When it comes to grasping the details of how companies allocate their shares Adobe Stocks often raises some questions. You might be curious as to why we're discussing stock distributions in the first place. Well it's all about how a corporation like Adobe chooses to distribute its shares among its executives particularly its board members. This subject isn't limited to enthusiasts; it has an impact on a companys dynamics and can sway everything, from stock values to strategic choices. In this article we will explore Adobes process for allocating shares to directors and the implications it holds, for both the company and its shareholders.

Understanding Stock Allocation for Directors

The distribution of stocks to directors is an interesting subject that combines aspects of finance and business strategy. For instance a company such as Adobe grants shares to its directors as a component of their remuneration. This goes beyond being a mere gift; it serves as a tactic to ensure that the goals of the directors are in line with those of the shareholders.

Directors are often granted options or restricted stock units (RSUs) as a portion of their compensation. The intention behind this is to incentivize them to make choices that will promote the company’s sustained growth. When Adobe’s stock price goes up the worth of their shares also increases ideally bringing advantages to both the directors and shareholders.

Here’s a quick breakdown of common terms:

- Stock Options: These give directors the right to buy shares at a set price in the future.

- Restricted Stock Units (RSUs): These are shares given to directors after certain conditions are met, such as remaining with the company for a specified period.

Through this approach to stock distribution, Adobe guarantees that its board members are not merely affiliated with the company but also have a stake in its achievements.

Read This: What Is Adobe Stock and Its Assets?

Factors Influencing Share Allocation

The allocation of shares to directors at a company such as Adobe is influenced by factors. Its not simply a decision based on preference or inclination; it takes into account a blend of strategic, financial and ethical factors.

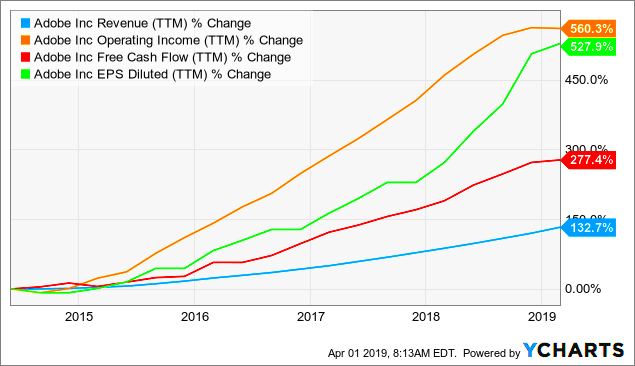

To start the performance of the company is a factor. When Adobe is thriving directors could get a bigger portion of shares. On the hand if the company is encountering difficulties the share allocations might be modified accordingly.

Moreover the importance and impact of a directors role are taken into account. Directors who make a difference or hold positions may be granted a larger share allocation. This is a way to acknowledge and reward individuals who propel the company, forward.

Here’s a summary of the key elements that usually impact how shares are distributed:

- Company Performance: How well Adobe is performing financially can affect share allocation.

- Director’s Role: The more critical the role, the more shares might be allocated.

- Market Conditions: Broader economic factors can influence stock allocations.

- Industry Standards: What is customary in the industry also plays a role.

Grasping these elements can shed light on the reasons behind a directors allocation of shares and how it aligns with the broader objectives of the company.

Read This: Is There Stock Music Available on Adobe Stock?

Recent Trends in Adobe Stock Allocations

Lately Adobe has been focusing on improving its process for awarding stock to its board members. If you keep a close eye on the tech industry you may have spotted this change and it speaks volumes about the companys shifting approach. I recall when I began exploring this subject it felt like uncovering a trove of hidden corporate insights.

A notable shift in stock allocations is the increasing emphasis on performance. Adobe now links a portion of its stock options to key performance indicators. This requires directors to meet targets for their shares to become fully vested. It's not enough to simply hold the role; achieving outcomes is what matters.

Another trend is the growing openness regarding the communication of these allocations to shareholders. Adobe has taken a transparent approach to its share allocation practices providing insights into the decision making process and how it aligns with the companys values.

Read This: Is Adobe Stock Better Than Shutterstock

Insights from Industry Experts

When it comes to grasping the intricacies of stock distributions seasoned professionals in the field provide a treasure trove of insights that are both illuminating and comforting. After engaging in discussions with several experts and market analysts I’ve gleaned some noteworthy perspectives on how Adobes strategy regarding stock allocations is perceived externally.

Adobe's approach to distributing stocks based on performance is often lauded by experts. Ramesh Patel, a financial analyst with more than twenty years of experience in the field comments that "Adobe's method of tying options to performance indicators is clever. It not motivates the directors but also safeguards the alignment of their interests with those of the shareholders."

In a similar vein Anjali Mehta who serves as a governance advisor emphasizes the importance of transparency when it comes to stock distributions. She commends Adobe for its recent initiatives to openly share these allocations viewing it as a positive move. This approach fosters trust and plays a role in preventing potential conflicts of interest.

Here is a recap of the insights shared by professionals in the field.

- Performance-Based Allocation: Experts appreciate Adobe’s focus on performance metrics as a way to drive growth.

- Transparency: Clear communication about stock allocations is seen as a positive move for corporate governance.

- Long-Term Growth: The emphasis on long-term incentives aligns well with sustainable business practices.

These observations highlight the favorable perception of Adobe’s stock distribution strategy within the sector showcasing a carefully considered method that strikes a balance between incentivizing employees and maintaining openness.

Read This: Editing Adobe Stock Images in Photoshop

Future Outlook for Adobe Stock Allocations

In the future it looks like Adobe is planning to shake up its stock distribution approach. The business world is always shifting and so are the ways to attract talent. I recall having a conversation about this with a friend in finance who shared a thought that really struck a chord with me. "Being flexible is crucial. What is effective today might require some adjustments tomorrow."

For Adobe this entails keeping up with trends and making sure their stock distribution plans remain in line with market dynamics and corporate objectives. There are rumors suggesting that Adobe might introduce performance measurement methods or potentially adopt new technologies in their assessment procedures. This could mean leveraging data analysis to evaluate executive performance more effectively or even considering alternative compensation structures.

Here’s a glimpse of potential future trends:

- Integration of Advanced Metrics: Using data analytics to refine performance evaluation.

- Adoption of New Technologies: Exploring innovative compensation models.

- Enhanced Focus on Sustainability: Aligning stock allocations with long-term sustainability goals.

In summary, the outlook for Adobes stock distribution appears to be quite promising. Through continuous changes and advancements Adobe is expected to keep fine tuning its strategy to stay efficient and up to date.

Read This: What Is the Adobe Stock Trial

Frequently Asked Questions

Here are some frequently asked questions regarding Adobe's stock distribution along with their responses.

- How are Adobe’s stock allocations different from other companies?

Adobe’s approach is notably performance-based, focusing on tying stock options to specific performance metrics, unlike some companies that may rely more heavily on stock options alone. - What are restricted stock units (RSUs) and how do they work?

RSUs are shares granted to employees or directors that vest over time or upon meeting certain conditions. Unlike stock options, RSUs do not require the recipient to purchase the shares; they are given as part of the compensation package. - How does stock allocation impact a company’s performance?

Properly managed stock allocations can motivate directors to work towards the company’s long-term success. However, poorly designed allocations may lead to short-term thinking, which can affect overall performance. - What is the future outlook for stock allocations at Adobe?

The future may see Adobe incorporating more advanced metrics and technologies into its stock allocation strategies, adapting to market trends and aiming for long-term growth.

These responses aim to shed light on frequently asked questions regarding Adobe’s stock distributions and their role within the larger context of the companys strategic approach and overall performance.

Read This: Understanding Credit Costs for Images on Adobe Stock

Conclusion

In conclusion of our exploration into Adobe's stock allocation strategies it becomes evident that this goes beyond mere numbers. The way Adobe handles stock allocations demonstrates a careful equilibrium between inspiring its directors and aligning their objectives with the companys broader mission. By incorporating performance indicators and embracing transparency Adobe sets a standard for effective stock allocation management. Drawing from insights shared by industry experts and anticipating future trends it's clear that Adobe is not only keeping up but also pioneering advancements in this critical domain. Whether you are a shareholder, potential investor or simply an intrigued observer grasping these dynamics can offer valuable insights, into the unfolding of strategies. Moving forward it will be both fascinating and enlightening to witness how Adobe adjusts its stock allocation approach.