded as a video platform aiming to provide free speech avenues, Rumble has garnered attention for its content policies. Look into its growth metrics, user engagement, and community feedback.

- Financial Health: Review Rumble's financial statements—balance sheets, income statements, and cash flow statements. Key ratios to focus on include:

| Financial Metric | Importance |

|---|---|

| P/E Ratio | Indicates how much investors are willing to pay for $1 of earnings. |

| Debt-to-Equity Ratio | A measure of company leverage and financial stability. |

| Revenue Growth Rate | Shows how quickly the company's revenue is increasing. |

- Competitive Positioning: Analyze Rumble's competitive landscape. How does it stack up against rivals like YouTube and Vimeo? What unique features does it offer? Understanding its market position will help gauge its growth potential.

- Industry Trends: Keep an eye on trends in the digital video and social media space. Increased demand for decentralized platforms, user-generated content, or free speech advocacy can drive Rumble's growth.

- Market Sentiment: Look for recent news, investor sentiments, and analyst ratings. Social media and financial news sites can provide valuable insights about how the market views Rumble.

By taking these factors into account, you can get a clearer picture of Rumble’s potential as a sound investment. Remember, it's about more than just buying low and selling high; it's about understanding what you're investing in!

Read This: Does Fortnite Have Team Rumble? Exploring Fortnite’s Popular Game Mode and Its Features

Steps to Purchase Rumble Stocks

Ready to invest in Rumble? Great! Follow these straightforward steps to purchase their stocks with confidence:

- Step 1: Choose a Brokerage Account Start by selecting a brokerage platform that suits your needs. Options include traditional brokering firms and online platforms like Robinhood, E*TRADE, or Charles Schwab. Consider factors like:

- Commissions and Fees: Look for low or zero-commission trades.

- User Interface: Choose a platform that you find easy to navigate.

- Research Tools: Access to analytics and news can inform your decisions.

- Step 2: Fund Your Account Once you’ve chosen a brokerage, the next step is to fund your account. You can usually do this by linking a bank account. Ensure you deposit sufficient funds to cover your intended stock purchase plus any fees.

- Step 3: Research Rumble Stock Before making a purchase, take a moment to review your findings on Rumble's potential. Check the latest stock price and market trends. You can usually find this information directly on your brokerage platform.

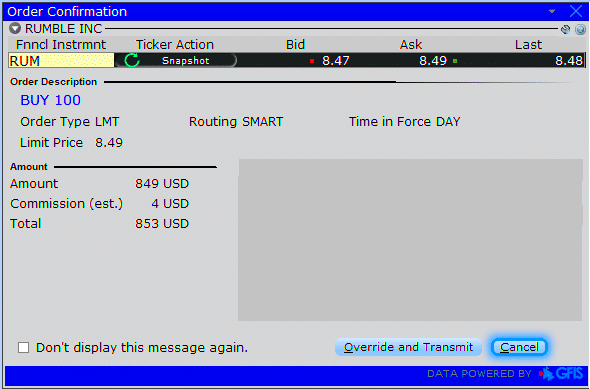

- Step 4: Place Your Order Now it's time to buy. Go to the trading section of your brokerage and enter "RUM" or the stock symbol for Rumble. Decide whether you want to place a market order (buy immediately at the current price) or a limit order (specify a price at which you want to buy).

- Step 5: Monitor and Review After your purchase, keep an eye on your investment. Track Rumble's performance and read up on market news. Reviewing your investment periodically will help you make informed decisions in the future.

Investing in stocks can be exhilarating, as long as you follow the steps and do your homework. Happy investing!

Read This: How Much Is the Royal Rumble on Pay Per View? Cost Breakdown

Choosing the Right Brokerage Platform

When it comes to investing in Rumble, selecting the right brokerage platform is crucial. It’s the gateway to your investment journey, so you'll want to choose wisely. Here are some factors to consider:

- Fees and Commissions: Look for a platform that offers competitive fees. Some brokerages charge per trade, while others have commission-free options. Make sure to read the fine print about any hidden fees.

- User Experience: A user-friendly interface can make a significant difference, especially if you're new to investing. Look for platforms that offer intuitive designs, easy navigation, and quick access to essential tools.

- Investment Options: Ensure the brokerage supports Rumble stock. Some platforms only offer limited access to certain stocks or even specific exchanges, so confirm that you can actually buy Rumble.

- Research Tools: The right brokerage should provide useful research tools and resources. Look for platforms that offer analytics, market news, and educational content to help you make informed decisions.

- Customer Support: Having solid customer support can save you a lot of headaches. Choose a brokerage with responsive customer service options like live chat, phone support, or email assistance.

Ultimately, it’s about finding a platform that feels right for you. Don't hesitate to sign up for a few and explore their features before committing to one. Doing your homework here can pay off big time down the road!

Read This: Who Won the Royal Rumble This Year?

Analyzing Rumble's Financial Health

To make a smart investment in Rumble, it’s essential to analyze its financial health carefully. Financial health is a reflection of a company's stability, profitability, and growth potential. Here’s how to assess it:

- Balance Sheet Analysis: Start by looking at Rumble’s balance sheet. Key metrics to assess include assets, liabilities, and shareholders’ equity. A healthy balance sheet typically has more assets than liabilities.

- Income Statement Insights: The income statement gives you a glimpse into Rumble’s revenues and expenses. Look for consistent revenue growth and manageable expenses. Profit margins are also vital; the higher the margin, the better the company is at turning revenue into profit.

- Cash Flow Review: Cash flow is the lifeblood of any business. Positive cash flow indicates that Rumble can meet its operating expenses and invest in growth. Look for trends in cash flow from operations, investing, and financing.

- Growth Potential: Analyzing growth metrics like earnings per share (EPS) and revenue growth rates is crucial. This can help you gauge how Rumble might perform in the future. A company with strong growth prospects can often command a higher valuation.

- Competitive Position: Evaluate how Rumble compares to its competitors. Understanding its market position and advantages can provide insight into its potential for sustainability and long-term profitability.

By closely analyzing Rumble’s financial health, you’ll be better equipped to make informed decisions about your investment. Remember, knowledge is power!

Read This: How Many Colossal Titans Are There in the Rumbling? Exploring the Scale

Tips for Investing in Rumble

Investing in any stock can feel a bit overwhelming, especially if you’re looking at a company with less established metrics like Rumble. So, let’s break it down into some practical tips that can guide you on your investment journey. Here are some strategies you might want to consider:

- Do Your Research: Before you hit that ‘buy’ button, it’s essential to gather as much information as possible. Look at Rumble’s financial statements, market position, and growth potential. Resources like earnings reports, analyst opinions, and industry news can provide valuable insights.

- Understand the Business Model: Rumble operates as a video platform with a focus on free speech. Get to know how it earns revenue—be it through advertisements or subscriptions. Knowing how the company makes money can help you assess its sustainability and growth potential.

- Diversify Your Portfolio: Don’t put all your eggs in one basket! While Rumble may have exciting potential, ensure your overall investment portfolio includes a mix of different stocks across various industries to mitigate risks.

- Set Clear Goals: Are you investing for the short term or long term? Set clear financial goals so you can create a well-defined strategy tailored to meet your needs without succumbing to impulsive decisions.

- Follow Market Trends: Keep a close eye on market trends and how they impact companies like Rumble. This can help you make educated decisions about when to buy or sell your shares.

- Consult Financial Advisors: If you're feeling lost, don’t hesitate to consult a financial expert. They can provide personalized advice based on your financial situation and investing experience.

Read This: When Does the Royal Rumble 2024 Start? Timings and Event Overview

Common Investment Mistakes to Avoid

Investing can be as tricky as navigating through a maze without a map. When it comes to making investments in Rumble or any stock for that matter, there are common pitfalls that even seasoned investors can fall into. Here’s a roundup of some mistakes to steer clear of:

- Lack of Research: Jumping into investments without doing thorough research is a recipe for disaster. Make sure you analyze Rumble’s business model, market trends, and financial health before investing.

- Emotional Investing: Letting your emotions dictate your investment decisions can lead to mistakes. Always try to base your decisions on data and analysis rather than fear or excitement.

- Timing the Market: Many investors believe they can time their purchases to pick the perfect moment. The reality is that market timing is highly unpredictable and often leads to suboptimal outcomes.

- Ignoring Diversification: Investing all your funds in Rumble or any single stock is risky. Not diversifying your portfolio can expose you to significant losses if that particular investment underperforms.

- Overreacting to Market News: It’s easy to panic when you hear negative news about your investment. However, acting impulsively can result in losses. Consider the long-term potential instead.

- Failing to Review Your Portfolio: It’s not enough to just invest and forget. Regularly reviewing and adjusting your portfolio is vital, especially as market conditions and your financial goals change.

By keeping these tips and mistakes in mind, you’ll be better equipped to navigate your investment in Rumble and potentially see positive results!

Read This: Are You Ready for the Rumble? How to Prepare for Epic Moments

Long-Term vs. Short-Term Investment Strategies

Investing in stocks like Rumble requires careful thought regarding your investment strategy. One of the fundamental decisions you’ll face is whether you want to adopt a long-term or short-term investment approach. Each strategy offers distinct pros and cons, and your choice should align with your financial goals, risk tolerance, and market outlook.

Long-Term Investment Strategy:

A long-term investment strategy revolves around buying stocks and holding them for extended periods—often five years or more. Here are some key points to consider:

- Potential for Growth: Investing long-term allows you to ride out market volatility. Over time, many stocks tend to increase in value.

- Compounding Returns: Reinvesting dividends can lead to compounding growth, significantly enhancing your returns.

- Less Stress: Long-term investors spend less time worrying about daily market fluctuations, allowing them to focus on the company’s fundamentals.

- Tax Benefits: Holding an asset for more than one year usually qualifies for lower long-term capital gains tax rates.

Short-Term Investment Strategy:

Short-term investing is often more speculative and focuses on taking advantage of market movements within a shorter time frame, sometimes just days or weeks. Consider these factors:

- Quick Gains: If you can accurately predict market trends, short-term investing can lead to rapid returns.

- Active Management: This strategy requires constant monitoring of stocks and market news, making it more labor-intensive.

- Market Timing Risk: It’s challenging to time the market perfectly, putting you at risk of substantial losses.

- Higher Tax Burden: Short-term gains are typically taxed at higher ordinary income rates, which can eat into your profits.

Ultimately, the choice between long-term and short-term investing comes down to your unique financial situation and investment style. Consider diversifying your portfolio to include both strategies for a balanced approach!

Read This: How to Play Rumble on the Guitar and Perfect Your Performance

Conclusion and Final Thoughts

Investing in stocks like Rumble can be an exhilarating experience, but like any investment, it requires caution, research, and a solid strategy. Whether you're considering a long-term or short-term investment, it's essential to stay informed and proactive in your investment approach.

Key Takeaways:

- Understand the fundamentals of Rumble, including its business model, economic environment, and market position.

- Decide on your investment strategy—long-term for steadier growth or short-term for potential quick gains.

- Don’t forget to diversify your investment portfolio to manage risk effectively.

- Regularly review your investments and adjust according to market changes or financial goals.

Finally, remember that investing should be aligned with your financial goals and risk tolerance. Whether you're new to investing or a seasoned pro, patience and education are your best allies. So grab your research tools, get familiar with Rumble, and make informed decisions as you embark on this investment journey!

Related Tags