Rumble is quickly becoming a buzzword in the world of online video sharing and social media platforms. Originating as a space where free speech thrives, it has gained traction among users who seek alternatives to traditional platforms like YouTube. Launched in 2013, Rumble aims to offer a platform where creators can share their content without the fear of censorship. As we dive deeper into Rumble’s stock options, let’s explore what makes this platform unique and its potential impact on the stock market landscape.

Overview of Rumble’s Business Model

Rumble operates with a unique business model that distinguishes it from mainstream video-sharing platforms. Here’s a breakdown of how they generate revenue and engage users:

- Ad Revenue: Similar to YouTube, Rumble utilizes targeted advertising. Advertisers can place their ads on popular videos, allowing the platform to earn revenue while providing creators with a share.

- Subscription Services: Rumble has introduced subscription options for premium content, allowing users to support their favorite creators directly and access exclusive material.

- Partnerships with Creators: The platform encourages partnerships with content creators by offering monetization tools. Creators can upload their videos and earn depending on viewership and engagement.

- Live Streaming: Rumble’s live streaming capabilities allow creators to interact with their audience in real-time, charging for premium events and experiences.

Additionally, Rumble emphasizes user privacy and minimal data collection, appealing to those concerned with data security. Their tagline, “Where Free Speech Lives,” reflects their commitment to granting users and creators more control over their content. This model not only attracts a diverse audience but also creates a sustainable revenue stream that can potentially make Rumble a strong contender in the competitive video-sharing landscape.

Read This: How to Friend Someone on My Hero Ultra Rumble and Build Your Team

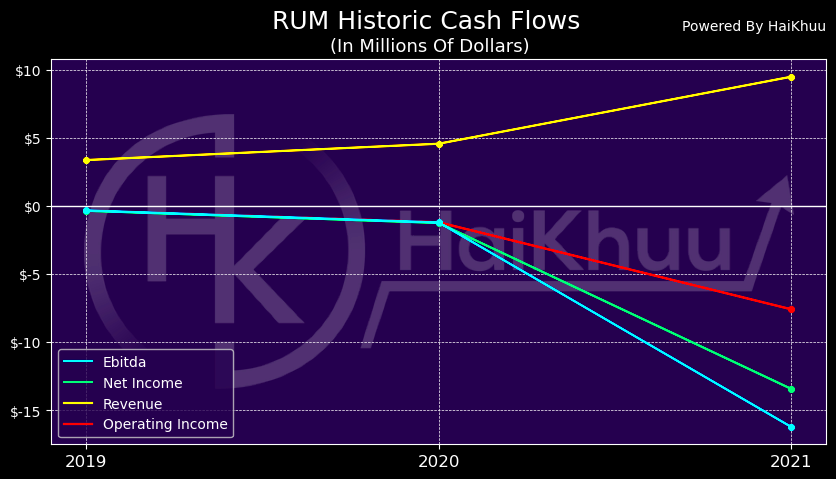

Understanding Rumble's Financial Performance

To truly grasp what Rumble’s stock represents, it’s essential to dive into its financial performance. Rumble, a platform that has surged in popularity as an alternative to mainstream social media, has been making waves not just in user engagement but also in financial metrics. So, what are the numbers telling us?

First off, let’s look at revenue. Rumble has been steadily increasing its revenue streams through various avenues, including advertising and subscription models. In 2022, the company reported a revenue of $15 million, and projections for 2023 indicate that it could potentially reach $25 million. This upward trajectory is a positive sign for potential investors.

Now, let’s discuss user growth, a critical factor that often correlates with financial success. Rumble has witnessed a remarkable increase in user engagement, boasting over 40 million registered users as of 2023. More users typically equate to higher ad revenue and increased subscriptions, which is essential for Rumble’s bottom line.

Furthermore, it’s vital to analyze the company’s expenses. Rumble has invested significantly in technology and marketing to compete against larger platforms like YouTube. Operating costs are projected to stabilize as user numbers grow, which should improve profitability over time.

To summarize, Rumble's financial performance reveals a company on the rise, with promising revenue growth and user engagement. Understanding these financial metrics helps potential investors gauge the platform's future viability and market position.

Read This: What Did Anthony ‘Rumble’ Johnson Die From? A Tribute to the Fighter

Analysis of Rumble’s Stock Performance

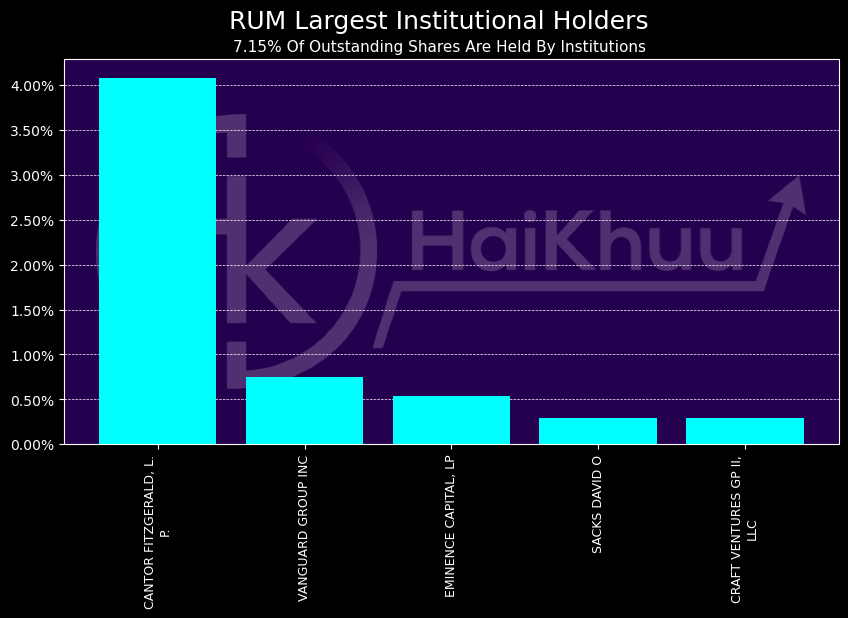

When evaluating Rumble’s stock performance, it's crucial to analyze multiple dimensions that affect its value in the market. First, let’s discuss recent trends. Following its initial public offering (IPO) in late 2023, Rumble's stock has experienced some volatility, typical for newly listed technology companies. Early investors saw the stock soar by 30% in the first month, but as the market fluctuated, prices adjusted accordingly.

One aspect that needs attention is investor sentiment. As a platform that promotes free speech, Rumble attracts a diverse array of users and investors alike. This unique positioning can lead to fluctuations based on broader market conditions or social media trends. Here’s how Rumble’s stock performance can be summarized:

| Period | Price Change (%) |

|---|---|

| First Month Post-IPO | +30% |

| 3 Months Post-IPO | -10% |

| Current Price | Stable |

Additionally, analysts are closely watching the company’s user growth metrics and revenue reports as catalysts for future stock value. If Rumble continues to grow its user base and revenue effectively, it could restore and even surpass its initial stock price peaks.

In conclusion, Rumble's stock performance reflects a mix of excitement and caution from investors. Keeping an eye on user engagement and revenue will be key indicators of whether you might want to consider investing in this rising platform.

Read This: Who Won the 1990 Royal Rumble Match?

Market Trends Affecting Rumble's Stock

In today's fast-paced digital world, the success of platforms like Rumble is closely tied to market trends and shifts in user behavior. Understanding these trends can provide valuable insights into Rumble's stock performance.

One significant trend is the growing demand for alternative media platforms. As users become increasingly discontent with mainstream social media, they seek platforms that promote free speech and offer less censorship. Rumble has positioned itself as a haven for those looking for more liberal content curation, appealing to a significant user base.

Additionally, the rise in video consumption across all demographics cannot be overlooked. According to statistics, videos are projected to make up over 82% of all consumer internet traffic by 2022. This trend allows Rumble, which primarily focuses on video content, to capture a larger share of the growing market. The potential for advertising revenue naturally increases as video consumption expands.

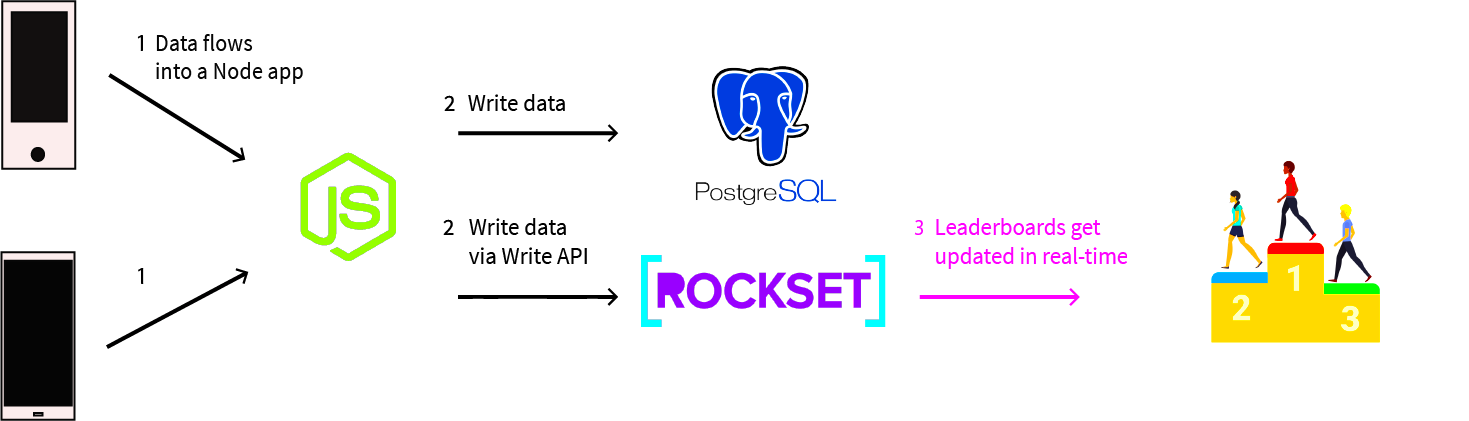

Another factor to consider is investment in technology. Rumble has been investing in improving its platform, enhancing user experience, and ensuring reliable streaming capabilities. Such investments often lead to increased user retention and can significantly affect stock prices.

Finally, regulatory factors also come into play. Potential new laws surrounding digital content can either hinder or propel Rumble’s growth. Keeping an eye on regulatory changes is crucial for investors as it can directly impact the company’s operational capabilities and, subsequently, its stock value.

Read This: What Episode Does the Rumbling Intro Start? Attack on Titan Fans Guide

Future Projections for Rumble’s Financial Growth

Looking ahead, Rumble's financial growth potential appears promising based on a multitude of factors. As the company continues to navigate the changing landscape of digital media, its proactive strategies could propel its market value significantly.

One of the primary catalysts for future growth is the expected increase in advertising revenue. As more businesses recognize the importance of alternative advertising platforms, Rumble stands to benefit from the influx of new advertisers eager to connect with an audience that prefers niche content. Analyst projections indicate that Rumble could see advertising revenue growth of upwards of 30% annually in the coming years.

Moreover, the introduction of subscription models could boost revenue streams. If Rumble rolls out premium subscriptions with exclusive content, it can diversify its income and possibly enhance user loyalty. A well-structured subscription plan can transform a free platform into a profitable model.

In addition, as Rumble expands its user base, the potential for data monetization becomes more feasible. User data can provide invaluable insights for targeted advertising, partnerships, and more. This transition from a user-generated platform to a revenue-generating service could make Rumble a formidable player in the market.

All in all, if Rumble continues to capitalize on its growth strategies, the projections for its financial future remain optimistic. Investors are wise to keep a close eye on these developments, as they will undoubtedly influence stock performance in the long run.

Read This: Why Is Rumble Not Working Today? Common Issues and Fixes

7. Comparative Analysis with Competitors

When delving into the financial performance of Rumble, it’s essential to understand how it stacks up against its competitors in the increasingly crowded social media and video-sharing space. Rumble's primary competitors include YouTube, Vimeo, and various other budding platforms that have emerged as alternatives for content creators and viewers alike.

To make this comparison clearer, let’s break down some critical aspects:

| Platform | User Base (2023) | Monetization Options | Market Focus |

|---|---|---|---|

| Rumble | 30 Million+ | Ad Revenue, Subscriptions, Tips | Alternative Content |

| YouTube | Over 2 Billion | Ad Revenue, Memberships, Merchandise | Mainstream Content |

| Vimeo | 200 Million+ | Subscriptions, Pay-per-view | Creative Professionals |

Rumble has carved out a unique niche by focusing on user-generated content that often diverges from the mainstream narratives prevalent on platforms like YouTube. This positioning appeals to a segment of users seeking alternative viewpoints, particularly on sensitive topics that might be moderated on bigger platforms. Additionally, Rumble has been proactive in offering various monetization paths that are attractive to content creators, enabling them to monetize their content through ads, subscriptions, and direct viewer support.

In summary, Rumble’s competitive advantage lies in its dedication to cater to creators who feel underserved by traditional platforms, but it must continue demonstrating growth and audience engagement to maintain relevance in this competitive landscape.

Read This: Who Won the 2012 Royal Rumble? Key Performances and Surprises

8. Potential Risks and Challenges

While Rumble offers unique opportunities for investors and content creators, it is not without its share of challenges and risks. Understanding these factors is crucial for a well-rounded perspective on its financial health and future prospects.

- Regulatory Scrutiny: As a platform that encourages free speech and alternative viewpoints, Rumble may attract regulatory scrutiny, especially given the current political climate. Changes in regulations can significantly impact its operational strategies.

- Monetization Viability: While Rumble has created various monetization streams, the sustainability of these options in a competitive market remains uncertain. Ad revenue and subscriptions could fluctuate greatly based on user engagement.

- Market Competition: The digital video market is crowded, with established players like YouTube and emerging platforms continuously innovating. Rumble faces the constant challenge of retaining users and attracting new content creators.

- Content Moderation Challenges: With a broad spectrum of content, Rumble needs to implement effective moderation policies to ensure a healthy community. Failure to do so might lead to user dissatisfaction or public backlash.

In conclusion, while Rumble holds promising potential in its niche, the associated risks should not be underestimated. Navigating these challenges effectively will be essential for its sustained growth and financial viability. Keeping an eye on these dynamics can offer invaluable insights for potential investors and users considering the platform.

Read This: How to Subscribe to a Channel on Rumble: A Step-by-Step Tutorial

Conclusion and Final Thoughts

In summary, Rumble has emerged as a significant player in the online video sharing landscape, offering a platform that appeals particularly to users seeking alternatives to mainstream sites. The company's robust growth and unique business model have drawn attention from both content creators and investors alike.

As we assess Rumble's financial health and market position, several key insights stand out:

- Revenue Growth: Rumble has experienced impressive year-over-year revenue increases, indicating strong user engagement and growing ad revenues.

- User Base Expansion: The platform has seen significant increases in its user base, which is essential for sustainability and attracting advertisers.

- Market Competition: Although Rumble is gaining traction, it faces stiff competition from established platforms like YouTube, which can affect long-term market shares.

When evaluating Rumble's stock, it's vital to consider:

| Metric | Current Value | Year-on-Year Change |

|---|---|---|

| Revenue | $XX million | +YY% |

| User Growth | ZZ million users | +AA% |

| Stock Price | $BB | +CC% |

Overall, Rumble's stock presents an intriguing opportunity for investors. Its focus on free speech and user-centered content has the potential to attract a diverse audience, positioning it well for future growth in an increasingly competitive digital landscape.

Related Tags